Please see Dissolution Of Partnership Firm Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Dissolution Of Partnership Firm in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Dissolution Of Partnership Firm Class 12 Accountancy

Short Answer Questions:

Question. In case of dissolution,where are general reserves and accumulated profits and losses transferred?

Answer: In partner’s Capital Accounts in their profit sharing ratio.

Question. Mention one difference between Realisation and Revaluation Account.

Answer: Realisation Account is prepared at the time of dissolution of firm where as Revaluation Account is prepared at the time of admission/retirement/death of a partner.

Question. The firm of Ravi and Mohan was dissolved om 31.03.2019. According to the agreement ,Ravi had agreed to undertake the dissolution work for an agreed remuneration of Rs 2,000 and bear all realization expenses. Dissolution expenses were Rs 1500 and the same were paid by the firm. Pass necessary journal entries.

Answer: (i) Realisation A/c Dr. 2000

To Ravi’s Capital A/c 2000

(remuneration due to Ravi)

(ii) Ravi’s Capital A/c Dr. 1500

To bank A/c 1500

(realization expenses paid on behalf of Ravi)

Question. If total assets are Rs 2,00,000; total liabilities are Rs 40,000; amount realized on sale of assets is Rs 1,75,000 and realization expenses are Rs 3,000,what will be the profit or loss on realization?

Answer: Loss Rs 28,000 (Realisation A/c Debit 2,43,000 Credit 2,15,000, difference of debit and credit= 28000(loss)

Question. State any one occasion for the dissolution of the firm on court’s order when a partner becomes.

Answer: Partner becomes permanently incapable of performing his duties as a partner.

Question. Name the assets that are not transferred to the debit side of Realisation Account, but brings certain amount of cash against its disposal at the time of dissolution of the firm.

Answer: Unrecorded Assets.

Question. How much amount will be paid to creditors for Rs 25,000 if Rs 5,000 of the creditors are not to be paid and the remaining creditors agreed to accept 5% less amount?

Answer: Rs 19000 ( Creditors to be paid 25000- 5000= 20,000; Amount paid= 20,000- 5% of 20,000)

Question. On dissolution of a firm, where are assets shown in Balance Sheet transferred?

Answer: On the Debit side of Realisation Account.

Question. On dissolution of a firm ,where is cash in hand transferred?

Answer: On the debit side of Cash Account.

Question. How much amount will be paid to A, if his opening capital is Rs 2,00,000 and his share of realization profit amounts to Rs 10,000 and he has taken over assets Rs 25,000 from the firm?

Answer: Rs 2,000 ( opening capital +realisation profit – asset taken over)

Question. In case of dissolution of a firm which liabilities are to be paid first?

Answer: Debt of third parties

Question. In the event of dissolution of a partnership firm, where is provision for doubtful debts transferrd?

Answer: On the credit side of Realisation Account.

Question. On dissolution, patents appearing in the balance sheet is transferred to which account?

Answer: Realisation Account.

Question. Give any one difference between reconstitution of firm and dissolution of a firm.

Answer: Reconstitution of firm means change in the existing agreement between partners, whereas dissolution of firm means dissolution of partnership between all partners of the firm.

Question. If creditors are Rs 25,000, capital is Rs 1,50,000 and cash balance is Rs 10,000, what will be amount of sundry assets?

Answer: 1,65,000 ( Sundry Assets= Creditors +Capital -Cash balance)

Question. A and B are partners in a firm .Their firm was dissolved on 1.1.2019. A was assigned the work of dissolution. For this work, A was to be paid Rs 500. A paid dissolution expenses from his own pocket. Will any journal entry be passed for Rs 400 paid by A? If yes, pass the entry, If no, give reason

Answer: Yes, journal entry will be passed.

Realisation A/c Dr. 400

To A’s Capital A/c 400

(being realization expenses paid by A on firm’s behalf)

Question. Distinguish between “Dissolution of Partnership’’ and ‘Dissolution of Partnership Firm” on the basis of settlement of accounts.

Answer: In case of Dissolution of Partnership assets are revalued and liabilities are reassessed where as in case of Dissolution of Firm all assets are sold off except cash and liabilities are paid .

Question. Creditors of Rs 50,000 took over stock at an agreed value of Rs 45,000 and the balance was paid to him. Pass the necessary journal entry.

Answer: For stock taken over by creditor no Journal entry , for the balance paid the entry will be

Realisation A/c Dr. 5000

To bank A/c 5000

(being balance of creditors settled for cash)

Question19. List any four modes of dissolution of partnership firm.

Answer: Dissolution by agreement, Compulsory dissolution, Dissolution by Court, Dissolution by notice in case of partnership at will.

Question. In case of dissolution of a firm, which item on the liabilities is to be paid last?

Answer: Partner’s Capital

Numerical Questions :

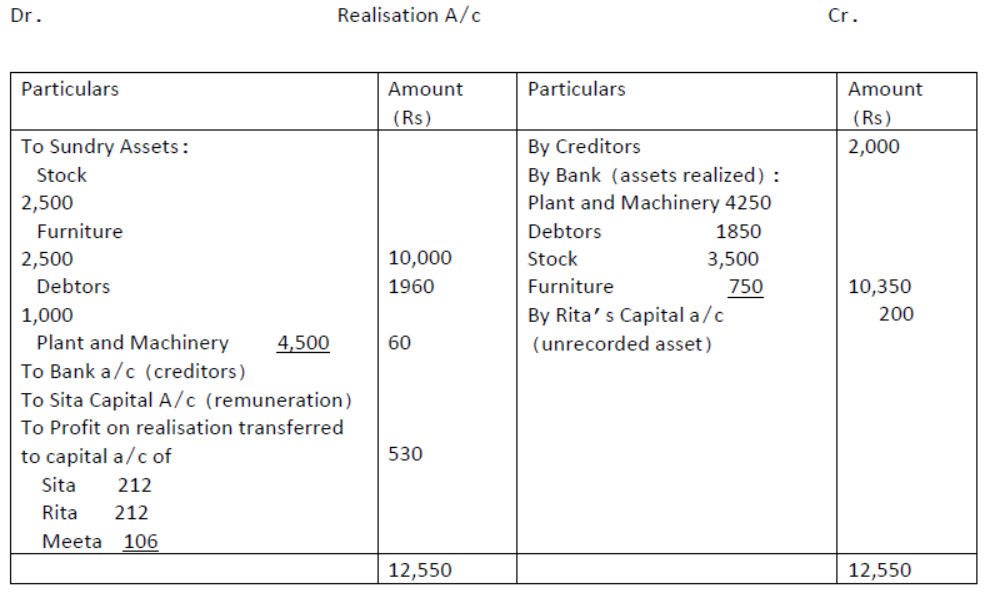

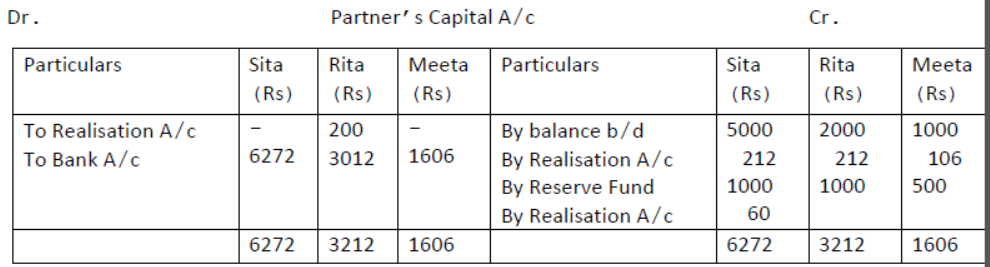

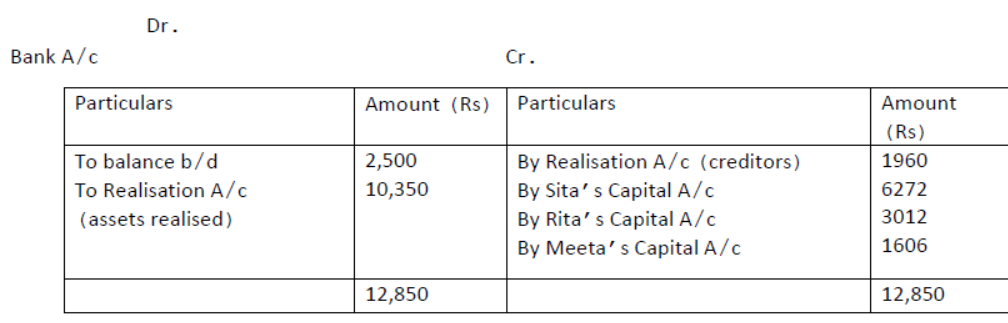

Question. Sita , Rita and Meeta are partners in a firm sharing profits and losses in the ratio 2:2:1. Their balance sheet as on March 31, 2020 is as follows:

Balance Sheet of Sita ,Rita and Meeta as

They decided to dissolve their business. The following amounts were realized:

Plant and machinery rs 4,250, Stock Rs 3,500 , Debtors s 1,850, Furniture 750. Sita agreed to bear all realisation expenses. For the service Sita is paid Rs 60.

Actual expenses on realisation amounted to Rs 450.Creditors were paid 2%less.

There was an unrecorded asset of Rs 250 , which were taken over by Rita at Rs 200.

Prepare Realisation Account, Partners’Capital Accounts and Bank Account.

Solution:

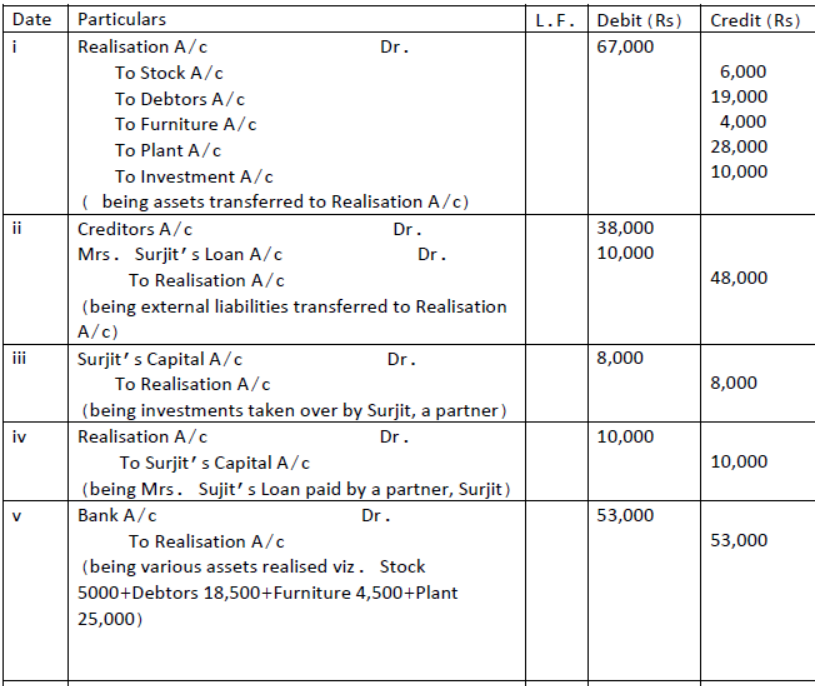

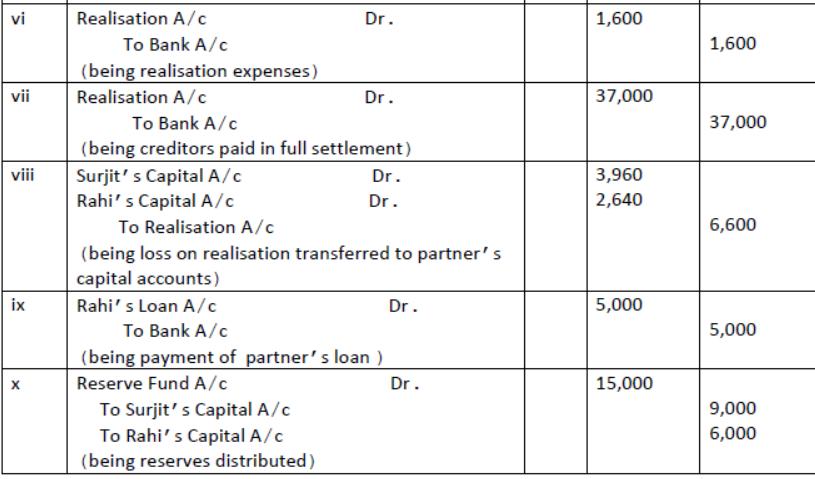

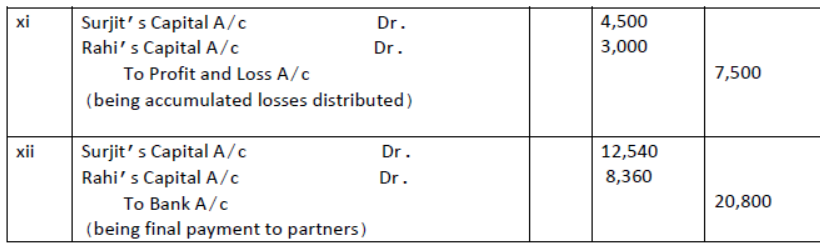

Question. Surjit and Rahi were sharing profits(or losses) in the ratio of 3:2, their Balance Sheet as on march 31, 2020 is as follows:

Balance Sheet of Surjit and Rahi as on March 31, 2020

The firm was dissolved on March 31, 2020 on the following terms:

i. Surjit agreed to take investments at Rs 8000 and to pay Mrs.Surjit’s Loan.

ii. Other assets were realised as follows:

Stock – Rs 5000,Debtors – Rs18,500, Furniture –Rs 4,500,Plant – Rs 25,000

iii. Expenses on realisation amounted to Rs 1,600

iv. Creditors agreed to accept Rs 37,000 as a final settlement.

Pass necessary journal entries on dissolution of the firm.

Solution:

JOURNAL

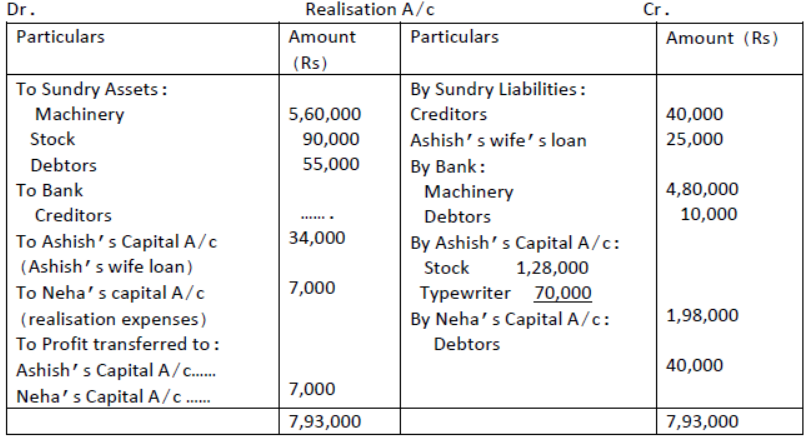

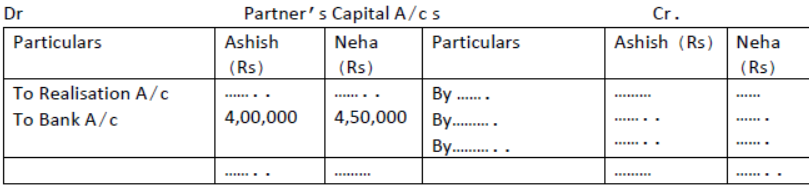

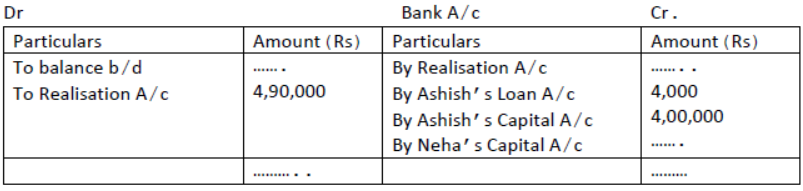

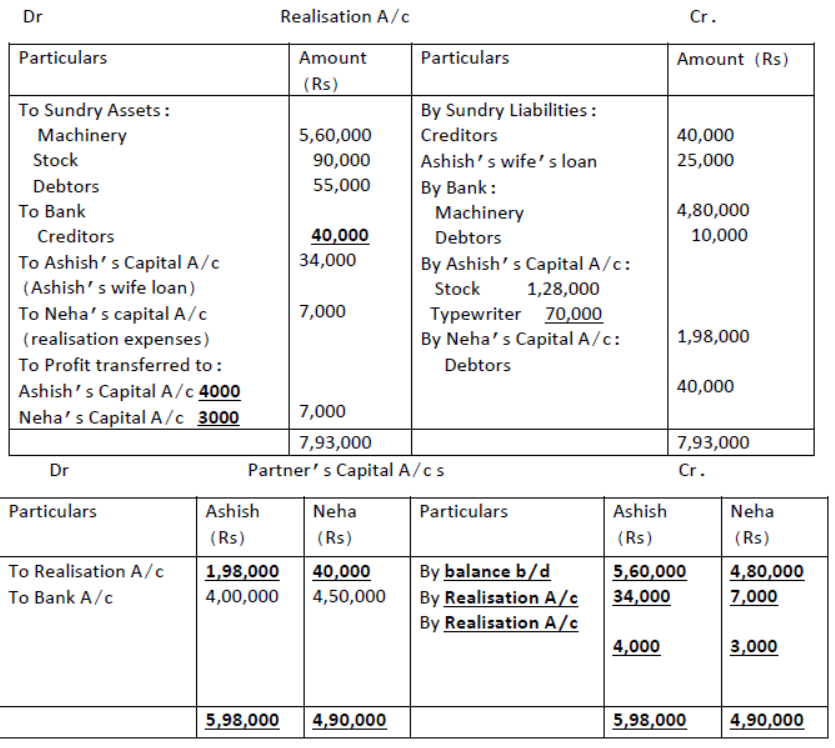

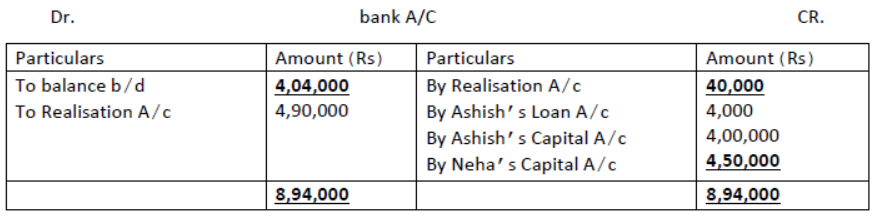

Question. Ashish and Neha were partners in a firm sharing profits and losses in the ratio 4:3. They decided to dissolve the firm on 31st Mar, 2019. From the following information given below, complete Realisation A/c, Partner’s Capital A/c s and bank A/c:

Solution:

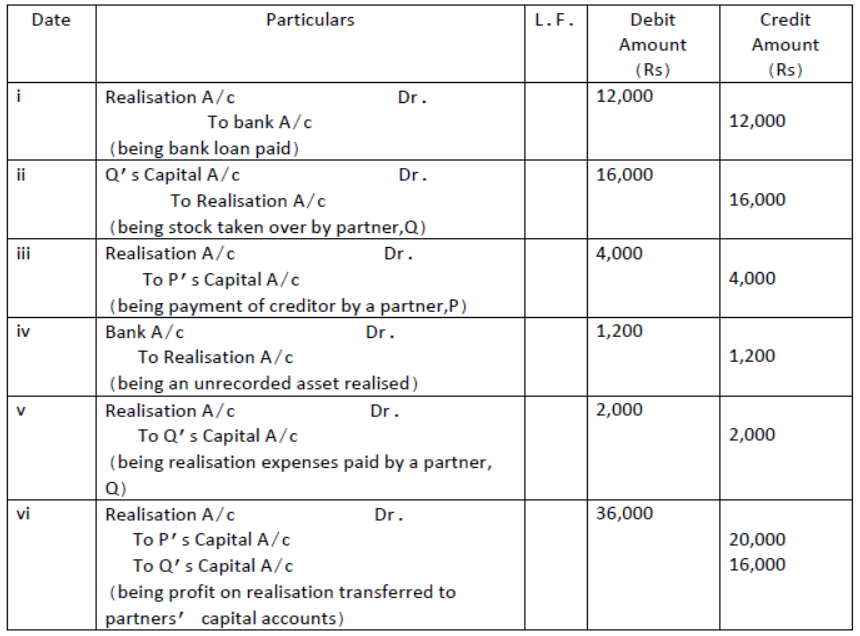

Question. Pass the necessary journal entries for the following transactions on the dissolution of the firm of P and Q after the various assets( other than cash) and outside liabilities have been transferred to Realisation account.

i. Bank Loan Rs 12,000 was paid

ii. Stock worth Rs 16,000 was taken over by partner Q

iii. Partner P paid a creditor Rs 4,000

iv. An asset not appearing in the books of accounts realized Rs 1,200

v. Expenses of realisation Rs 2,000 were paid by partner Q

vi. Profit on realisation Rs 36,000 was distributed between P and Q in 5:4 ratio.

Solution :

JOURNAL

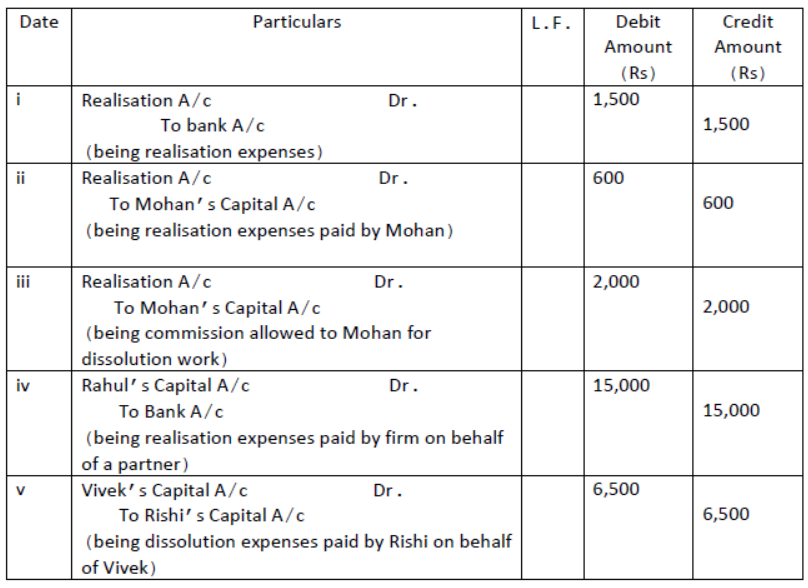

Question. Pass Journal entries in the following cases:

i. Expenses of realisation Rs 1500

ii. Expenses of realisation Rs 600 but paid by Mohan, a partner

iii. Mohan, one of the partners of the firm ,was asked to look into the dissolution of the firm for which he was allowed a commission of Rs 2,000.

iv. Realisation expenses of Rs 15,000 were to be met by Rahul, a partner, but were paid by the firm.

v. Vivek a partner was appointed to look after dissolution work and he agreed to bear the dissolution expenses.Actual dissolution expenses Rs 6,500 were paid by Rishi another partner, on behalf of Vivek.

Solution:

JOURNAL