Please see Financial Statements of a Company Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Financial Statements of a Company in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Financial Statements of a Company Class 12 Accountancy

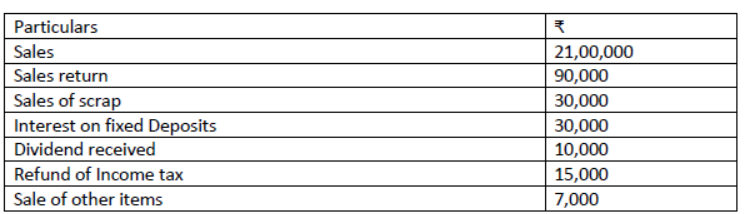

Question. Prepare balance Sheet of XYZ Ltd. As at 31st March, 2013 from the details given below

Answer:

Question. Out of the following, Identify the items that are shown in the Notes to accounts on employee benefit expenses –

(a) Wages (b) Salaries (c ) Entertainment expenses (d) Bonus ( E ) Gratuity Paid (f) Conveyance Expenses

Answer: Wages, Salaries, Bonus and Gratuity Paid

Question. List the items Shown under the head ‘Long term borrowings.

Answer:

1. Debentures

2. Bonds

3. Long term loans from Bank

Public deposits

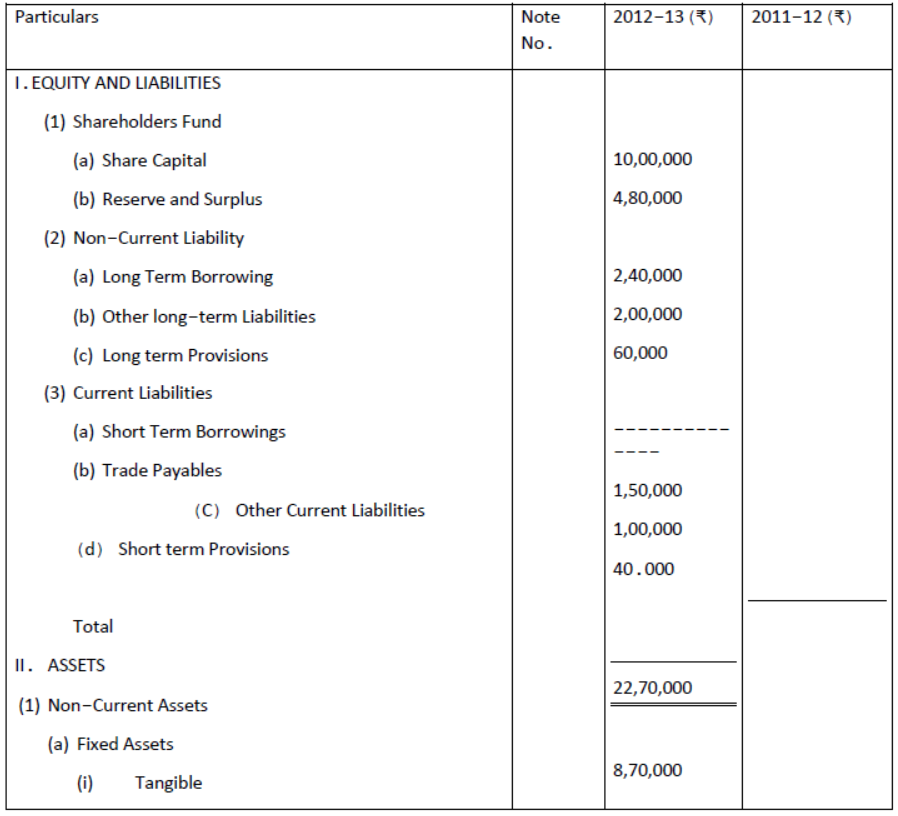

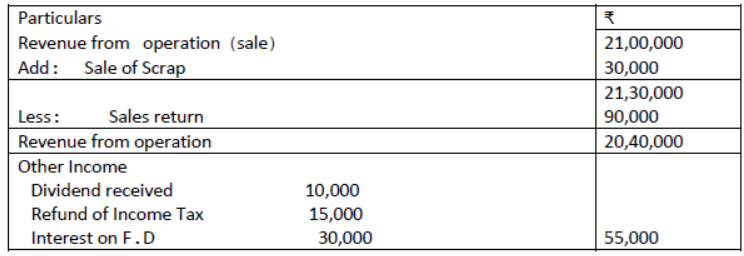

Question. Calculate Revenue from operation, other Income, and total revenue for a non- financial company from the following information

Answer:

Question. Prepare Statement of Profit and loss from the following particulars as on 31st March,2013

Answer:

Question. List any three items that can be shown under the heading ‘Reserves and surplus’ in a company’s balance sheet

Answer:

1. Security premium reserve

2. General Reserve

Debenture redemption reserve

Question. List the sub heading which are shown under the headings ‘Current Liabilities ‘as per Schedule III part-1 of the companies Act.2013

Answer: (a) Short term borrowings

(b) Trade payables

(c) Other current liability

(d) Short term provision

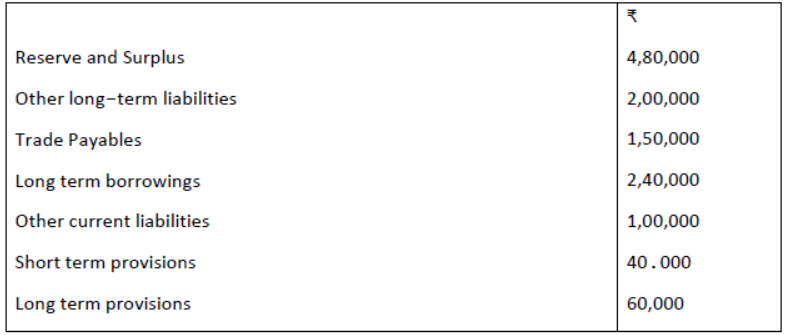

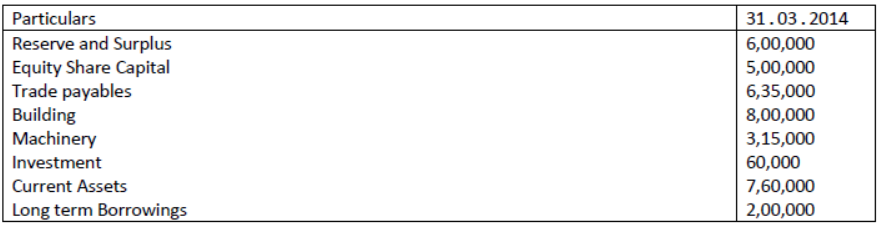

Question. From the following Information, Prepare Balance sheet of Goel Ltd:

Answer:

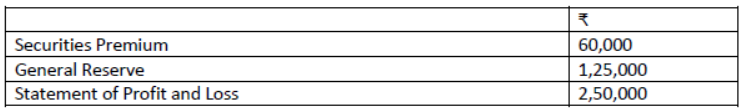

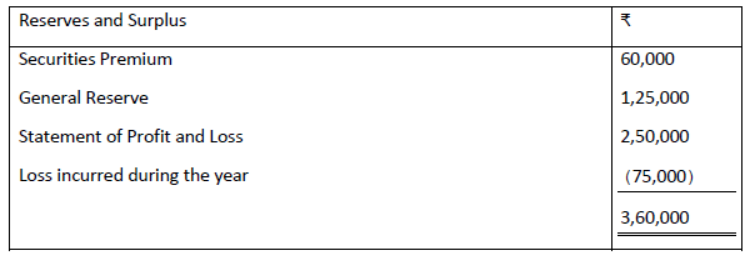

Question. XYZ Ltd. Has the following balances on 1st April 2013:

During the year ending 31st March 2014, it incurred a loss of ₹ 75,000. Show how these items will be shown in the balance sheet the company and Notes to accounts

Answer:

Notes to accounts

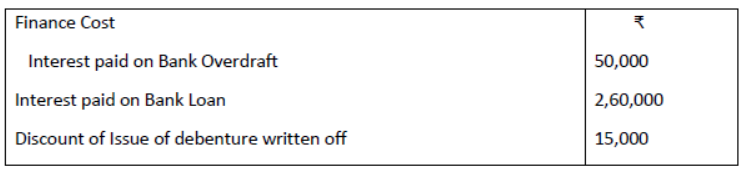

Question. From the following information Prepare Notes to accounts on Finance Cost :

(i) Interest paid on Bank Overdraft ₹50,000

(ii) Interest Paid on term loan ₹2,60,000

(iii) Interest received on fixed deposits ₹ 40,000

(iv) Bank Charges ₹ 8,000

(v) Discount of Issue of debenture Written Off ₹ 15,000

(vi) Processing charges for loan ₹ 20,000

Answer: Notes to accounts

Question. Out of the following, Identify the items that are shown in the Notes to accounts on Finance Cost

(a) Interest paid on term loan (b) Interest paid on overdraft (c) Interest received on fixed deposits (d) Bank Charges ( e) Discount on Issue of debentures written off

Answer: Interest paid on term loan , Interest paid on overdraft, Discount on Issue of debentures written off

Question. Identify which of the following items are to be shown in the notes to accounts on other expenses

(a) Wages and Salaries (b) Internet expenses (c) Rent for Factory (d) Depreciation on furniture (e ) Rent for office (f) Audit Fees (g) Staff welfare Expenses (h) Courier expenses

Answer: Internet expenses, Rent for Factory, Rent for office, Audit Fees, Courier expenses

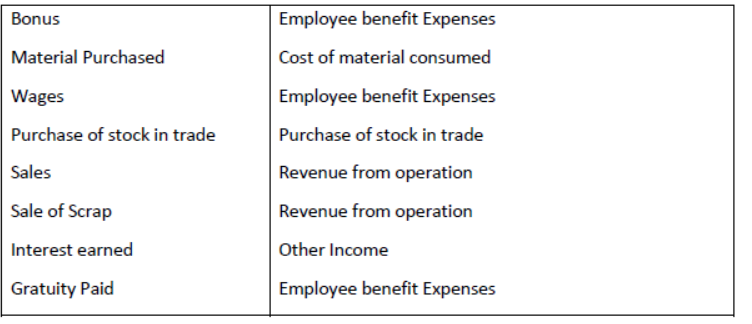

Question. Under which major head of the statement of profit and loss of a company following items will be shown

(i) Bonus (ii) Material Purchased (iii) Wages (iv) Purchase of stock in trade

(v) Sales (vi) Sale of Scrap (vii) Interest earned (viii) Gratuity Paid

Answer:

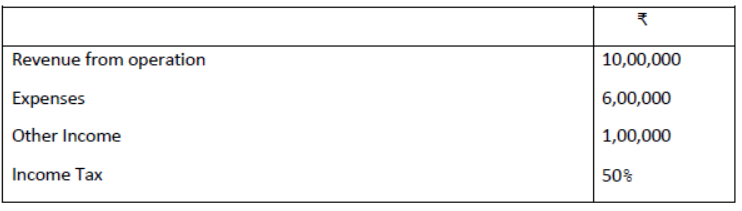

Question. From the following Information of Aroma Ltd, Prepare Statement of Profit and Loss as on 31st March 2016:

Answer:

Question. Compute the change in Inventory of Stock in Trade if

Opening Inventory of stock in Trade ₹80,000

Closing Inventory of Stock in Trade ₹50,000 ₹

Answer: Opening Inventory of Stock in Trade 80,000

Less: Closing Inventory of Stock in Trade 50000

Change in Inventory of stock in Trade 30,000

Question. Under which major heads of the statement of profit and loss of a company following items will be shown –

(i) Material Purchased

(ii) Sales

(iii) Wages and Salaries

Answer: Material Purchased- Cost of Material Consumed

Sales- Revenue from operation

Wages and Salaries – Employee benefit expenses

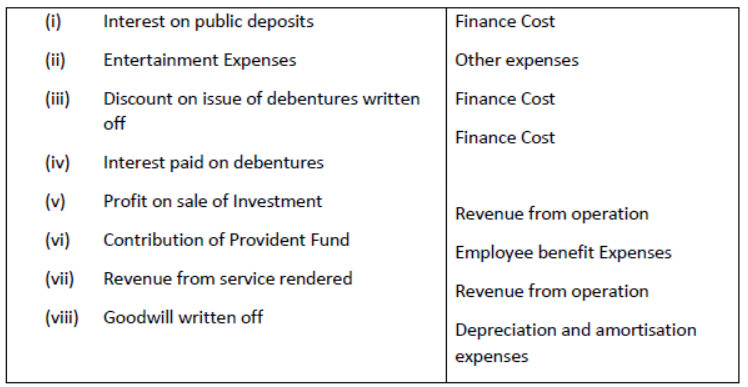

Question. Under which major heads of the statement of Profit and Loss of a company following Items will be shown

(i) Interest on public deposits

(ii) Entertainment Expenses

(iii) Discount on issue of debentures written off

(iv) Interest paid on debentures

(v) Profit on sale of Investment

(vi) Contribution of Provident Fund

(vii) Revenue from service rendered

(viii) Goodwill written off

Answer:

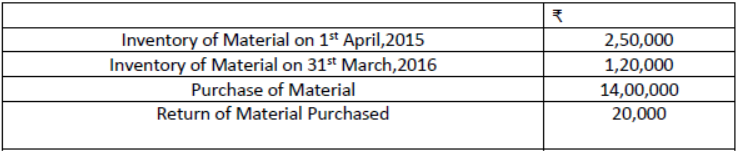

Compute cost of material Consumed from the following:

Answer: