Please see Accounting for Partnership Firms Basic Concepts Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Accounting for Partnership Firms Basic Concepts in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Accounting for Partnership Firms Basic Concepts Class 12 Accountancy

Short Answer questions :

Question. What are the circumstances under which the balance of the ‘Fixed capitals Accounts’ may change?

Answer: i) Additional capital Introduced. ii) Capital Withdrawn.

Question. A,B and C are partners and decided that no interest on drawings is to be charged from any Partner. But after one Year ‘C’wants that interest on drawings should be charged from every partner. State how ‘C’ can do this?

Answer: He can do so only by changing the Partnership deed with the consent of all partners.

Question. What do you understand by Sacrificing Ratio?

Answer:_Sacrificing ratio is the ratio in which the partner or partners have agreed to sacrifice their share of profit in favour of one or more partners of the firm. Sacrificing ratio of each partner is calculated as follows: Sacrificing Ratio = Old Ratio – New Ratio

Question. A and B are partners in a firm sharing profit in the ratio of 3:2. They had advanced to the firm a sum of Rs. 30,000 as a loan in their profits sharing ratio on 1st Oct. 2014. The partnership deed is silent on the question of interest on loan for partners. Compute the interest payable by the firm to the partners, assuming the firm closes its books on 31st March.

Answer: A- Rs.540 B- Rs. 360. (Note: In the absence of Partnership deed, 6% p.a will be allowed as Interest on Loan)

Question. Which Act of the Parliament specified the number of partners in Partnership?

Answer: Section 464 of Companies Act, 2013

Question. What share of profits would a “sleeping partner” who has contributed 75% of the total Capital get in the absence of Partnership Deed?

Answer: In the absence of Partnership Deed, a sleeping partner will get equal share of profits.

Question. Give the journal entry of P & L credit balance.

Answer: Profit and Loss A/c Dr

To Profit and Loss Appropriation A/c.

Question. What is a legal status of a firm?

Answer: A firm is not a legal person it is merely a collection of partners.

Question. Why is it preferable to have a written agreement between the partners?

Answer: To avoid all kinds of misunderstanding and disputes among the partners.

Question. If the partners’ capitals account are fixed where will you record drawings of partners?

Answer: Debit side of partners current A/c.

Question. Mention two items that are recorded in Partners Fixed Capital Account.

Answer: i) Capital Withdrawal ii) Fresh Capital Introduced.

Question. What is meant by Partnership? / Define Partnership.

Answer: According to Section 4 of Indian Partnership Act 1932, “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all”.

Question. How will you calculate interest on drawings when date of withdrawal is not given?

Answer: It will be calculated on the average basis of 6 months.

Question. In which account interest on partners loan is debited and why?

Answer: It is debited to Profit and Loss Account because it is a charge against theprofit

Question. Anna and Bobby were partners sharing profits and losses in the ratio of 5 : 3. On 1st April 2014, their capital accounts showed balances of Rs 3,00,000 and Rs 2,00,000 respectively. Calculate the amount of profit to be distributed between the partners if the partnership deed provided for interest on capital @ 10% per annum and the firm earned a profit of Rs 45,000 for the year ended 31st March 2015.

Answer:_No profit will be distributed as the amount of profit (i e., Rs 45,000) is not sufficient to pay the interest on capital (Rs 50,000),so Interest on capital i.e. Rs.45,000, to be provided in the interest ratio of the partners.

Question. Would a “Charitable Dispensary” run by 8 members be deemed a Partnership Firm? Give reason in support of your answer.

Answer: (i) In Partnership, there must be a business;

(ii) There must be sharing of profits from such business among the partners.

Question. Can a Partner be exempted from sharing the losses in a firm? If yes, under what circumstances?

Answer: Yes, if Partnership Deed provides so.

Question. A & B are two working partners whereas B is sleeping partner in the firm. B wants to inspect books of Accounts but A denies. What shall be done?

Answer: A is wrong, he cannot deny as B holds the right to inspect the accounts.

Question. In the absence of Partnership deed, how are mutual relations of partners governed?

Answer: In the absence of |Partnership deed, mutual relations are governed by The Indian partnership Act 1932.

Question. Debit balance of Partners Current A/Cs is shown on which side of the balance sheet?

Answer: Assets side.

Question. Under fixed capital method, partner’s drawings are shown in which account?

Answer: Partners Current A/cs

Question. What share of profits would a “sleeping partner” who has contributed 75% of the total Capital get in the absence of Partnership Deed?

Answer: In the absence of Partnership Deed, a sleeping partner will get equal share of profits.

Question. What is the status of partnership firm from an accounting viewpoint?

Answer: From the accounting view point, Partnership is a separate business entity from the partners.

Question. Can a Partner be exempted from sharing the losses in a firm? If yes, under what circumstances?

Answer: Yes, if Partnership Deed provides so.

Question. Why is that the Fixed Capital Account of a partner does not show “Debit Balance” in spite of regular and Consistent losses year after year?

Answer: When the capitals are fixed, the Capital Account of a partner will never show debit balance since, all transactions between the firm and the partner are recorded in Current Account.

Question. Name the Act under which partnership is governed?

Answer: Partnership Act, 1932.

Question. What do you understand by Sacrificing Partners?

Answer:_The partners whose share stand decreased as a result of change in profit-sharing ratio are known as Sacrificing Partners. Sacrificing ratio shows the sacrifice of share of each sacrificing partner.

PRACTICAL QUESTIONS :

Question. Raju and Jai commenced business in partnership on April 1, 2019. No partnership agreement was made whether oral or written. They contributed ₹4,00,000 and ₹1,00,000 respectively as capitals. In addtion, Raju advanced ₹2,00,000 as loan to the firm on October 1, 2019. Raju met with an accident on July 1, 2019 and could not attend the business up to september 30, 2019. The profit for the year ended March 31, 2020 amounted to ₹50,000 before charging interest on Raju’s loan. Disputes have arisen between them on sharing the profits of the firm. Raju Claims:

(i) He should be given interest at 10% p.a. on capital and so also on loan.

(ii) Profit should be distributed in the proportion of capitals. Jai Claims: (i) Net profit should be shared equally. (ii) He should be allowed remuneration of ₹1,000 p.m. during the period of Raju’s illness.

(iii) Interest on capital and loan should be given @ 6% p.a.

State the correct position on each issue as per the provisions of the Partnership Act, 1932.

Solution:

Settlement of disputes as per the provisions of the Partnership Act, 1932:

(i) No interest is payable on Partners’ capitals in the absence of partnership agreement.

(ii) Interest on Raju’s loan is payable @6% p.a., i.e., 2,00,000 × 6% × 6/12 = `6,000

(iii) Jai’s claim for remuneration @ `1,000 p.m. is not valid since no remuneration is payable when there is no partnership agreement.

(iv) Profits should be distributed equally among the partners irrespective of their capital contributions.

Net profit after charging interest on Raju’s loan = 50,000 – 6,000 = `44,000, which will be distributed equally between Raju and Jai, i.e. RS `22,000 each.

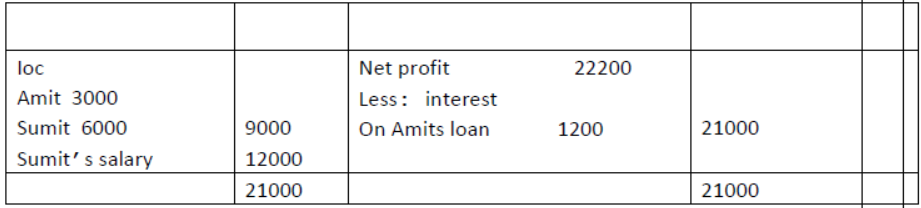

Question. Amit and Sumit are partners in ratio of 3 :1. They invested ₹ 50,000 and ₹ 100,000 as their capitals. Amit has advanced a loan of ₹ 20,0O0 to the firm. Partners are entitled to:

1) Intereston capital @10% pa

2) Salary to a Rs 5000 per quarter

Net profit for the year was Rs 22,200

Prepare Profit & Loss Appropriation Account if :

(a) Interest on capital and salary are appropriation

(b) Interest on capital and salary are treated as charge against profits.

Solution:

(a) PROFIT AND LOSS APPROPRIATION ACCOUNT

Working note:

Total appropriation

Amit’s IOC Rs 5000+ Sumit’s IOC 10000+ Sumi’s salary Rs 20000=35000

Profit is less than total appropriation I.e Appropriation will be in the ratio of =5000:10000:20000 or 1:2:4

(b)interest and salary considered as charged

Profit and loss Adjustment account

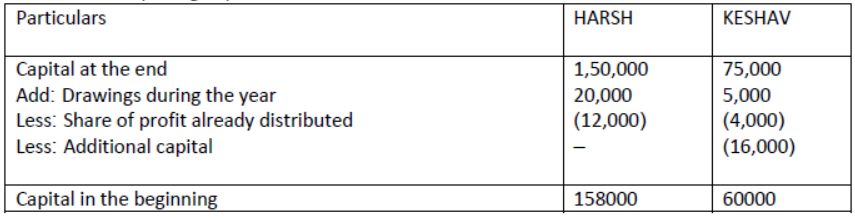

Question. Harsh and Keshav are partners sharing profits and losses in the ratio of 3:1. Their capitals at the end of the financial year 2019-20 were `1,50,000 and `75,000. During the year 2019-20, Harsh’s drawings were `20,000 and the drawings of Keshav were `5,000, which had been duly debited to partner’s capital accounts. Profit before charging interest on capital for the year was `16,000. The same had also been distributed in their profit sharing ratio. Keshav

had brought additional capital of `16,000 on October 1, 2019. Interest on capital is allowed @ 12% p.a.

Solution:

Calculation of Opening Capitals:

Interest on Harsh’s Capital = 12% of 1,58,000 = `18,960

Interest on Keshav’s Capital =(12 %OF 60, 000 X6/12)+(76, 000 X12 X6/12 = 3,600 + 4,560 = `8,160

Total interest payable to the partners = 18,960 + 8,160 = `27,120.

But profit for the year is `16,000, which is less than total interest payable.

Therefore, the payment of interest on capital will be restricted to the amount of profits.

In that case, the profit will be effectively distributed in the ratio of interest on capital of each partner i.e. 18,960 : 8,160.

Interest on Harsh’s Capital = 18 960/27120X16000=11186

Interest on Keshav’s Capital = 8 160/27120X16000=4814

Question. A and B are partners sharing profits in the ratio of 3:2, with capitals of ₹50,000 and ₹30,000 respectively. Interest on capital is agreed @ 6% p.a. B is to be allowed a quarterly salary of ₹625. Manager is to be allowed commission ₹5,000. A has also given a Loan on 1 October 2019 of ₹1,00,000 to the firm without any agreement. During the year 2019-20, the profits earned is `22,250.

Solution:

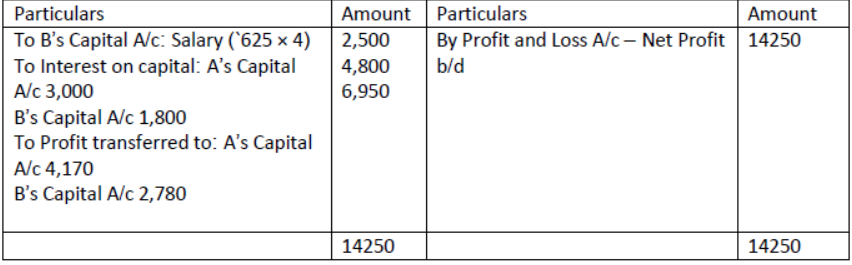

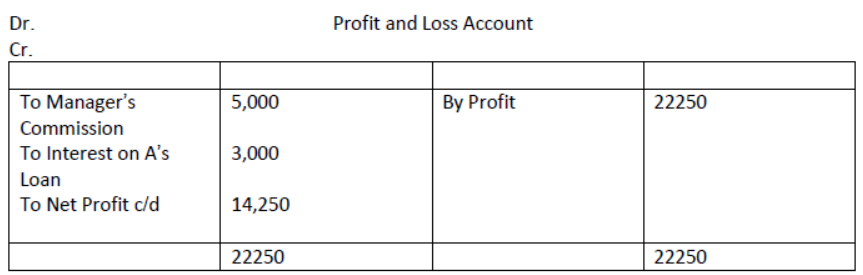

Profit and Loss Appropriation Account for the year ending March 31, 2020

Working notes: Interest on A’s Loan = `1,00,000 × 6/100 × 6/12 = `3,000

Manager’s Commission and Interest on Partner’s Loan are charged to Profit and Loss Account.

Question. Sukesh and Vanita were partners in a firm. Their partnership agreement provides that:

(i) Profits would be shared by Sukesh and Vanita in the ratio of 3:2.

(ii) 5% p.a. interest is to be allowed on capital.

(iii) Vanita should be paid a monthly salary of `600.

The following balances are extracted from the books of the firm, on March 31, 2019.

Net profit for the year, before charging interest on capital and after charging partner’s salary was `9,500.

Prepare the Profit and Loss Appropriation Account for the year ending 31 March 2020 and the Partner’s Current

Accounts.

Solution:

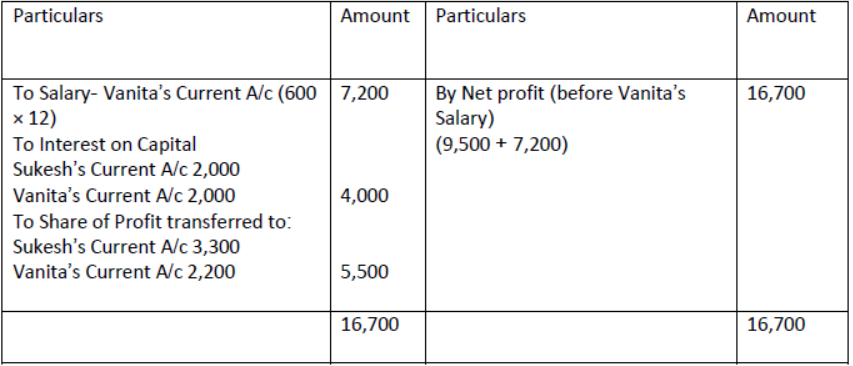

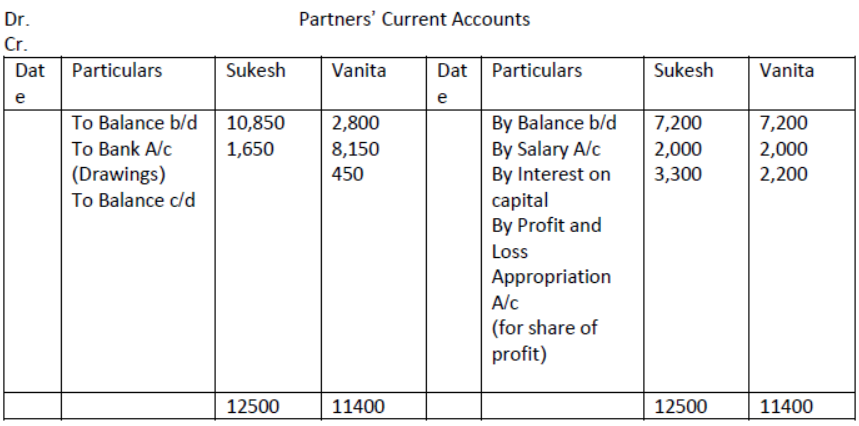

Books of Sukesh and Vanita

Dr. Profit and Loss Appropriation Account for the year ending 31 March 2020

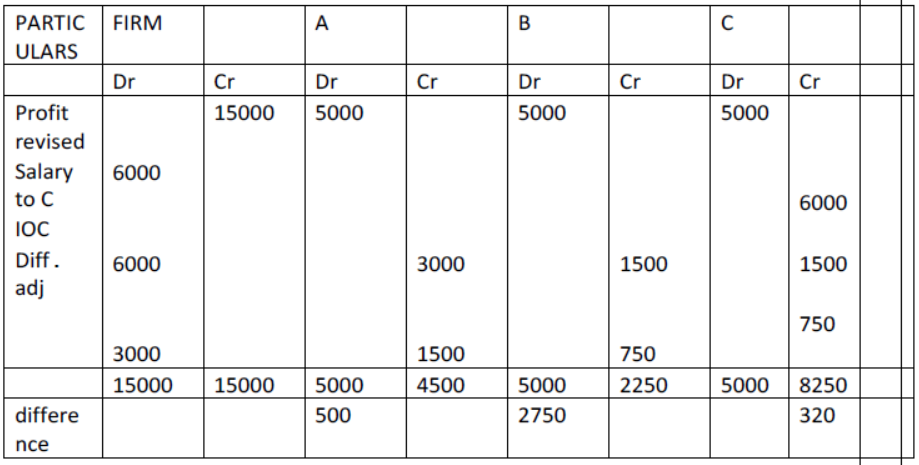

Question. A, B and C were partners in a firm. On 1 ST January, 2018, their fixed capitals were ₹ 60,000, ₹30,000 and ₹ 30,000 respectively. As per partnership deed, partners were entitled to

(a) Salary to C at ₹500 per month.

(b) Interest on Capital 5% p.a.

(c) Profits to be shared in the capital ratio.

Net profit for 20 18 amounting to ₹ 15,000 was divided equally without providing for

above adjustments. Pass adjustment entry to rectify the above errors.

Solution:

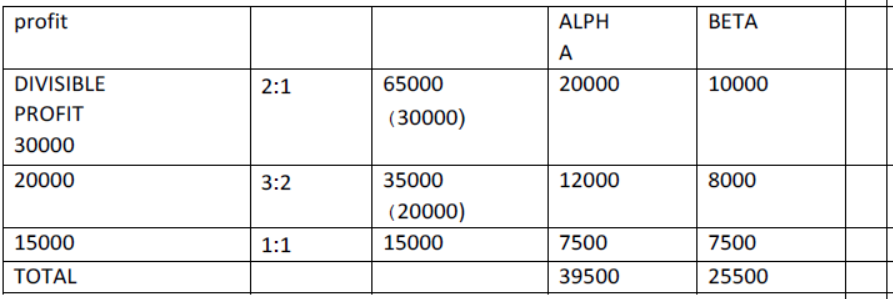

Question. Alpha & Beta are partners with capitals of ₹ 2,00,000 and ₹ 1,00,000 respectively. Give journal entries for distribution of profit according to following provisions in the deed.

A) Partners are entitled to interest on capital@5% p.a.

B) B being a working partner was also allowed a half yearly salary of ₹ 10,000.

C) Profits were to be divided as follows:

(i) First ₹ 30,000 in proportion to their capitals

(ii) Next ₹ 20,000 in ratio of 3 : 2

(iii) Remaining profits to be shared equally.

Profit for the year was ₹ 100000.

Solution: