Please see Accounting For Not For Profit Organisation Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Accounting For Not For Profit Organisation in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Accounting For Not For Profit Organisation Class 12 Accountancy

Short Answer Questions :

Question. State any three features of income and expenditure account.

Answer: The main features of Income and Expenditure Account:

i) It is prepared for an accounting period on accrual concept following the matching principle.

ii) Only revenue items are considered, while capital items are excluded.

iii) All items both cash and non-cash (depreciation) are recorded.

Question. How would a “Not- for- profit organization” deal with the following items:

a. Outstanding Subscription

b. Subscription received in advance

c. Tournament Fund

Answer:

a. Outstanding Subscription is credited to Income & Expenditure A/c and shown on assets side of Balance sheet.

b. Subscription received in advance is Deducted from subscription received on income side of Income & Expenditure A/c and shown on liabilities side of Balance sheet.

c. Tournament Fund is a specific Fund which is capitalised, i.e., shown on liabilities side of Balance sheet.

Question. State the meaning and objective of Not-for-profit organisation.

Answer: Not-for-profit organisation is an economic entity that provides services beneficial to the society without making profits.

The objective of these organisations is to promote charity, religion, education, literature, sports, art and culture, without aiming at profit.

Question. What is Receipts and Payments account? State its features.

Answer: Receipts and Payments account is a financial statement prepared by not-for- organization with the help of cash book that is maintained throughout the year. Its features are as follows:

a) It is a summary of cash and bank transactions, prepared at the end of the year.

b) It starts with the opening balance of cash in hand, cash at bank or bank overdraft.

c) It follows cash basis of accounting wherein all capital and revenue items are recorded irrespective of period, i.e. preceding year, current year or succeeding year.

Question. How is ‘Sale of old newspapers and magazines’ treated in Not-for-profit organisation?

Answer: Amount received from the sale of old newspapers and magazine are treated as revenue receipts because it is a regular feature of Not-for-profit organisation. Hence sale of old newspaper etc. are shown on the credit side of income and expenditure account.

Question. Give any three differences between Receipt & Payment account and Income & Expenditure account.

Answer: Three differences between Receipt & Payment A /c & Income & Expenditure A/c are:

| Basis | Receipts & Payments A/c | Income & Expenditure A/c |

| 1. Nature | It is a summary of cash book | It acts like profit & loss A/c |

| 2. Nature of items | It records receipts and payment of revenue and capital nature | It records only incomes and expenditure of revenue nature |

| 3. Opening balance | There is no opening balance | Balance in the beginning represents cash in hand /cash at bank or bank overdraft |

Question. What is meant by Fund Based Accounting?

Answer: In fund-based accounting separate accounts are maintained for specific activities of the organisation such as sports fund, price fund etc. All items related to the specific fund are recorded fund wise, i.e., incomes related to the fund is added to it and expenses related to the fund are deducted from it. The consolidation of these accounts is presented on the liabilities side of the balance sheet.

Long Answer Questions :

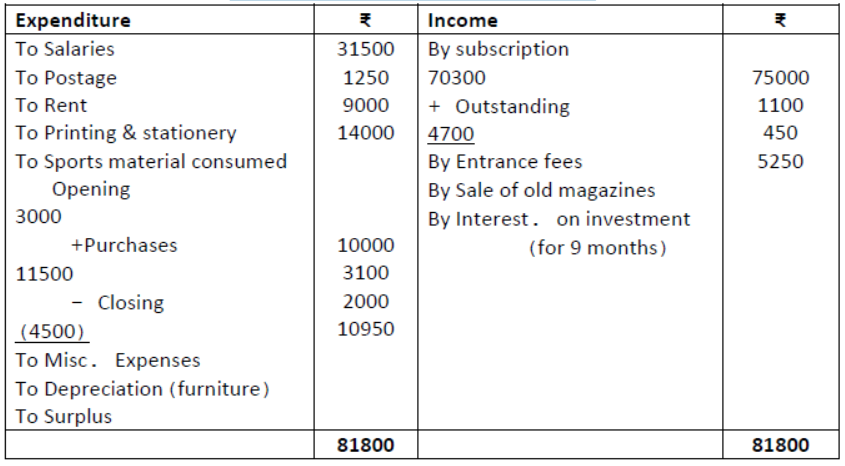

Question. Prepare an Income and Expenditure Account for the year ended 31st March 2020 from the following particulars of Arts club which organises art competitions for disabled people during the year:

Receipts and Payments account (for the year ended 31.03.2020)

| Receipts | ₹ | Payments | ₹ |

| To balance b/d To Subscriptions To Donation (Billiard Table) To Entrance fees To Sale of old magazines | 32,500 70,300 90,000 1,100 450 | By Salaries By Postage By Rent By Printing & stationery By Sports material By Miscellaneous expenses By Furniture By 10% Investments (on 1.7.2019) By Balance c/d | 31,500 1,250 9,000 14,000 11,500 3,100 20,000 70,000 34,000 |

| 1,94,350 | 1,94,350 |

Answer:

Income and expenditure A/c

for the year ended on 31st March 2020

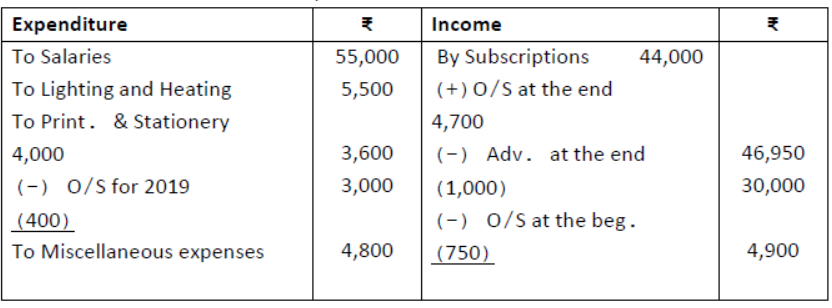

Question. From the following information, prepare the Income and Expenditure Account for the year ended 31st March 2020.

| Details | ₹ |

| Salaries paid Lighting and Heating Printing and Stationery (including ₹ 400 for the 2019) Subscriptions received (including ₹1,000 in advance for 2021 and ₹750 for 2019) Net proceeds from refreshment room Miscellaneous expenses Interest paid on Loan for 3 months Rent and rates (including ₹500 prepaid) Locker’s rent received | 55,000 5,500 4,000 44,000 30,000 3,000 1,200 4,500 4,900 |

Additional information: Subscription in arrears on 31.03.2020 were ₹4,700 and interest on Loan outstanding for 9 months.

Answer:

Income and Expenditure A/c

for the year ended 31st March 2020

Question. Following are the particulars of cash transactions of Geeta Pustakalaya Allahabad for the year ended 31st December 2019.

| Receipts | ₹ | Payments | ₹ |

| To Balance b/f | 1,319 | By Rent and rates | 168 |

| To Entrance fees | 255 | By Wages | 245 |

| To Subscriptions | 1,600 | By Lighting | 72 |

| To Donation | 165 | By Lecturers fee | 435 |

| To Life membership fee | 250 | By Books | 213 |

| To Interest | 14 | By Office expenses | 450 |

| To Profit on entertainment | 42 | By 3% Fixed deposits (1.7.2019) | 800 |

| By Bank balance | 242 | ||

| By Cash in hand | 1,020 | ||

| 3,645 | 3,645 |

Additional information:

Library has books worth ₹2,000 and furniture worth ₹850 in the beginning of year. Outstanding subscription was ₹35 in the beginning of year and ₹45 at the end of year. Outstanding rent was ₹60 in the beginning as well as at the end of year. Charge depreciation ₹50 on Furniture and ₹113 on Books.

You are required to prepare Income and Expenditure Account and Balance Sheet of Pustakalaya as on 31st December 2019.

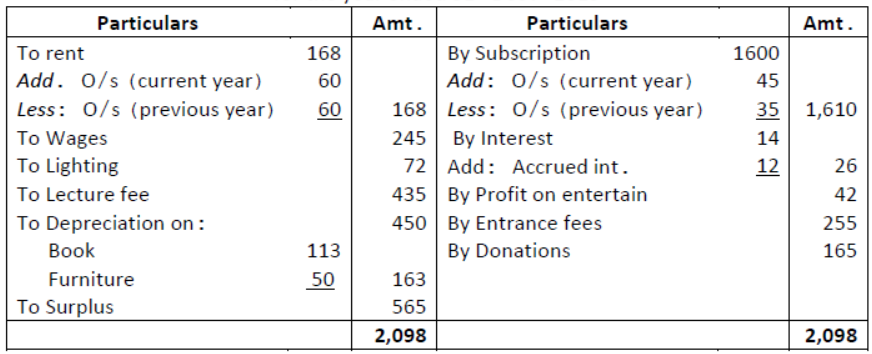

Answer: Income and expenditure account

for the year ended 31st Dec. 2019

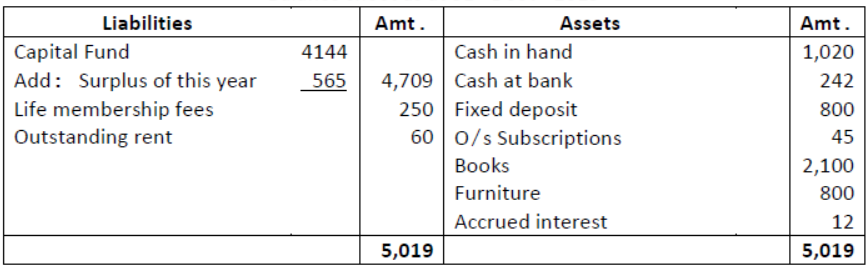

Balance sheet as at 31st Dec. 2019

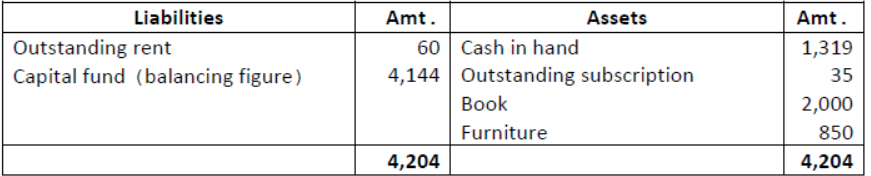

WN: Calculation of opening capital fund

Balance sheet as at 31st Dec. 2018

Question. From the following Receipts and Payment Account of Pioneer Cricket Club and from the information supplied, prepare Income and Expenditure Account for the year ended 31st March, 2020.

Receipts and Payment A/c

for the year ended 31st March, 2020

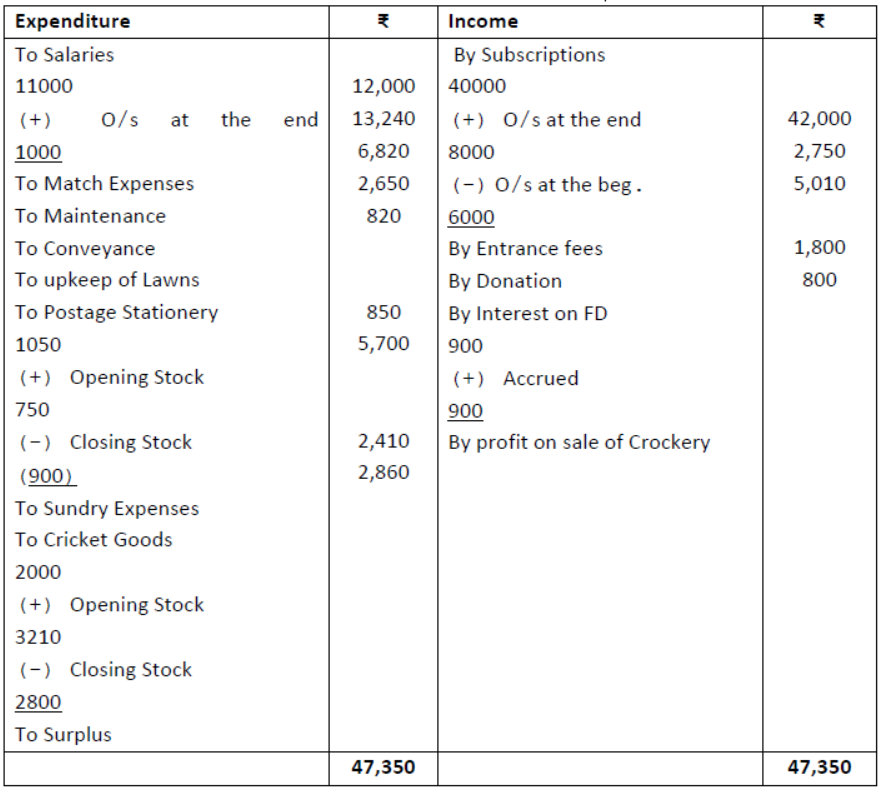

Additional Information:

a) Salary outstanding is ₹1,000

b) Opening balance of stock of postage and stationery and cricket goods is ₹750 and ₹3,210, respectively. Closing stock of the same is ₹900 and ₹2,800, respectively.

c) Outstanding subscriptions for 2018-19 and 2019-20 are ₹6,600 and ₹8,000respectively.

Answer:

Income and Expenditure A/c

for the year ended 31st March 2020

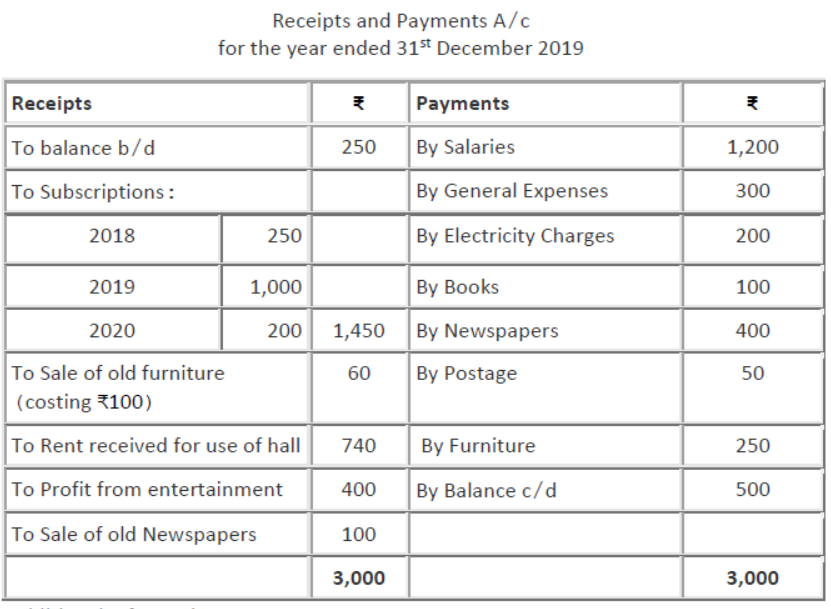

Question. From the following Receipts and payments Account of Cosmo Club, from the information supplied, prepare the Income and Expenditure account for the year ended December 31st, 2019 and balance sheet as at that date:

a) The club has 50 members each paying an annual subscription of ₹25. Subscriptions Outstanding on 31st December 2018 were to value of ₹300.

b) On the 31st December 2019, Salaries outstanding amounted to ₹100. Salaries paid included ₹100 for the year 2018.

c) On January 1, 2019, the club owned land and buildings valued at ₹10,000, Furniture worth ₹600 and Books ₹500.

Answer: Income & Expenditure A/c

for the year ended 31st Dec, 2019