Please see Reconstitution Of A Partnership Firm Admission Of A Partner Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Reconstitution Of A Partnership Firm Admission Of A Partner in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Reconstitution Of A Partnership Firm Admission Of A Partner Class 12 Accountancy

Long Questions :

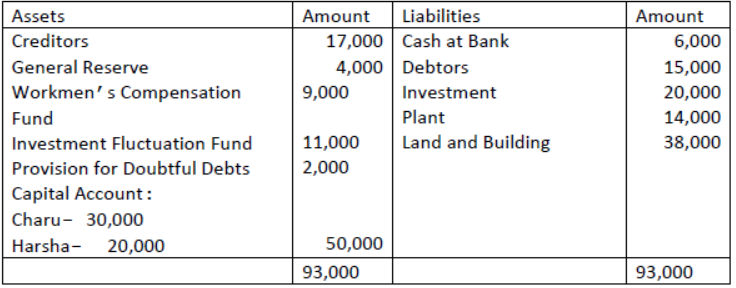

Question. Charu and Harsha were partners in a firm sharing profits in the ratio of 3:2. On 1stApril, 2014 their Balance Sheet was as follows:

On the above date Vaishali was admitted for 1/4th share in the profits of the firm on the following terms.

i. Vaishali will bring Rs.20,000 for her capital and Rs.4,000 for her share of goodwill premium.

ii. All Debtors were considered good.

iii. The market value of Investments was Rs.50,000.

iv. There was a liability of Rs.6,000 for Workmen’s compensation.

Pass necessary entries.

Solution:

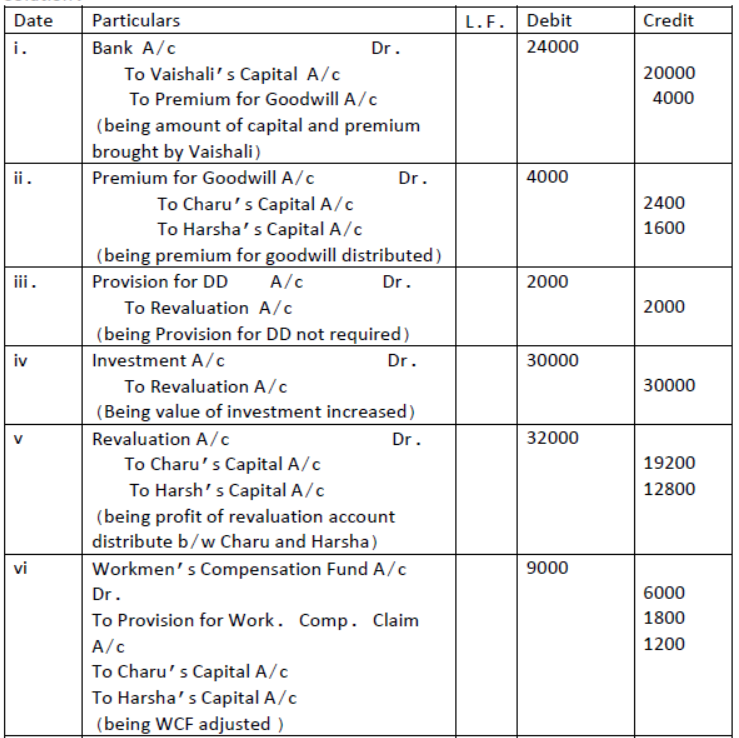

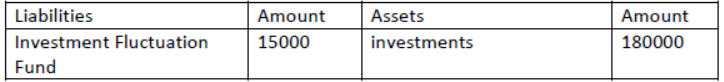

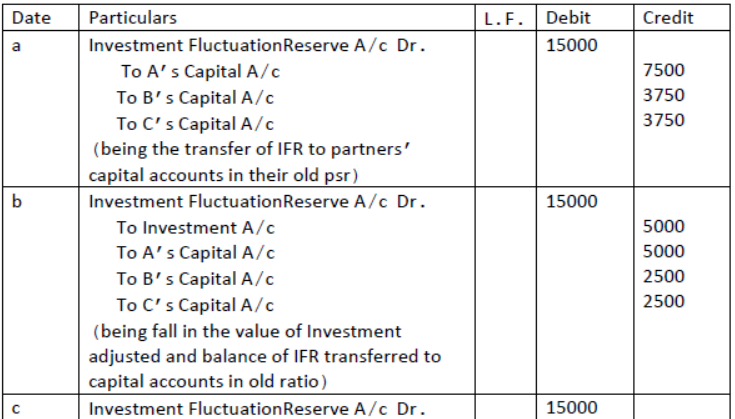

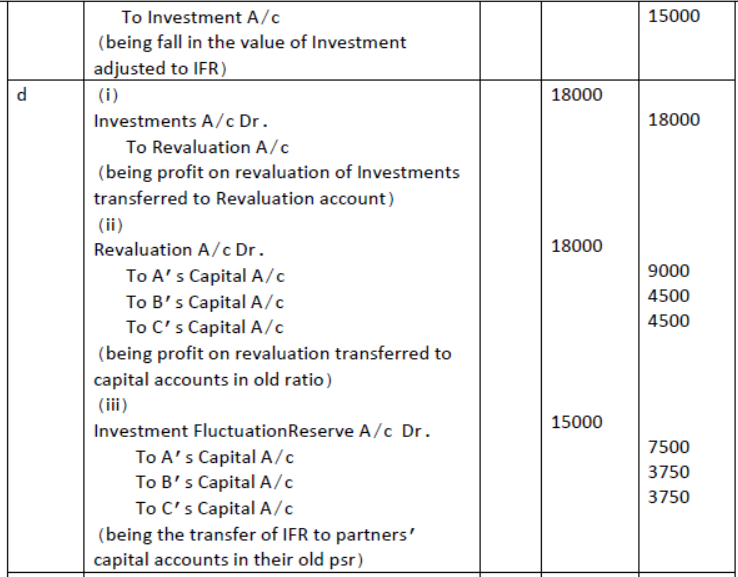

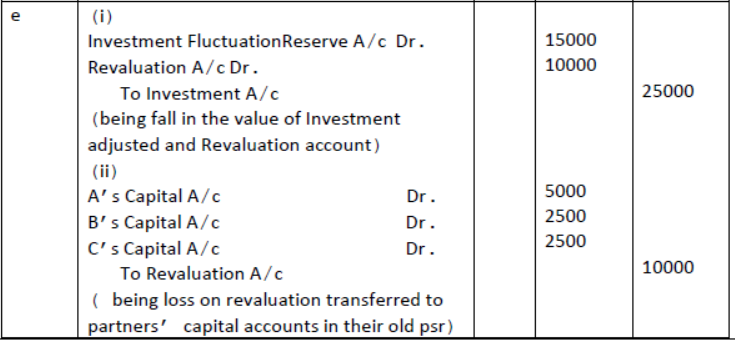

Question. A, B and C were partners sharing profits and losses in the ratio of 2:1:1. They admit D as a new partner on April 1, 2020. On that date their Balance Sheet had following items appearing in it.

You are required to pass necessary journal entries in each of the following situation in connection with investment Fluctuation Fund:

(a) There is no additional information given.

(b) Market value of investment is Rs.175000

(c) Market value of investment is Rs.165000

(d) Market value of investment is Rs.198000

e) Market value of investment is Rs.155000

Solution:

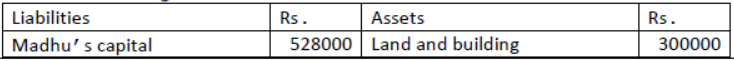

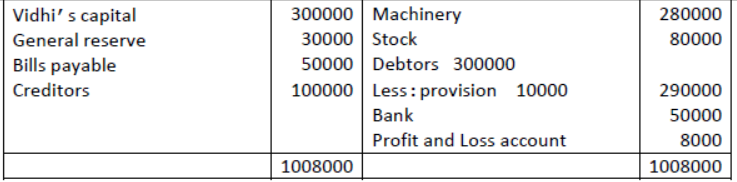

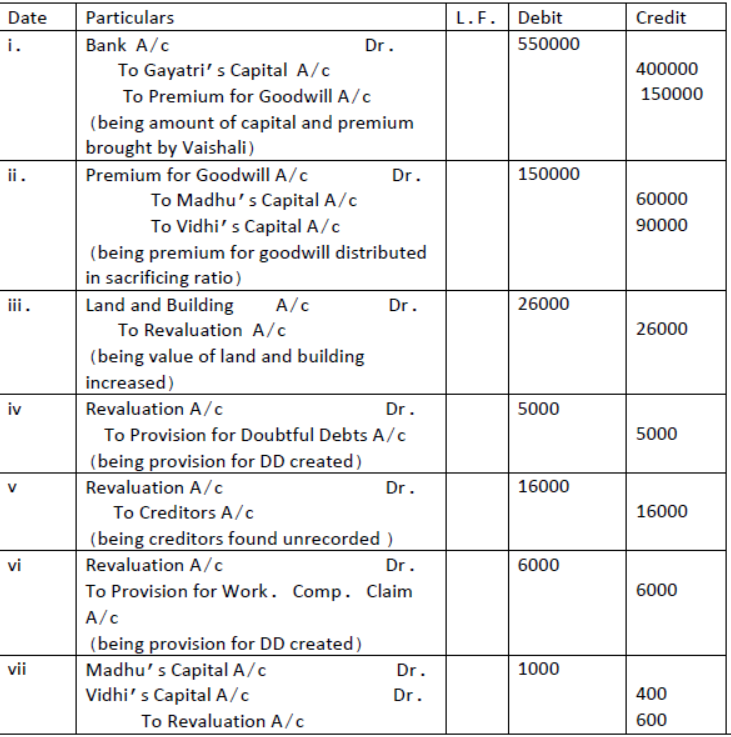

Question. The balance sheet of Madhu and Vidhi who are sharing profits in the ratio of 2:3 as at 31st March 2016 is given below

Madhu and Vidhi decided to admit Gayatri as a new partner from 1stapril 2016 and their new profit sharing ratio will be 2:3:5.Gayatri brought Rs 400000as capital and goodwill premium in cash.

A. Goodwill of the firm was valued at Rs.300000

B. Land and building was found undervalued by Rs.26000

C. Provision for doubtful debts was to be made equal to 5% of the debtors.

D. There were unrecorded supplier to the extent of Rs.20000.

E. There was a claim of Rs.6000 on account of workmen compensation.

Pass necessary journal entries.

Solution:

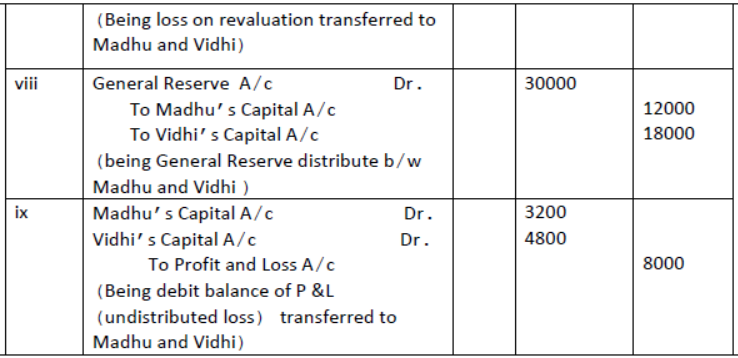

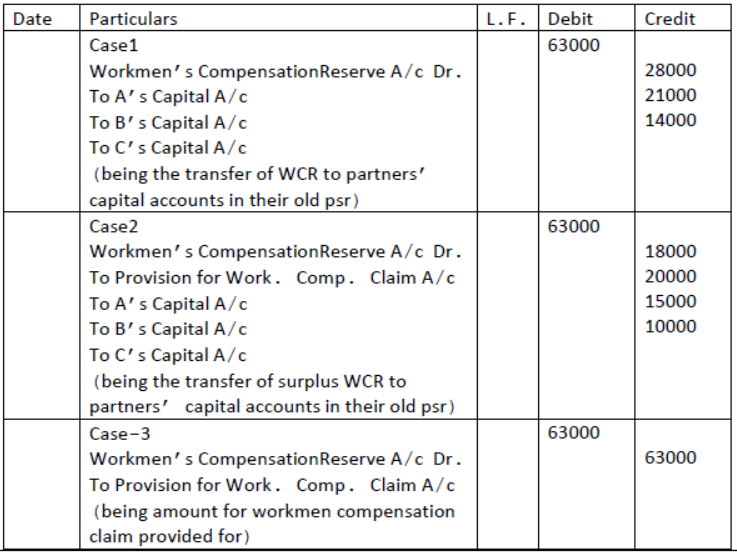

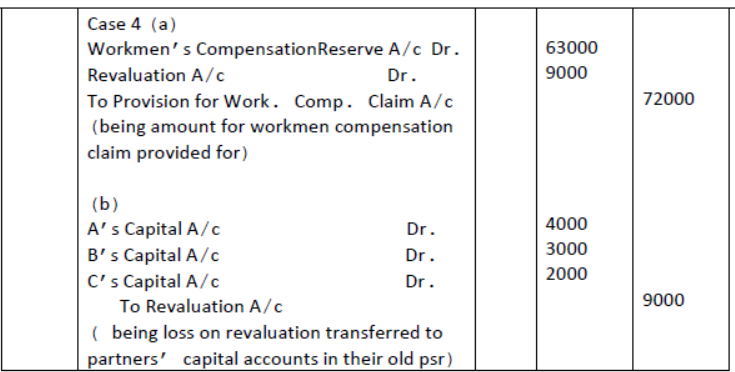

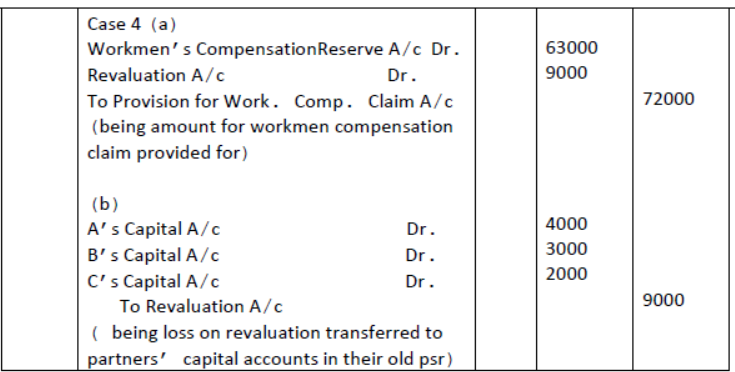

Question. A, B and C were partners sharing profits and losses in the ratio of 4:3:2. They admit D as a new partner on April 1, 2020. An extract of their Balance Sheet as at 31st March, 2020 is as follows:

Show the accounting treatment under the following alternative cases:

Case 1: If there is no claim made against WCR.

Case 2: If a claim on account of WCR is estimated at Rs.18000.

Case 1: If a claim on account of WCR is exactly Rs.63000

Case 1: If a claim on account of WCR is Rs.18000.

Solution:

Question. The Balance Sheet of Madan and Mohan who share profits and losses in the ratio of 3:2 as at 31st March 2017 was as follows.

They decided to admit Gopal on 1st April 2017 for 1/4th share on the following terms.

i. Gopal shall bring Rs.25,000 as his share of premium for goodwill and capital Rs.80000.

ii. That unaccounted accrued income of Rs.500 be provided for.

iii The market value of investment was Rs.45,000.

iv. A debtor whose dues of Rs.1,000 were written off as Bad Debts paid Rs.800 in full settlement.

v. A claim of Rs.2,000 on account of Workmen’s Compensation to be provided for.

vi. Patents are undervalued by Rs.5,000.

Pass journal entries.

Solution: Loss on revaluation- 8700

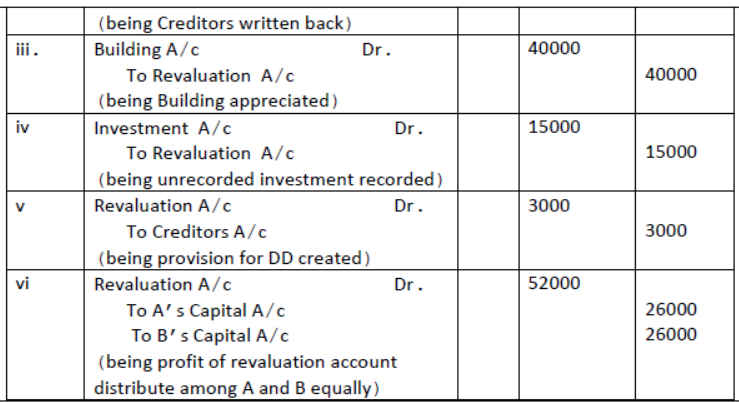

Question. At the time of admission of a new partner, the assets and liabilities of A and B were revalued as follows.

i) A provision for Doubtful Debts @10% was made on sundry debtors (Sundry Debtors Rs.50,000)

ii) Creditors were written back by Rs.5,000.

iii) Building was appreciated by 20% (Book Value of Building Rs.2,00,000)

iv) Unrecorded investments were worth Rs.15,000.

v) A provision of Rs.2,000 was made for an outstanding bill for repairs.

vi) Unrecorded Liability towards suppliers was Rs.3,000.

Pass necessary journal entries.

Solution:

Question. X, Y and Z were partners sharing profits and losses in the ratio of 5:3:2. They admit S as a new partner on April 1, 2020. On that date their Balance Sheet had following items appearing in it. 10

You are required to pass necessary journal entries in each of the following situation in connection with investment Fluctuation Fund:

Solution: i) There is no additional information given.

ii) Market value of investment is Rs.180000

iii) Market value of investment is Rs.172000

iv) Market value of investment is Rs.224000

v) Market value of investment is Rs.160000

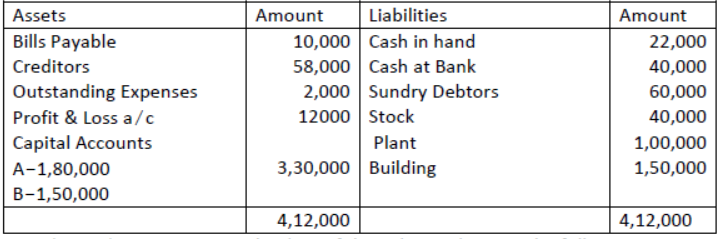

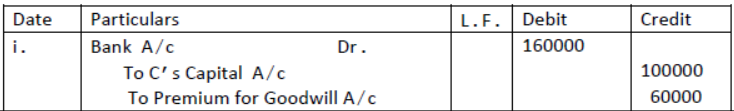

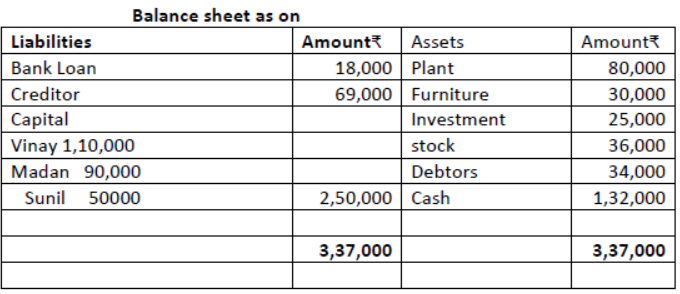

Question. Given below is the balance sheet of A and B who are carrying partnership business on 31st March 2018 A and B share profits and losses in the ratio of 2:1

Balance Sheet of A and B as on 31st March 2018

C is admitted as a partner on the date of the Balance Sheet on the following terms

i. C will bring in Rs.1,00,000 as his capital and Rs. 60,0000 as his share of goodwill for 1/4th share in the profits.

ii. Plant is to be appreciated to Rs.1,20,000 and the value of Building is to be appreciated by 10%.

iii. Stock is found overvalued by Rs.4,000

iv. A provision for doubtful debts is to be created at 5% of Sundry Debtors.

v. A creditors were unrecorded to the extent of Rs.1,000.

Pass the necessaries journal entries.

Solution:

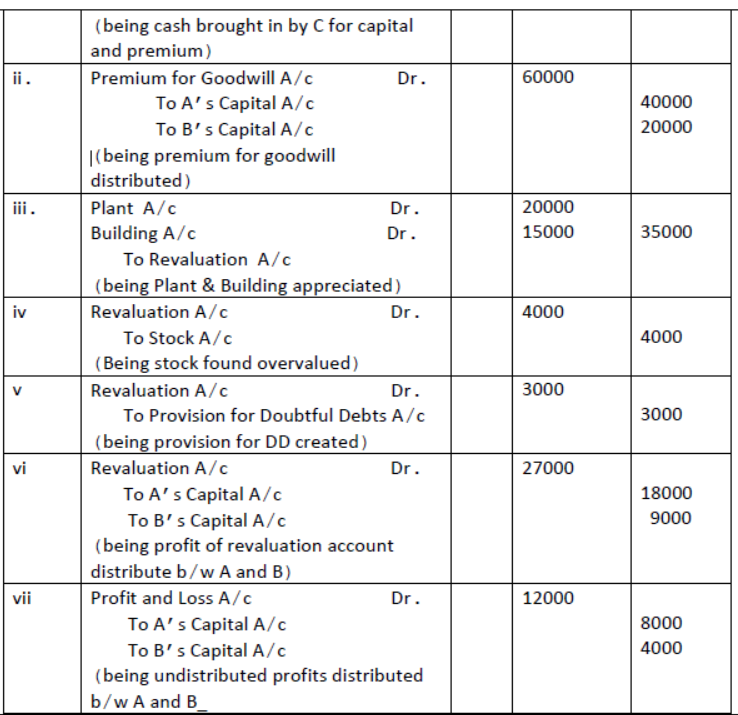

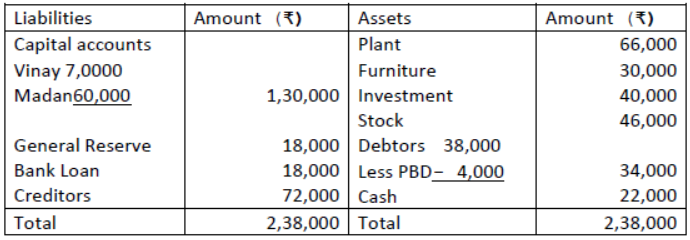

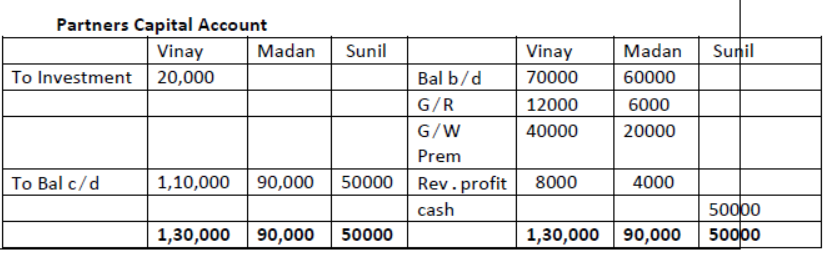

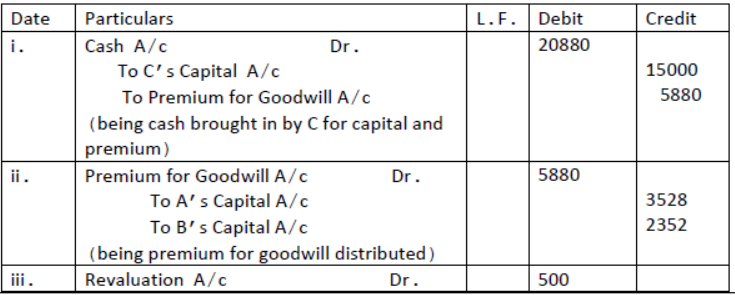

Question. Vinay and Madan were partners sharing profits in the ratio of 2:1. On 1st April 2019, They admitted Sunil, a retired army officer who had lost his legs while servicing in army, as a new partner for 1/4 share in profits. Sunil will bring 60,000 for Goodwill and ₹ 50,000 as capital, At the time of admission of Sunil the Balance Sheet Vinay and Madan was as under :-

It was decided to

(i) Reduce the value of stock by ₹.10, 000.

(ii) Plant to be valued at ₹ 80,000.

(iii) An amount of ₹.3,000 included in creditors was not payable.

(iv) Half of the investment were taken over by Vinay and remaining were valued at ₹.25,000.

Prepare revaluation account, partners ‘capital account and Balance sheet of the reconstituted firm.

Solution:

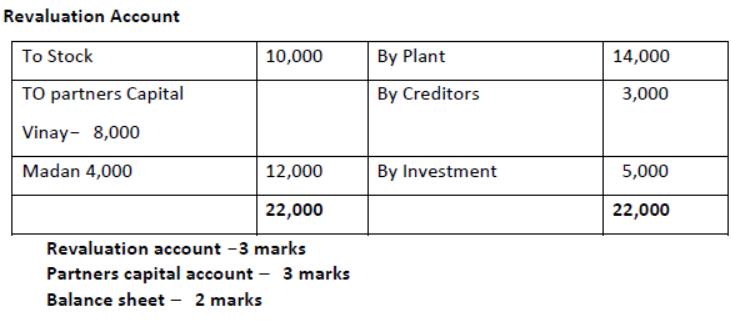

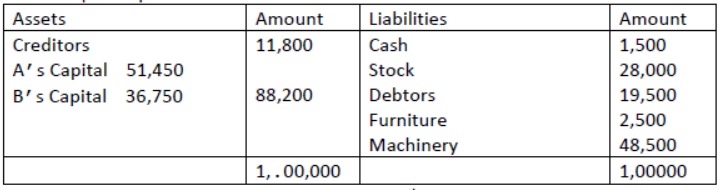

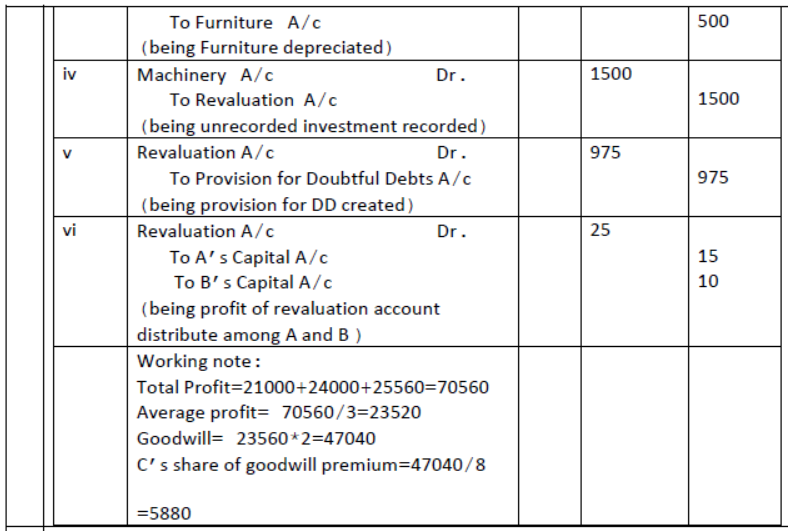

Question. A & B carrying on business in partnership and sharing profits and losses in the ratio of3:2 require a partner when their Balance Sheet stood as follows:

They admit C into partnership and gave him 1/8th share in the future profits in the following terms.

i. Goodwill of their firm will be valued twice the average of the last three years profits which amounted to Rs.21000; Rs.24000 and Rs.25560.

ii. C is to bring in cash for the amount of his share of goodwill.

iii. C is to bring Rs.15000 as his capital.

iv Furniture decreased by Rs.500

v Machinery increased to Rs50000

vi. Make a provision @5% for DD on debtors.

Pass journal entries to record these transactions.

Solution:

Question. A,B and C were partners in a firm sharing profits in the ratio 3:2 :1. On 31st march,2015, their balance sheet was as follows:

On the above date, D was admitted as a new partner, he brought Rs.100000 as capital and further it was decided that:

a. The new profit sharing ratio between A,B,C and D will be 2:2:1:1

b. Goodwill of the firm was valued at Rs 90000 and D bought his share of goodwill premium in cash

c. The market value of investments was Rs 24000

d. Machinery will be reduced to Rs 29000

e. A creditor of Rs 3000 was not likely to claim the amount and hence to be written off

Pass necessary journal entries.

Solution: profit on revaluation- 3000