Please refer to Class 12 Accountancy Sample Paper Set A with solutions below. The following CBSE Sample Paper for Class 12 Accountancy has been prepared as per the latest pattern and examination guidelines issued by CBSE. By practicing the Accountancy Sample Paper for Class 12 students will be able to improve their understanding of the subject and get more marks.

PART A

1.Interest on capital will be paid to the partners if provided for in the partnership deed but only out of:

a. Profits

b. Reserves

c. Accumulated

d. Goodwill

Answer: Profits

2.When a new partner brings goodwill in cash, it is credited to:

a. His Capital A/c

b. Sacrificing Partner’s Capital A/cs

c. Old Partner’s Capital A/c

d. All Partner’s Capital A/cs

Answer: Sacrificing Partner’s Capital A/cs

3.If premium on the forfeited shares has already been received, then Securities Premium A/c Should be:

a. Credited

b. No Treatment

c. Debited

d. None of these

Answer: No Treatment

4. What amount will be credited to the Income and Expenditure Account for the year ending 31st March, 2020 on the basis of the following information?

31-03-2019 31-03-2020

. Rs. . Rs.

Outstanding Subscription 12,000 20,000

Advance Subscription 8,000 10,000

Subscription received during the year 2010 -20 were Rs. 3,50,000.

a. Rs. 3,44,000

b. Rs. 3,60,00

c. Rs. 3,88,000

d. Rs. 356,000

Answer: Rs.3,56,000

5. On firm’s dissolution, a partner undertook firm’s creditors at Rs. 76,000. In this case the account will be credited:

a. Creditors A/c

b. Realisation A/c

c. Partner’s Capital A/c

d. Cash A/c

Answer: Partner’s Capital A/c

6. Verma Textile Ltd. forfeited 8,000 shares of Rs.10 each on which application money of Rs.3 has been paid. Out of these 2,000 shares were reissued as fully paid up and Rs.4,000 has been transferred to capital reserve. Calculate the rate at which these shares were reissued.

a. Rs. 9 per share

b. Rs. 6 per share

c. Rs. 8 per share

d. Rs. 7 per share

Answer: Rs. 9 per share

7. If fixed amount is withdrawn by a partner on the first day of each quarter, interest on the total amount is charged for …………………. Months

a. 4.5

b. 7.5

c. 6

d. 3

Answer: 7.5

8. A, B and C are partners sharing profits in the ratio of 3:3:2. As per the partnership agreement, C is to get a minimum amount of Rs.1,20,000 as his share of profits every year and any deficiency on this account is to be personally borne by A. The net profit for the year ended 31st March, 2020 amounted to Rs.4,56 ,000. Calculate the amount of deficiency to be borne by A?

a. Rs. 1,14,000

b. Rs. 6,000

c. Rs. 1,20,000

d. Rs. 1,71,000

Answer: Rs 6,000

9. Rohan, Sohan and Mohan are partners. Mohan expired on 20th October 2019 and as per agreement surviving partners Rohan and Sohan directed the accountant to prepare financial statements as on 20th December 2019 and accordingly the share of profits of Mohan (deceased partner) was calculated as Rs.10,00,000. Which account will be debited to transfer Mohan’s share of profits?

a. Profit and Loss Suspense Account.

b. Profit and loss Appropriation Account.

c. Profit and loss Account.

d. None of the above.

Answer: Profit and Loss Suspense

10. Prakash paid the realisation expenses of Rs. 22,000 out of his private funds, who was to get a remuneration of Rs. 20,000 for completing dissolution process and was responsible to bear all the realisation expenses. Which of the following journal entries of the above transaction is correct?

a. Realisation A/c Dr Rs. 44,000

To Prakash’s Capital A/c Rs. 44,000

b. Realisation A/c Dr Rs. 22,000

To Bank A/c Rs. 22,000

c.Realisation A/c Dr Rs. 20,000

To Bank A/c Rs. 20,000

d.Realisation A/c Dr Rs. 20,000 Rs. 20,000

To Prakash’s Capital A/c

Answer: D

11. A, B and C are equal Partners in a firm. B retires and the remaining partners decide to share the profits of the new firm in the ratio of 5:4. Gaining ratio will be:

a. 1: 1

b. 1:2

c. 2:1

d. 5:4

Answer: 2:1

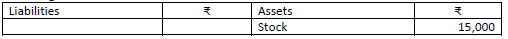

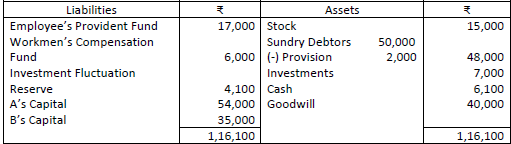

12. Following is the extract Balance Sheet of X and Y

The firm was dissolved. Find the amount to be realised from the asset Stock, if Y took over part of stock at Rs. 4,000 (being 20% less than the book value) and balance stock realised at 50%.

a. Rs. 7,500

b. Rs. 5,000

c. Rs. 5,500

d. Rs. 11,000

Answer: Rs. 5,000

13. A and B were partners in a firm sharing profits in the ratio 2:3. Their capitals were Rs. 50,000 and Rs. 1,00,000 respectively. They admitted C on 1st April, 2020 as a new partner for 1/4th share in future profits. C brought Rs. 1,00,000 as her capital. Calculate the value of Goodwill of the firm.

a. Rs. 4,00,000

b. Rs. 6,00,000

c. Rs. 4,50,000

d. Rs. 1,50,000

Answer: Rs. 1,50,000

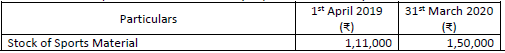

14. From the following information, calculate the amount of sports material that will be debited to the Income and Expenditure Account of Kabya Sports Club for the year ended 31-03-2020

Additional Information:

Cash Purchase of sports material during the year was Rs. 2,50,000 Rs. 1,50,000 were paid to the creditors of sports material.

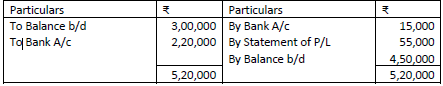

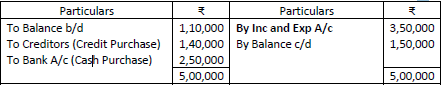

Answer: Sports Material A/c

Dr Cr

Rs. 3,50,000 will be shown in Income and Expenditure A/c on debit side

Working note:

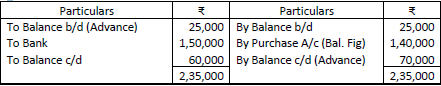

Creditors for Sports Material A/c

Dr Cr

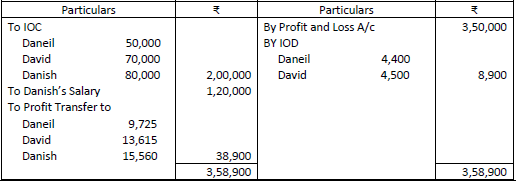

15. Daneil, David and Danish were partners in a firm sharing profits in the ratio of 5 : 7 : 8. Their fixed capitals on 1st April 2019 were Daneil Rs. 5,00,000, David Rs. 7,00,000 and Danish Rs. 8,00,000. Their partnership deed for the following

i. Interest on Capital @ 10% p.a.

ii. Salary of Rs. 10,000 per month to Danish

iii. Interest on drawing @ 12% p.a.

Daneil withdrew Rs. 40,000 on 30th April 2019; David withdrew Rs. 50,000 on 30th June 2019 and Danish withdrew Rs. 30,000 on 31st March 2020.

During the year ended 31st March, 2020 the firm earned a profit of Rs. 3,50,000 Prepare the Profit and Loss Appropriation Account for the year ended 31st March, 2020.

Answer: Profit and Loss Appropriation A/c

For the year ending 31st March 2020

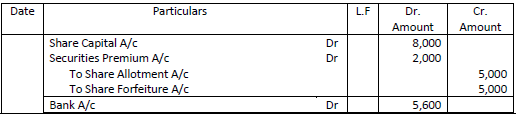

16. X ltd. Forfeited 1,000 shares of Rs. 10 each (Rs. 8 called up) issued at a premium of Rs. 2 per shares to Mr. Ajay, for non-payment of allotment money of Rs. 5 per share (including premium). Out of these, 800 shares were issues to Mr. Sanjay at Rs. 8 called for Rs. 7 per share. Give necessary Journal entries relating to forfeiture and re-issue of shares.

Answer:

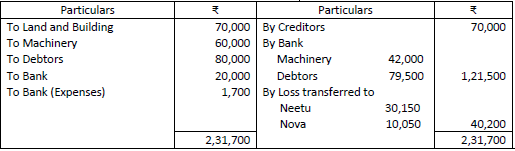

17. Neetu and Nova were partners in a firm sharing profits in the ratio of 3:1. On 31.03.2020 their Balance sheet was as follows:

The firm was dissolved on 1.4.2020 and the assets and liabilities were settled as follows:

i. Creditors of Rs. 50,000 took over Land and Building in full settlement of their claim;

ii. Remaining creditors were paid in cash;

iii. Machinery was sold at a depreciation of 30%;

iv. Debtors were collected at a cost of Rs. 500.

v. Expenses of realisation were Rs. 1,700.

Prepare Realisation A/c

Answer: Realisation A/c

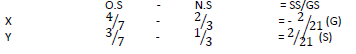

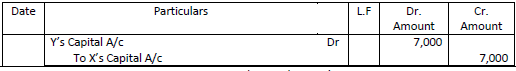

18. X and Y are partners sharing profits and losses in the ratio of 4:3. Their Balance Sheet as at 31st March 2020 stood as follows

They decided that with effect from 1st April 2020 they will share profits and losses in the ratio of 2:1. For this purpose they decided that:

a. Fixed assets are to be depreciated by 10%

b. A provision of 6% be made on debtors for doubtful debts.

c. Stock be valued at Rs. 1,90,000.

d. An amount of Rs. 3,7000 included in creditors is not likely to be claimed.

Partners agreed that altered values are not to be recorded in the books and they also do not want to distribute the general reserve.

You are required to post a single journal entry to give effect to the above

Answer: Calculation of Net effect

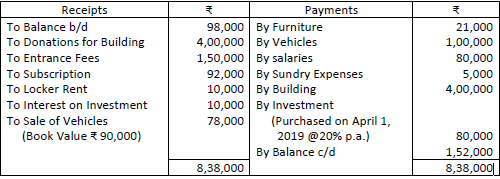

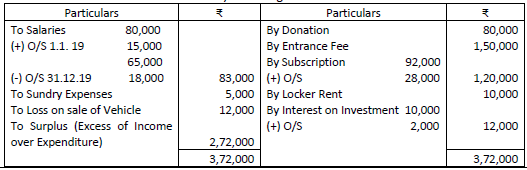

19. Following is the Receipt and Payments Account of Guwahati Youth Club for the year ended 31st December, 2019

Receipts and Payments Account

Dr. for the year ending 31st December 2019 Cr.

Additional Information:

i. Donations for building include 20% general donations.

ii. During the year, the club had 600 members and each paying an annual subscription of Rs. 200.

iii. Outstanding salaries as at January 1, 2019 were Rs. 15,000 and as on December 31, 2019 were Rs. 18,000.

Prepare Income and Expenditure Account of the club for the year ended 31st December 2019.

Answer: Income and Expenditure A/c

For the year ending 31.12. 2019

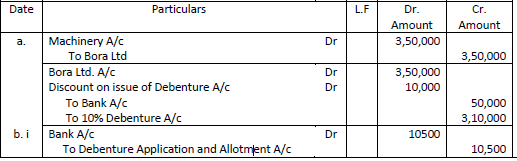

20. a. Goswami Ltd. Purchased machinery for Rs. 3,50,000 from Bora Ltd. On 31.03.2020. Rs. 50,000 were paid to Bora Ltd. Immediately and the balance was paid by issue of 10% debentures of Rs. 3,10,000 in Goswami Ltd. Pass Journal entries.

b. Pass necessary Journal entries for the issue of 11% debentures in the following cases:

i. 100 debentures of Rs. 100 each issued at Rs. 105 each repayable at Rs. 105 each.

ii. 200 debentures of Rs. 100 each issued at a discount of 10% and redeemable at 5% premium.

Answer:

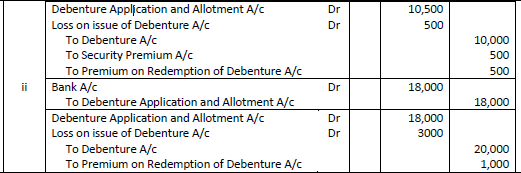

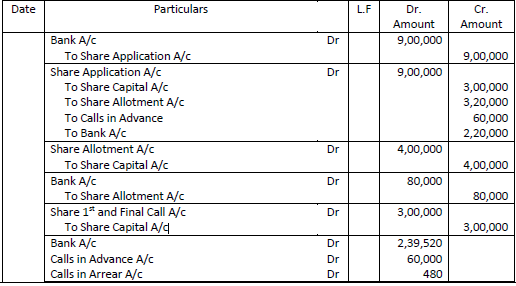

21. Kalita Ltd. Issued 50,000 equity shares of Rs. 10 each at a premium of Rs. 2 per share, payable as follows:

Rs. 3 per share on application; Rs. 3 per share on allotment (including premium) and balance on 1st and final call.

The applications were received for 75,000 shares and the allotment was made as follows:

To the applicants of 5000 shares – Full

To the applicants of 40,000 shares – 30,000 shares

To the applicant of 30,000 shares – 15,000 shares

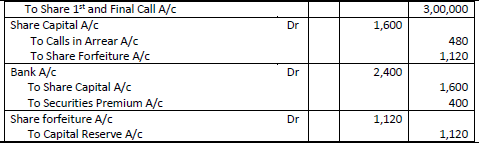

All the shareholders paid the amount due on allotment and call except Mr. Das, who was allotted 1,500 shares out of the group of 40,000 shares and Mr. Hazarika, who was allotted 1,000 shares out of the group of 30,000 shares. They did not pay money due on allotment and 1st and final call. Their shares were forfeited and reissued for Rs. 6 fully paid up.

Pass necessary journal entries.

Answer:

Or

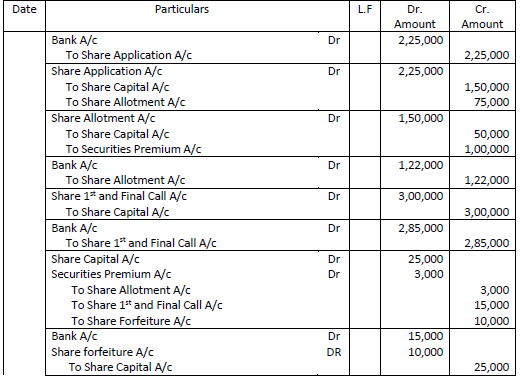

Barua Ltd. Invited applications for issuing 1,00,000 equity shares of Rs. 10 each at par. The amount was payable as follows:

On Application Rs. 3 per share.

On Allotment Rs. 4 per share

On 1st and final call Rs. 3 per share

The issue was over-subscribed by three times. Application for 20% shares were rejected and the money refunded. Allotment was made to the remaining applicants as follows.

Category No. of shares Applied No. of shares Allotted

I 1,60,000 80,000

II 80,000 20,000

Excess money received with applications was adjusted towards sum due on allotment only. All calls were made and were duly received except the final call by a shareholder belonging to category I who has applied for 320 shares. His shares were forfeited. The forfeited shares were re-issued at Rs. 15 per share fully paid up.

Pass necessary journal entries.

Answer:

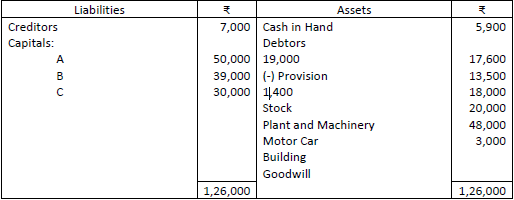

22. A, B and C were partners sharing profits and losses in the ratio 4 : 3: 2. As at 1st April 2018, their Balance Sheet was as follows:

C retired on the above date as per the following terms:

i. Goodwill of the firm was valued at Rs. 42,000.

ii. Stock to be appreciated by 15%

iii. Provision for doubtful debts should be 5% on debtors.

iv. Machinery is to be valued at 10% more than its book value.

v. C be paid Rs. 2,000 in cash and balance be transferred to his loan account.

Pass necessary journal entries.

Answer:

Or

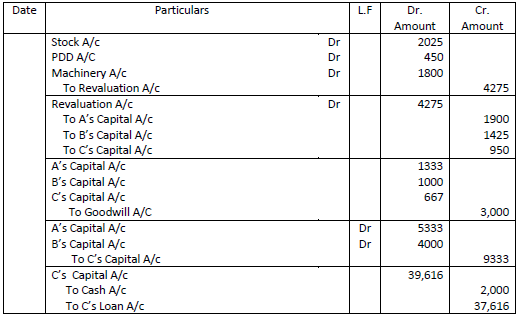

A and B are partners in a firm sharing profits and losses in the ratio 3:1. They admit C for 1/4th share on 31st March 2020 when their Balance Sheet was as follows:

The following adjustments were agreed upon:

a. C brings in Rs. 16,000 as goodwill and Proportionate Capital

b. Bad debts amounted to Rs. 3,000.

c. Market value of Investments is Rs. 4,500

d. Liabilities on account of workmen’s compensation reserve amounted to Rs. 2,000.

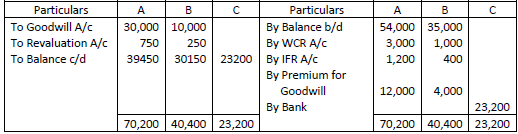

Prepare Revaluation A/c and Partner’s Capital A/c

Answer: Revaluation A/C

Partner’s Capital A/c

PART B

23. 11% Debenture of Rs. 80,000 to be redeemable within 12 months of the date of Balance Sheet will be shown under

a. Long Term Borrowings

b. Short Term Borrowings

c. Short Term Provision

d. Other Current Liabilities

Answer: Other Current Liabilities

24. A firm’s Debt Equity ratio is 1:2. After issue of Debenture of Rs. 1,00,000 for cash, Debt Equity ratio will:

a. No Change

b. Decrease

c. Increase

d. None of these

Answer: ncrease

25. Which of the following is not operating expenses?

a. Office Expenses

b. Selling Expenses

c. Bad Debts

d. Loss by fire

Answer: Loss by fire

26. Which of the following item is considered as cash equivalents?

a. Current Investment

b. Trade Investment

c. Bills of Exchange

d. Prepaid Expenses

Answer: Current Investment

27. Depreciation is added back to net profit to determine net profit before tax because it is a ……………….…………………………. Item.

a. Non operating expenses

b. Operating expenses

c. Cash expenses

d. Non cash expenses

Answer: Non cash expenses

28. Financial analysis become useless because it:

a. Measures the profitability

b. Measures the solvency

c. Lacks of Qualitative Analysis

d. Makes a Comparative Study

Answer: Lacks Qualitative Analysis

29. Revenue from Operations less cost of Revenue from Operation is called:

a. Net Profit

b. Operating Profit

c. Gross Profit

d. Total Profit

Answer: Gross Profit

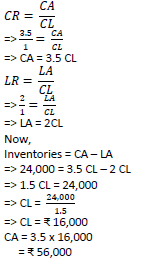

30. A firm has current ratio 3.5:1 and quick ratio of 2:1. Assuming inventory at Rs. 24,000, find out total current assets and total current liabilities.

Answer:

Or

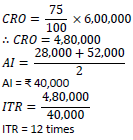

From the following, calculate Inventory Turnover Ratio:

Opening Inventory Rs. 28,000; Closing Inventory Rs. 52,000; Revenue from operation Rs. 6,00,000; Gross profit 25% on Cost of Revenue from Operations.

Answer:

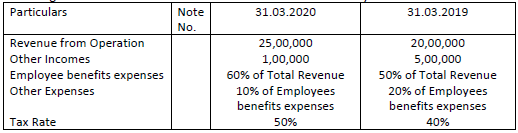

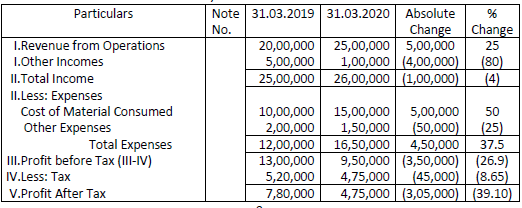

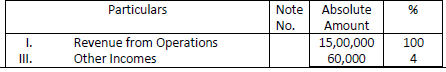

31. Following is the statement of Profit and loss of Victor Ltd. For the year ended 31st March 2020

Prepare Comparative Statement of Profit and Loss of Victor Ltd.

Answer: Comparative Statement of Profit and Loss

For the year ended 31st March 2020

or

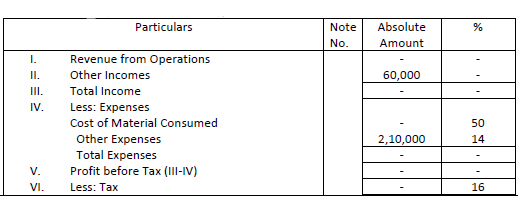

Fill in the missing figures in the following Common Size Statement of Profit and Loss

Answer: Common Size Statement of Profit and Loss

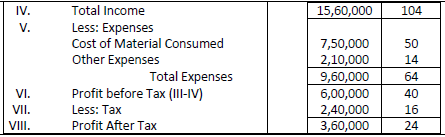

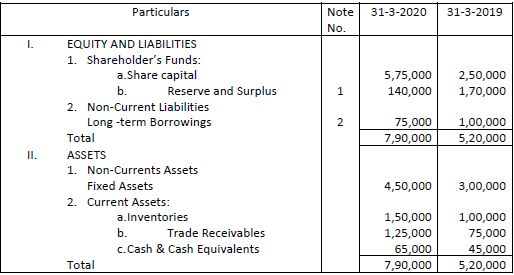

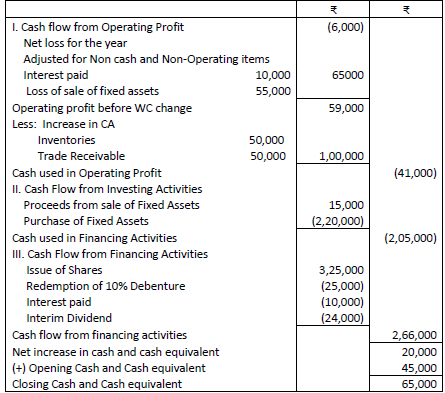

32. From the following Balance Sheets of Mr. Bhuyan as at 31-3-2019 and 31-3-2020 Prepare a Cash Flow Statement:

Additional Information:

a. During the year a machine of the book value of Rs. 70,000 was sold for Rs. 15,000

b. Interim Dividend paid Rs. 24,000

Answer: Cash Flow Statement

For the year ending 31st March 2020

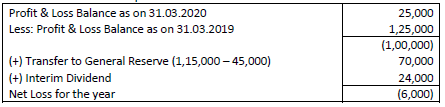

Note1: Calculation of Net profit before tax:

Fixed Assets A/c