Please refer to Class 12 Accountancy Sample Paper Set B with solutions below. The following CBSE Sample Paper for Class 12 Accountancy has been prepared as per the latest pattern and examination guidelines issued by CBSE. By practicing the Accountancy Sample Paper for Class 12 students will be able to improve their understanding of the subject and get more marks.

PART A

(Accounting for Partnership Firms and Companies)

Question. Vishnu and Sushmitha are partners respectively sharing profits in the ratio of 3:2. Their capitals as on 1st April 2022 were Rs 1,60,000 and Rs 1,20,000 respectively. They ad-mit Balachandran into the partnership on that date giving him a 1/5th share in the future profits, which he acquired equally from Vishnu and Sushmitha. Balachandran is to bring in Rs 1,20,000 as his share of capital. The journal entry for hidden goodwill is:

The new profit-sharing ratio of Vishnu Sushmitha and Balachandran will be:

a) 3:2:1

b) 4:3:2

c) 5:3:2

d) 1:1:1

Answer

C

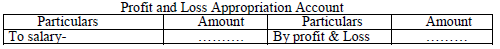

Question. Assertion (A):- Salary provided to partner is shown in Profit and Loss A/c.

Reason (R):- Salary provided to partner is charge against profits and is to be provided at fixed amount.

a) (A) is correct but (R) is wrong

b) Both (A) and (R) are correct, but (R) is not the correct explanation of (A)

c) Both (A) and (R) are incorrect.

d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

Answer

C

Question. The portion of the capital which can be called-up only on the winding up of the Company is called..

a) Authorised capital

b) Issued capital

c) Subscribed capital

d) Reserve Capital

Answer

D

OR

ABC Ltd acquired assets of Rs 10,00,000 and took over liabilities of Rs 10,000 from Sanjana Ltd. ABC Ltd issued 10% debentures of Rs 100 each at a discount of 10%. as purchase consideration. The number of debentures issued will be.

a) 10,000

b) 11,000

c) 12,000

d) 24,000

Answer

B

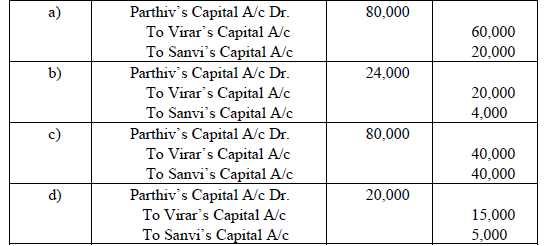

Question. Virar and Sanvi were partners in a firm sharing profits and losses in 3:1 ratio. They ad-mitted Parthiv for 1/4 share of profits. Parthiv could not bring his share of goodwill pre-mium in cash. The Goodwill of the firm was valued at Rs. 80,000 on Parthiv’s admis-sion. Record necessary journal entry for goodwill on Parthiv’s admission.

Which of the following is the correct treatment of the above?

Answer

D

OR

Abhi and Sakhi are partners sharing profits and losses in the ratio of 3 : 2. Their capital accounts showed balances of Rs. 1,50,000 and Rs. 2,00,000 respectively on April 01, 2021. Show the calculation of interest on capital for the year ending 31 March, 2022. If the partnership deed provides for interest on capital @ 8% p.a. and the firm earned a profit of Rs. 14,000 during the year. Interest on capital for the partners will be:

a) 12,000 and 18,000 respectively.

b) 15,000 and 20,000 respectively.

c) 6,000 and 8,000 respectively.

d) 7,000 and 7,000 respectively.

Answer

C

Question. Jolly and Kithu are partners sharing profits and losses in the ratio of 3:1. Their capitals at the end of the financial year 2021-2022 were Rs. 1,50,000 and Rs. 75,000. During the year 2021-2022, Jolly’s drawings were Rs. 20,000 and the drawings of Kithu were Rs. 5,000, which had been duly debited to partner’s capital accounts. Profit before charging on capital for the year was Rs. 16,000. The same had also been debited in their profit sharing ratio. Kithu had brought additional capital of Rs. 16,000 on Octo-ber1,2021. Opening capitals of Jolly and Kathu were…

a) 1,58,000 and 60,000 respectively.

b) 60,000 and 1,58,000 respectively.

c) Both a) and b) are wrong.

d) 1,50,000 and 75,000 respectively.

e) Complete the following journal entries

Answer

A

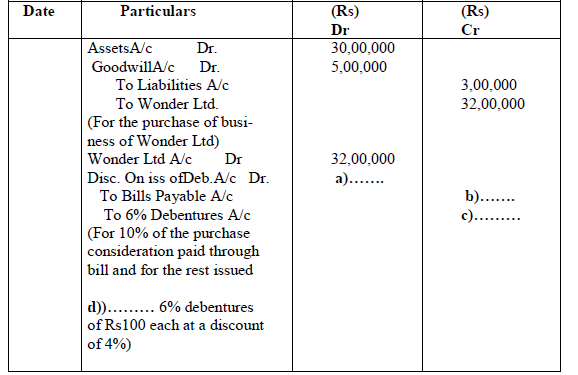

Question. Journal in the books of Eagle Ltd. Find out the correct option.

I a) 32,00,000 b) 3,20,000, c) 30,000 d) 5,00,000

II a) 1,20,000 b) 3,20,000 c) 30,00,000 d) 30,000

III a) 5,00,000 b) 3,00,000 c) 1,00,000 d) 10,000

IV a) 10,000 b) 8,000 c) 10,00,000 d) 11,00,000

Answer

A

OR

Question.Surya Ltd, purchased a running business from Nila Ltd, for a sum of 1,50,000 paya-ble by issue of 10,000, 12% debentures of rupees 10 each at a premium of Rs. 2 per share and the balance in cash. The asset and liabilities taken over were:

Fixed asset (tangible) Rs.1,00,000, Trade receivables Rs.30,000; Inventory Rs.50,000 Trade payable Rs.20,000. The amount of goodwill/ Capital reserve will be:

a) 1,00,000

b) 20,000

c) 40,000

d) None of these.

Answer

C

Question. Sarada Ltd, issued a prospectus inviting applications for 10,000 shares of ₹10 each payable ₹5 on application, ₹ 3 on allotment and ₹ 2 on call. Public had applied for certain number of shares and application money was received. As per SEBI guidelines, which of the following application money, if received restricts the company to proceed with the allotment of shares?

a) Rs 50,000

b) Rs 45,000

c) Rs 1,00,000

d) Rs 38,000

Answer

D

Question. M, N and O are partners in a firm sharing profit and losses in 3:4:2. N retired from the firm. The profit on revaluation on that date was ₹ 72,000. New profit sharing ratio be-tween M and O is 5:3. Profit on revaluation will be distributed as:

a) M ₹ 32,000; N ₹ 24,000; O ₹ 16,000

b) M ₹ 24,000; N ₹ 32,000; O ₹ 16,000

c) M ₹ 45,000; O ₹ 27,000

d) M ₹ 47,250; N ₹ 24,750

Answer

B

OR

Question. A group of 40 people wants to form a partnership firm. They want your advice regard-ing the maximum number of persons that can be there in a partnership firm and the name of the Act under whose provisions it is given.

Read the following hypothetical situation, answer Question No. 9,10 and 11

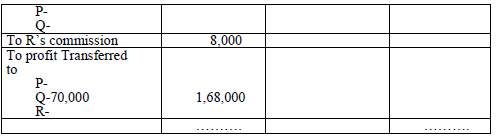

P, Q and R are Partners in a firm sharing profits and Losses in the ratio of 5:4:1. The Partnership deed provided for the following:

1) Salary of ₹ 3,000 per quarter to P and Q.

2) R was entitled to a commission of ₹ 8,000.

3) Q was guaranteed a profit of ₹ 70,000 p. a and any deficiency will be borne by P and R equally.

4) The Profit for the year ended 31st March, 2022 was ₹ 2, 00,000.

Answer. As per the Companies Act, 2013 the maximum number of partners in a partnership Firm can be 50.

Question. P’s salary will be:

a) 12,000

b) 6,000

c) 24,000

d) 9,000

Answer

A

Question. Deficiency of Q is…

a) 1,000

b) 2,000

c) 1,400

d) 2,800

Answer

D

Question. R’s share of profit is…..

a) 82.600

b) 70,000

c) 15,400

d) 2,00,000

Answer

C

Question. If 5,000 shares of ₹10 each were forfeited for non-payment of first and final call money of ₹ 2 per share and only 3,000 shares were re-issued @ ₹ 11 per share as fully paid up, then what is the minimum amount that the company have to get at the time of re-issue of the remaining 3,000 shares?

a) 6,000

b) 24,000

c) 5,000

d) 11,000

Answer

A

Question. Securities Premium can be utilized for:

a) Writing off preliminary expenses

b) Issue fully paid bonus shares

c) Write off expenses/ discount on issue of debentures

d) All the above

Answer

D

Question. At the time of death of a partner the profits of the deceased partner till the date of death is transferred to ……..Account.

a) Revaluation Account

b) Capital Account

c) Profit and Loss suspense Account

d) Executor’s A/c

Answer

C

Question. Under what circumstances the premium for goodwill paid by incoming partner will not be recorded in books of accounts?

a) When he brings privately

b) When he brings premium for goodwill

c) When he doesn’t have capital

d) None of these.

Answer

A

OR

Question.Kingini , a partner withdrew ₹ 10,000 in the beginning of each quarter and interest on drawings was calculated as ₹ 2,500 at the end of accounting year 31 March 2022. What is the rate of interest on drawings charged?

a) 6% p.a

b) 7% p.a

c) 10% p.a

d) 15% p.a

Answer

C

Question. Change in existing agreement between the partners is called_____

a) Dissolution of Firm

b) Dissolution of Partnership

c) Dissolution of Business

d) All of the above

Answer

B

Question. Vasav, Dheeru and Dev were partners in a firm sharing profits and losses in the ratio of 4: 3 :1 The firm closes its books on 31st March every year. As per the terms of partnership deed on the death of any partner the share of goodwill of the deceased part-ner will be calculated on the basis of 50% of the net profit credited to the partner’s capi-tal account during the last four completed years before death. Vasav died on Ist July 2022.

The profits for last four years were: 2018-19- Rs 97,000; 2019-20~Rs 1,05,000; 2020-21 -Rs 30,000; 2021-22 -Rs 84,000.

His share of profit in the year of his death was to be calculated on the basis of sales. Sales for the year ended 31, March 2022 amounted to Rs 8,40,000. Sales shows a growth trend of 20% and percentage of profit earning reduced by 1%. Pass necessary journal entries relating to the treatment of goodwill and his share in profits. Show your works clearly.

Answer.P & L suspense A/c Dr 11,340

To Vasav’s Cap 11,340

Dheeru’s Cap A/c Dr 59,250

Dev’s Cap A/c Dr 19,750

To Vasav’s Cap A/c 79,000

Working Notes:

Sales=8,40,000+ 20% of 8,40,000=10,08,000

Profit %=(84000/8,40,000*100) -1%=10%-1%=9%

Vasav’s ’s share of profit=10,08,000*3/12*9/100*4/8=11,340

Vasav’share in goodwill=50% (97000+1,05,000+30,000+84,000)*4/8

Rs 79,000

Question. Rohit, Raman and Raina are partners in a firm. Their capital accounts on 1st April, 2021, stood at Rs 2,00,000, Rs 1,20,000 and Rs 1,60,000 respectively. Each partner withdrew Rs 15,000 during the financial year 2020-21. As per the provisions of their partnership deed:

Interest on capital was to be allowed @ 5% per annum.

Interest on drawings was to be charged @ 4% per annum.

Profits and losses were to be shared in the ratio5:4:1.

The net profit of Rs 72,000 for the year ended 31st March 2020, was divided equally among the partner’s without providing for the terms of the deed. You are re-quired to pass a single adjustment entry to rectify the error. Show your workings clearly.

OR

Question.Raj and Suri are partners in a firm sharing profits equally. Their Capitals as on April,2021 were Rs 2,50,000 and Rs 1,50,000 respectively. On July 1,2021 ,they de-cided that their capitals should be Rs 2,00,000 each. The necessary adjustments in the capital were made by introducing or withdrawing cash by the partners. Interest on capi-tals is allowed @ 8% p.a. Pass necessary journal entries on July 1,2021 and compute interest on partners’ capital for the year ended March 31,2022.

Answer.Raina’s Cap A/c Dr 11,410

To Rohit Cap 10,150

To Raman Cap 1260

OR

1. Raj Cap A/c Dr 50,000

To Cash/Bank A/c 50,000

2. Cash/bank A/c Dr 50,000

To Suri’s Capital A/c 50,000

Interest on Raj Cap=250000*8/100*3/12+2,00,000*8%*9/12=17000

Interest on Suri Cap=1,50,000*8%*3/12+2,00,000 *8%*9/12=Rs 15,000

Question. Pass journal entries for issue of debentures in each of the following cases:

(1) 8% Debentures of Rs 100 each issued at 10% discount; redeemable at 10% premium.

(2) 8% Debentures of Rs 100 each issued at 10% premium; redeemable at 10% premium.

(3) 8% Debentures of Rs 100 each issued at par; redeemable at 10% premium.

OR

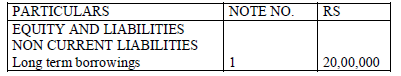

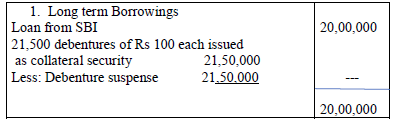

Balbir obtained a loan of Rs 20,00,000 from SBI @9% interest. The company issued Rs 21,50,000 9% debentures of Rs 100 each in favour of SBI as collateral security.

Pass journal entries for the above transactions and show the presentation in the Balance Sheet of Balbir.

Answer.1) Bank A/c Dr 90

To debenture application and allotment A/c 90

Debenture application and allotment A/c 90

Loss on issue of debentures 20

To 8%debentures 100

To premium on redemption of debentures 10

2) Bank A/c Dr 110

To debenture application and allotment A/c 110

Debenture application and allotment A/c 110

Loss on issue of debentures 10

To 8%debentures 100

To securities premium reserve 10

To premium on redemption of debentures 10

3) Bank A/c Dr 100

To debenture application and allotment A/c 100

Debenture application and allotment A/c 100

Loss on issue of debentures 10

To 8%debentures 100

To premium on redemption of debentures 10

OR

Extract of Balance sheet

Question. Anu, Manu and Sanu are partners in a firm. Their capital accounts on 1st April, 2022, stood at 3, 00,000, 2, 20,000 and 2, 60,000 respectively. Each partner withdrew `15,000 during the financial year 2021-22.

As per the provisions of their partnership deed:

(a) Interest on capital was to be allowed @ 5% per annum.

(b) Interest on drawings was to be charged @ 4% per annum.

(c) Profits and losses were to be shared in the ratio 3:2:1

The net profit of `90,000 for the year ended 31st March 2022, was divided equally amongst the partners without providing for the terms of the deed.

You are required to pass a single adjustment entry to rectify the error (Show workings clearly).

Answer.Manu’s Capital A/c Dr. 2,000

Sanu’s Capital A/c Dr. 8,650

To Anu’s capital A/c 10,650

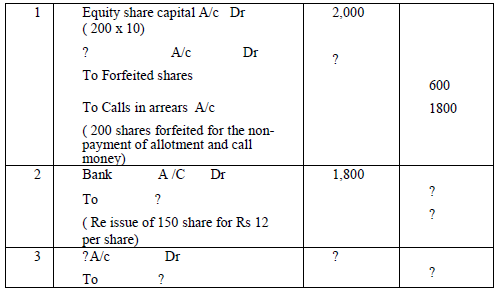

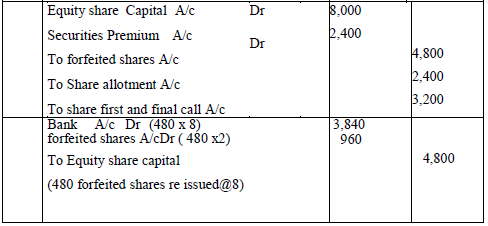

Question. Fill in the blank spaces in the journal entries given below of S Ltd .

Answer.1. Securities premium 400

2. share capital 1,500 and securities premium 300

3. forfeited shares A/c Dr. 450

To Capital reserve 450

Question. X and Y were partners in a firm. They had entered into partnership five years back, without any written agreement. They contributed Capitals in the firm to meet financial requirements. Within a short span of time, their conflicts started so they have decided to dissolve the firm. They were sharing profits and Losses in the ratio of 3:2. Assets and external liabilities have been transferred to realization A/c. Pass Journal entries to effect the following.

a) Bank Loan of ₹ 10,000 is paid off.

b) X was to bear all expenses of realization for which he is given a commission of ₹ 5,000.

c) Advertisement Expenditure A/c appeared in the books at ₹ 48,000.

d) Stock worth ₹10,600 was taken over by Y at ₹ 10,200.

Answer.

a) Realization A/c Dr 10,000

To Bank 10,000

( Bank loan discharged)

b) Realization A/c Dr 5,000

To X’s Capital 5,000

( Commission Payable to X)

c) X’s capital A/c Dr 28,800

Y’s Capital A/c Dr 19,200

To Advertisement Expenditure 48,000

( Transfer of advt.exp to partner’s Capital A/c)

d) Y’s Capital A/c Dr 10,200

To Realization 10,200

(Stock taken over by Y)

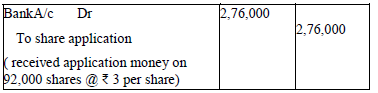

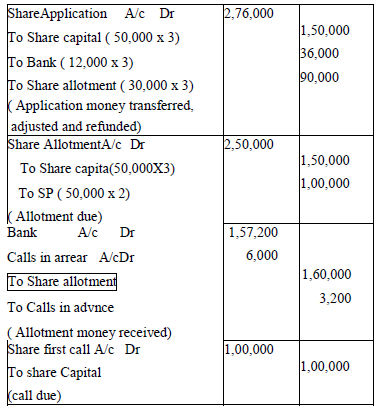

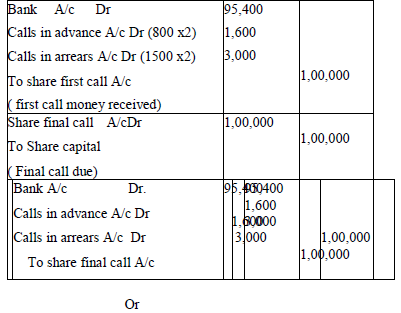

Question. White Ltd issued 50,000 shares of ₹10 Each at a premium of ₹ 2 per share payable ₹ 3 on application, ₹ 5 including premium on allotment and the balance in equal instal-ments over two calls. Applications were received for 92,000 shares and the allotment was done as under:

a) Applications of 40,000 shares – allotted 30,000 shares

b) Applications of 40,000 shares – allotted 20,000 shares

c) Applications of 12,000 shares – Nil

Vishnu who applied for 2,000 shares (Category A) did not pay any amount other than appli-cation money. Vyshakh who was allotted 800 shares (Category B) paid the call money due along with allotment. All other shareholder’s paid their dues as per schedule.

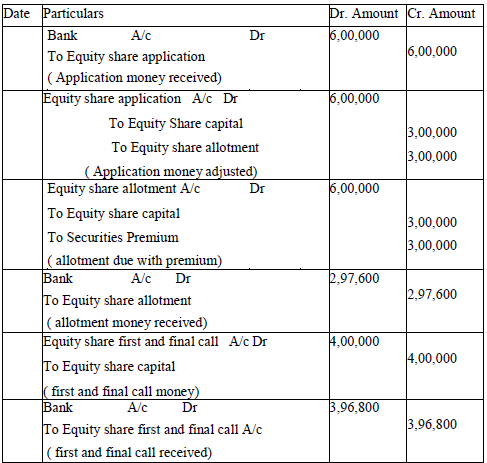

Pass Journal entries in the books of White Ltd.

OR

Ahan Company Ltd made an issue of 1, 00,000 equity shares of ₹ 10 each at a premium of 30% payable as follows:

On application ₹ 3 per share , On allotment ₹ 6 per share

On first and final call- balance

Applications were received for 2, 00,000 equity shares and the directors made pro-rata allotment. Vaibhav who had applied for 1,600 shares did not pay the allotment and final call money. His shares were forfeited and 60% of them were re- issued at ₹ 8 per share fully paid.

Pass journal entries in the books of Ahan Company Ltd.

Answer.

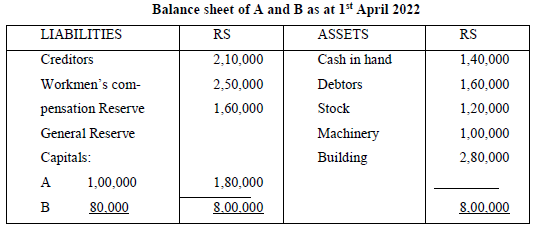

Question. A and B were partners in a firm sharing profits in the ratio of 3:2. On 1st April 2022 they admit C as a partner in the firm. The Balance sheet of A and B on that date was as under:

It was agreed that:

1) The value of building and stock be appreciated to 3,80,000 and 1,60,000 respectively.

2) The liabilities of workmen’s compensation reserve was determined at 2,30,000.

3) C brought in his share of goodwill Rs 1,00,000 in cash.

4) C was to bring further cash as would make her capital equal to 20% of the combined capital of A and B after above revaluation and adjustments are carried out.

5) The future profit sharing ratio will be for A 2/5th B 2/5th and C 1/5th.

Prepare revaluation account, partner’s capital account and Balance sheet of the new firm. Also show clearly the calculation of capital brought by C.

OR

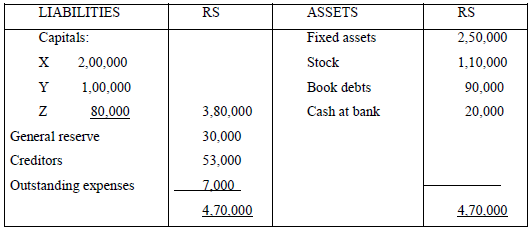

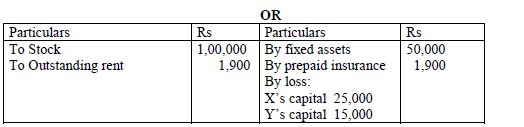

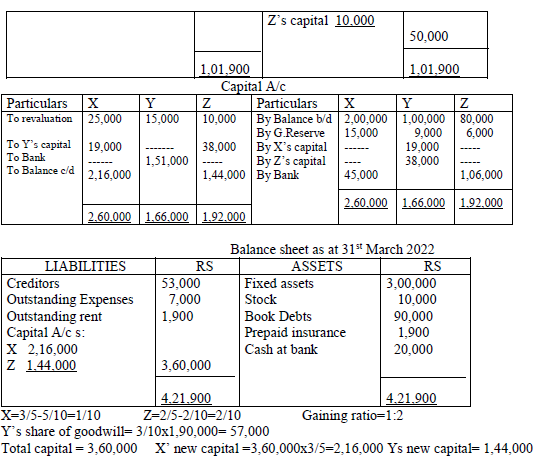

X, Y and Z are partners in a firm sharing profits in the ratio of 5:3:2. On 31st March 2022, the Balance sheet of the firm stood as follows:

On the above date Y decides to retire from the firm,

1) Goodwill is to be valued at 1,90,000.

2) Fixed assets be valued at Rs 3,00,000.

3) Stock be considered worth Rs 10,000.

4) A liability of Rs 1,900 for outstanding rent has not been shown in the books of the firm. The same is to be recorded now.

5) Insurance premium amounting to Rs5,700 was debited to profit and loss account, of which Rs 1,900 is related to next year.

Y is to be paid in cash brought in by X and Z in such a way so as to make their capital proportionate to their new profit sharing ratio which is to be 3:2 respectively.

Prepare necessary ledger accounts and Balance sheet of the new firm.

Answer.

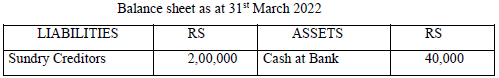

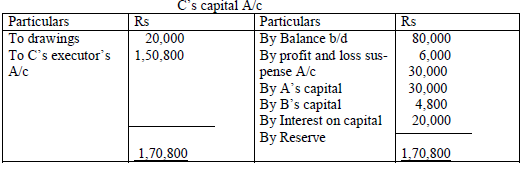

Question. A, B and C are partners in a business sharing profits and losses in the ratio of 2:2:1. Their Balance sheet as at 31st March 2022was as follows:

Balance sheet as at 31st March 2022

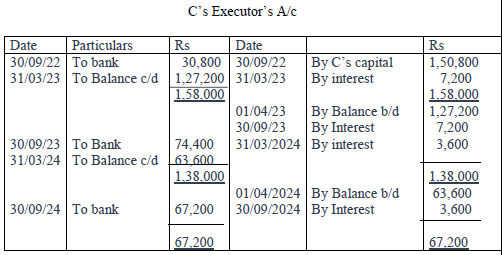

C died on 30th September 2022. The partnership deed provided following:

1) Deceased partner will be entitled to his share of profit up to the date of death calculated on the basis of previous year’s profit.

2) He will be entitled to his share of goodwill of the firm calculated on the basis of 3 year’s purchase of average of last 4 year’s profit.

Profits for the last four financial years are: for 2018-19:Rs 1,60,000; for 2019-20: Rs 1,00,000; for 2020-21: Rs 80,000; for 2021-22:Rs 60,000.

3) Drawings of the deceased partner up to the date of death amounted to Rs 20,000.

4) Interest on capital is to be allowed at 12% per annum.

Continuing partners agreed that Rs 30,800 will be paid to the executor immediately and the balance in two equal yearly instalments starting from 30th September 2022 with in-terest @ 12% p.a. on outstanding balance. Show C’s capital account and his executor’s account till the settlement of the amount due.

Answer.

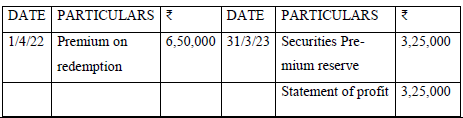

Question. Latha Ltd., a pharmaceutical company appointed sales expert, Ms. Shivada as the CEO of the company, with a target to penetrate their roots in the rural regions. Ms. Shivada discussed the ways and means to achieve target of the company with financial, production and marketing departmental heads and asked the finance manager to prepare the budget. After reviewing the suggestions given by all the departmental heads, the fi-nance manager proposed requirement of an additional fund of ₹ 68,25,000. Latha Ltd. is a zero-debt company. To avail the benefits of financial leverage, the finance manager proposed to include debt in the capital structure. After deliberations, on 1st April1,2022, the board of directors had decided to issue 10% Debentures of ₹100 each to the public at a premium of 5%, redeemable after 10 years at ₹110 per share. You are required to answer the following questions:

(i) Calculate the number of debentures to be issued to raise additional funds.

(ii) Pass Journal entry for the allotment of debentures.

(iii) Pass Journal entry to write off loss on issue of debentures.

(iv) Calculate the amount of annual fixed obligation associated with debentures.

Prepare Loss on Issue of Debentures Account.

Answer.

i) Number of Debentures to be issued = 68,25,000/105 = 65,000

ii) Debenture Application & Allotment A/c Dr.68,25,000

Loss on Issue of Debentures A/c Dr. 6,50,000

To 10% Debentures A/c 65,00,000

To Securities Premium Reserve A/c 3,25,000

To Premium on Redemption of Debentures A/c 6,50,000

(Being allotment of debentures made)

i) Securities Premium Reserve A/c Dr. 3,25,000

Statement of Profit & Loss Dr. 3,25,000

To Loss on Issue of Debentures A/c 6,50,000

(Being Loss on Issue of Debentures A/c written off)

ii)Interest on 10% debentures = 65,00,000 x 10 /100 = ₹6,50,000

iii) Loss on issue of debentures A/c

Part B :- Analysis of Financial Statements

(Option – I)

Question. If expected period of payment of Trade payables is 13 months and Operating cycle is 15 months it is ______Liability.

a) Current

b) Non current

c) fictitious

d) None of these

Answer

A

OR

Question.If the operating ratio of a company is 75%, operating profit ratio will be ____

a) 75%

b) 25%

c) 100%

d) 35%

Answer

B

Question. From the following information calculate ‘Interest Coverage ratio.

Profit after Interest and Tax ₹ 1, 98,000, Rate of In-come Tax ₹ 40%,15% debentures ₹ 2, 00,000.

a) 10 times

b) 12 times

c) 25times

d) 15 times

Answer

B

Question. State a transaction that is always classified as a financing activity for every enter-prise while preparing Cash flow statement. C

OR

Pick the correct option : which of the following would result in inflow of cash and cash equivalents:

i) Purchase of stock in trade for cash Rs 50,000 ii)Sale of current investments Rs 10,000. iii) Purchase of land Rs 1,00,000. iv)Debtors paid Rs 10,000.

a) i) only

b) ii) only

c) i) ,ii) , iii) and iv)

d) None of these

Answer

D

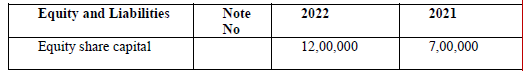

Question. Extract of Balance sheet:

Additional Information:-

Equity shares were issued at a premium of 15%.

How much amount related to above information will be shown in the Financing activity of cash flow statement prepared on 31st March 2022?

a) Inflow 5,00,000

b) Inflow 5,75,000

c) Inflow 7,10,500

d) Inflow 4,25,000

Answer

B

Question. Under which head and sub heads the following items will be shown in the balance sheet of a company as per Schedule III of the Companies Act 2013.

1) Premium on redemption of debentures.

2) Provision for tax

3) Mining rights

Answer.1) Non current liabilities; other current liabilities

2) Current liabilities; Short term provisions

3) Non current assets; fixed assets: Intangible assets

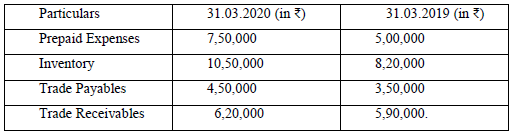

Question. Read the following hypothetical text and answer the given questions on the basis of the same:

Rian an alumni of IIM Ahemdabad initiated her startup Rian Ltd. in 2020. The prof-its of Rian Ltd. in the year 2020-2021 after all appropriations was ₹ 31,25,000. This profit was

arrived after taking into consideration the following items:-

Gain on sale of fixed tangible assets- 12,50,000

Goodwill written off – 7,80,000 Transfer to General Reserve -8,75,000

Provision for taxation – 4,37,500 .

Additional Information:-

Question. Net Profit before tax will be ₹…………………………….

a)22,50,000

b) 35,62,500

c) 39,67,500

d) 44,37,500

Answer

D

Question. Operating profit before working capital changes will be ₹……………………

a) 52,17,500

b) 64,67,500

c) 39,67,500

d) 39,69,500

Answer

C

Question. Cash from operating ctivities before tax will be₹……………………

a) 35,57,500

b) 40,67,500

c) 37,87,500

d) 35,67,300

Answer

A

Question. The current ratio of a company is 2.1:1.2. state with reasons, which of the follow-ing transactions will increase, decrease or no change in the ratio:

1) Received from debtors Rs 20,000.

2) Issued Rs 5,00,000 equity shares to the vendors of land.

3) Accepted bill of exchange drawn by the creditors Rs 12,000.

4) Redeemed 5% debentures of Rs 3,00,000 at a premium of 5%.

OR

Calculate proprietary ratio, if :

Total assets to Debt ratio is 2:1. Debt is 5,00,000.

Equity shares capital is 0.5 times of debt.

Preference Shares capital is 25% of equity share capital.

Net profit before tax is 10,00,000 and rate of tax is 40%.

Answer.1) No change. It will increase and decrease debtors with the same amount.

2) No change. Both current assets and current liabilities are not affected.

3) No change. Increase in one current liability results in decrease in another current liability with the same amount.

4) Increase. If redemption takes place in the current year where outstanding debentures are taken as current liability, both current assets and current liabilities have decreased by the same amount.

OR

Proprietary Ratio = Proprietor’s Fund /Total Assets

Total Assets = Debts × 2 = `5,00,000 × 2 = `10,00,000

Proprietor’s Funds = Equity Share Capital + Preference Share Capital + Surplus

= (5,00,000 × 0.5) + (5,00,000 × 0.5 × 25%) + (10,00,000 – 40% of 10,00,000) = 2,50,000 + 62,500 + 6,00,000 )= `9,12,500

Proprietary Ratio = 9,12,500 / 10,00,000 = 0.912 : 1

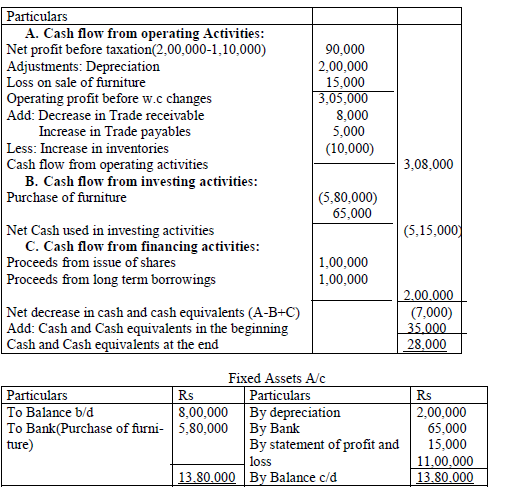

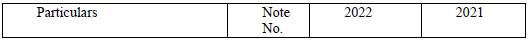

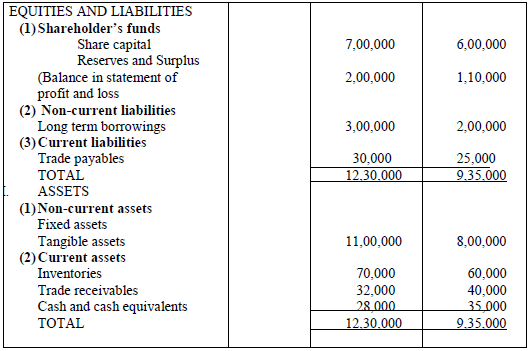

Question. Following is the balance sheet of Volvo Ltd as on 31st March 2022:

Adjustments: During the year a piece of furniture of the book value of Rs 80,000 was sold for Rs 65,000. Depreciation provided on tangible assets during the year amounted to Rs 2,00,000. Prepare a cash flow statement.

Answer.Cash flow statement