Please see Accounting for Share Capital Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Accounting for Share Capital in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Accounting for Share Capital Class 12 Accountancy

Very short answer questions:

Question. What is meant by Capital reserve?

Answer: Capital reserve is the reserve created out of Capital profits.

Question. What is meant by forfeiture of shares?

Answer: If any shareholder fail to pay allotment and call money within the specified period, the directors may cancel his shares. This is called forfeiture of shares.

Question. Can a Company issue a shares having face value of Rs 10 at Rs 9?

Answer: No. Under section 53 of Companies Act 2013, a Company can not issue shares at a discount

Question. What is a share?

Answer: Total capital of the Company is divided in units of small denominations such as Rs 10 or Rs 100. Each such unit is called share.

Question. What do you mean by Authorised Capital of a Company?

Answer: This is the maximum capital for which a Company is authorised to issue shares during its lifetime. It is also known as Registered or Nominal capital.

PRACTICAL QUESTIONS:

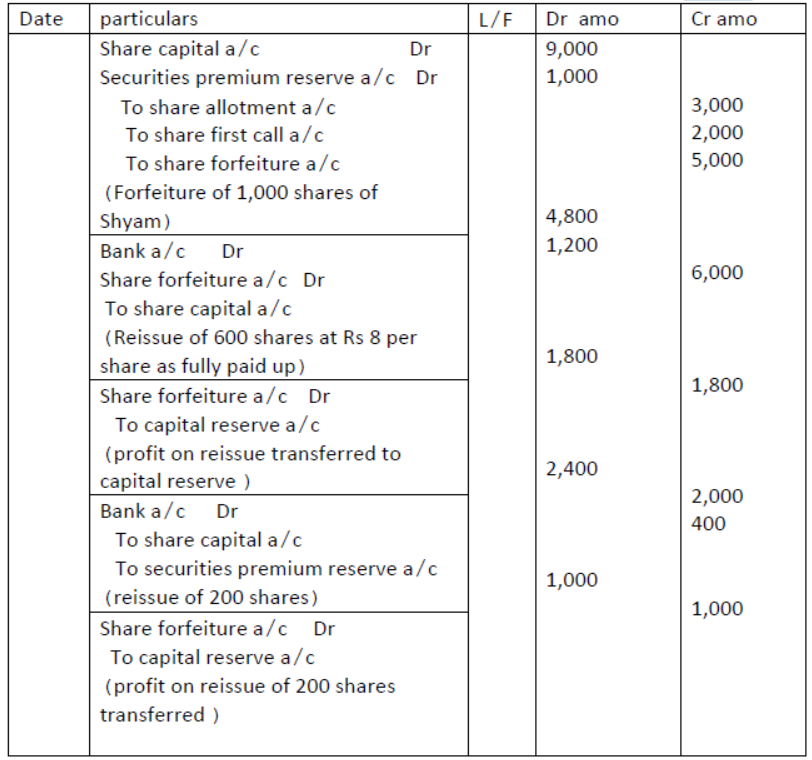

Question. Y Ltd forfeited 1,000 shares of Rs 10 each issued at 10% premium to Shyam (Rs 9 called up) on which he did not pay Rs 3 on allotment(including premium) and on first call of Rs 2. Out of these ,600 shares were reissued to Ram as fully paid up for Rs 8 per share and 200 shares to Mohan as fully paid up @ Rs 12 at different intervals of time.

Give journal entries for forfeiture and reissue.

Answer:

Journal

Working notes: Profit on reissue of 600 forfeited shares = (5,000×600/100)-1,200(loss on reisssue) =1,800

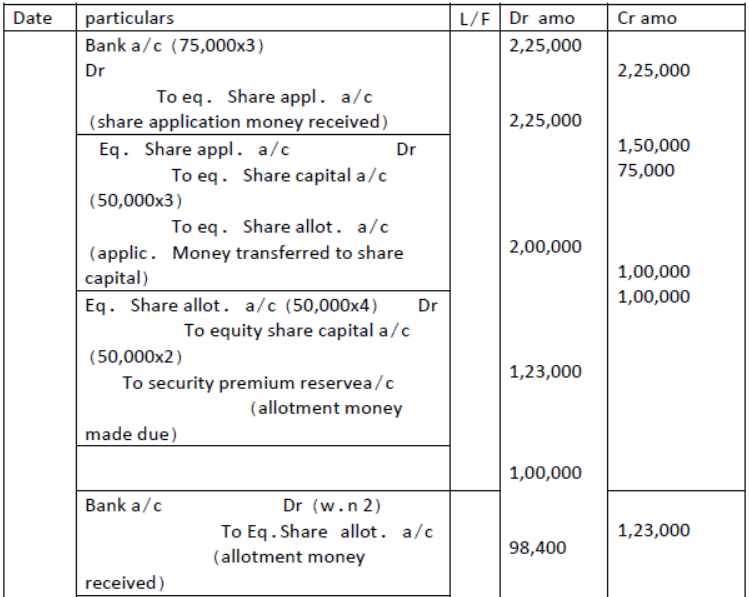

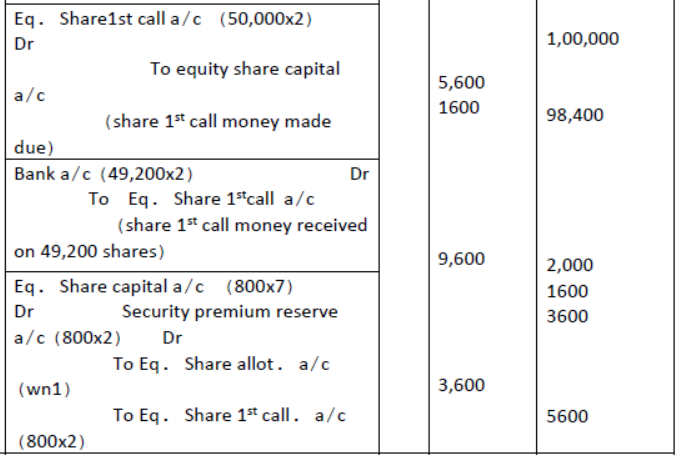

Question. Amrit Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share payable as follows:

Rs 3 on application Rs 4 on allotment(including premium), Rs 2 on 1st call and the balance on 2nd call.

Answer: Application were received for 75,000 shares and prorate allotment was made to all the applicants. All money due were received except allotment and 1st call from Mohan who applied for 1200 shares. All his shares were forfeited. The forfeited shares were reissued for Rs 9,600. Final call was not yet made. Pass necessary journal entries.

Workings:1. Allotment money not received:

Shares applied by Mohan = 1200 shares

Shares allotted to him =50,000/75,000 x1200 = 800 shares

Excess application money paid by Mohan = 400x 3 =1200

Allotment money due from Mohan = 800x 4 =3,200

Less : excess application money paid by him 1,200

Allotment money not received from Mohan =2,000

2. Allotment money received:

Tota allotment money = 50,000 x 4 =2,00,000

Less Excess application money with the company= 25,000×3= 75,000

=1,25,000

Less : Allotment money not paid by Mohan 2,000

Total allotment received =1,23,000

3.profit on reissue of forfeited shares: 3600

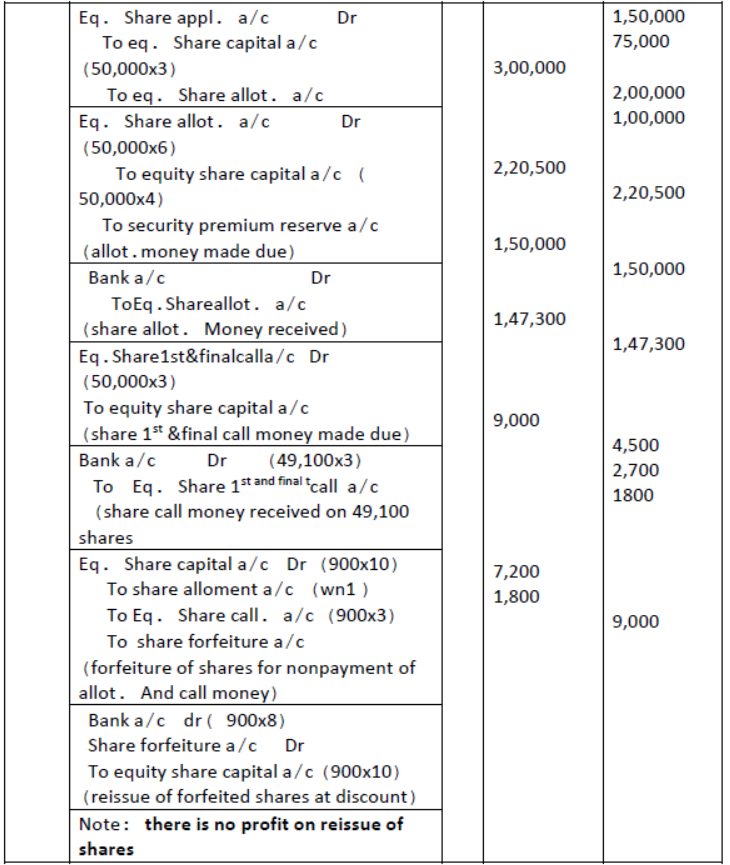

Question. X Ltd issued 50,000 shares of Rs 10 each at a premium of Rs 2 per share payable as follows:

Rs 3 on application, Rs 6 on allotment (including premium) and Rs 3 on call.

Application was received for 75,000 shares and pro-rata allotment was made as follows:

To the applicants of 40,000 shares, 30,000 shares were issued and for the rest 20,000 shares were issued. All money due was received except the allotment and call money from Ram who had applied for 1,200 shares (out of group of 40,000 shares). All his shares were forfeited. The forfeited shares were reissued for Rs 8 per share as fully paid up.

Pass necessary journal entries for the above transactions.

Answer: Workings:

- Allotment money not received from Ram:

Shares applied by Ram 1200 shares

Shares allotted to him = 30,000/40,000 x 1200 = 900 shares

Excess application money paid by him =300x 3= 900

Allotment money due from Ram = 900 x 6 = 5400

Less : excess application money paid by him 900

Allotment money not received = 4,500

Allotment money received: - Total allotment money = 50,000 x6 =3,00,000

- Less : excess application money with company 25,000×3= 75,000

- 2,25,000

- Less : Allotment money not paid by Ram 4,500

- Total allotment money received =2,20,500

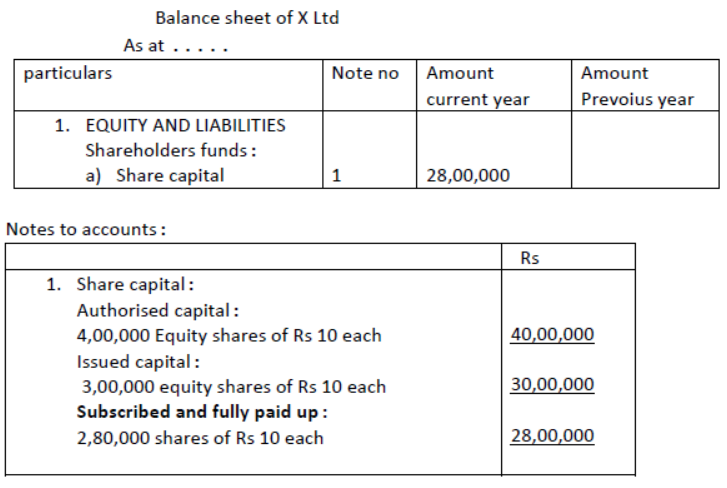

Question. X Ltd has an authorised capital of Rs 40, 00,000 divided into 4, 00,000 Equity shares of Rs 10 each. Out of these shares ,the Company invited application for 3,00,000 equity shares. The public applied for 2, 80,000 shares and all the money was duly received.

Show how share capital will appear in the Balance sheet of the Company. Also prepare notes to accounts.

Answer:

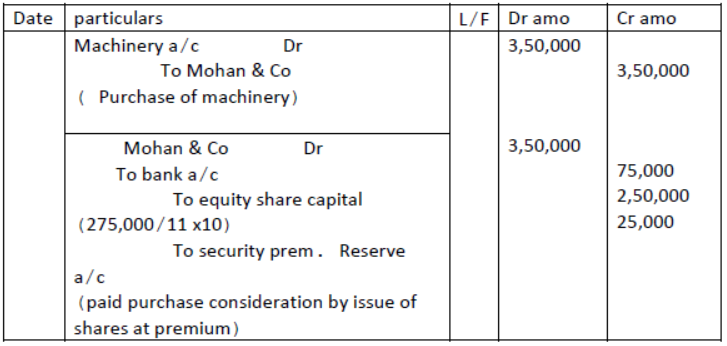

Question. Rohit Ltd purchased machinery from Mohan & Co. For Rs 3, 50,000. A sum of Rs 75,000 was paid by means of a bank draft and for the balance due Rohit Ltd issued equity shares of Rs 10 each at a premium of 10%. Pass journal entries in the books of Rohit Ltd.

Answer:

Note: Equity share capital= Amount to be paid/Issue price of shares x Nominal value of shares

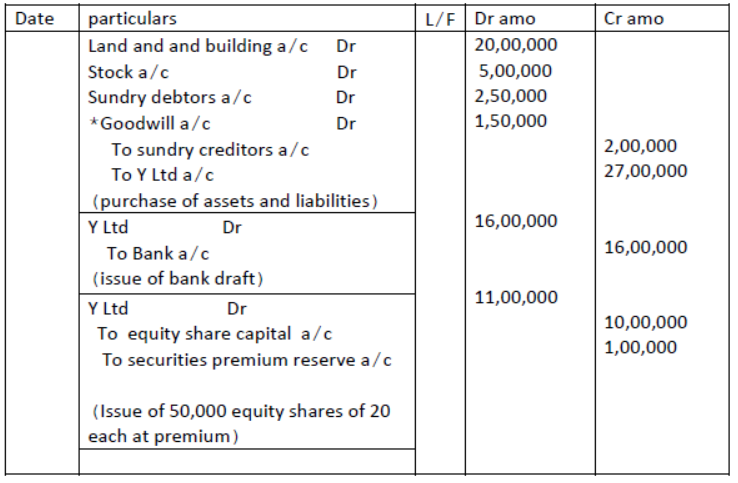

Question. X Ltd took over the following assets and Liabilities of Y Ltd:

Land and building Rs 20,00,000; Stock Rs 5,00,000; Sundry debtors Rs 2,50,000 and sundry creditors Rs 2,00,000.

X Ltd paid the purchase consideration by issuing bank draft of Rs 16,00,000 and 50,000 equity shares of Rs 20 each at a premium of 10%. Calculate purchase consideration and pass journal entries in the books of X Ltd

Answer: calculation of purchase consideration:

Nominal value of shares issued =50,000 x 20= 10,00,000

Securities premium reserve = 1,00,000

Bank draft =16,00,000

27,00,000

Journal In the books of X Ltd