Please refer to Class 12 Accountancy Sample Paper Term 2 Set B with solutions below. The following CBSE Sample Paper for Class 12 Accountancy has been prepared as per the latest pattern and examination guidelines issued by CBSE. By practicing the Accountancy Sample Paper for Class 12 students will be able to improve their understanding of the subject and get more marks.

CBSE Class 12 Accountancy Sample Paper for Term 2

Part A

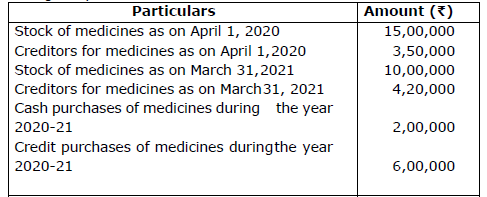

Question. Following information has been provided by M/s Achyut Health Care. You are required to calculate the amount of medicines consumed during the year 2020-21:

Answer.Amount of medicines consumed during the year 2020-21:

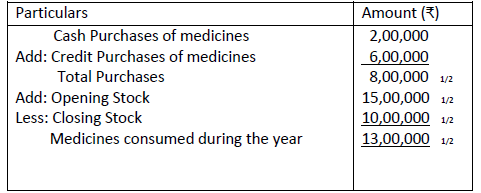

Question. Distinguish between ‘Dissolution of Partnership’ and ‘Dissolution of Partnership Firm’ based on:

(i) Settlement of assets and liabilities

(ii) Economic relationship

Answer.

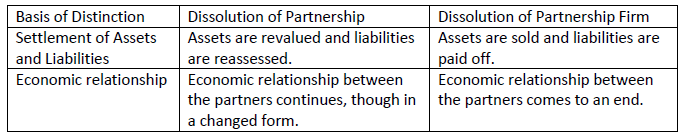

Question. Suresh, Ramesh and Tushar were partners of a firm sharing profits in the ratio of 6:5:4. Ramesh retired and his capital after making adjustments on account of reserves, revaluation of assets and reassessment of liabilities stood at ₹ 2,50,400. Suresh and Tushar agreed to pay him ₹ 2,90,000 in full settlement of his claim.

Pass necessary journal entry for the treatment of goodwill. Show workings clearly.

Answer.

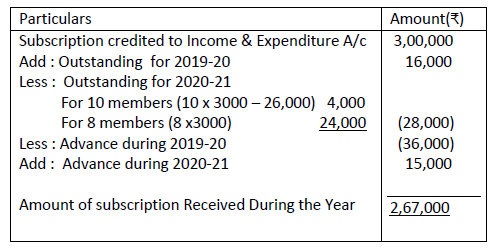

Question. From the following information given by Modern Dance Academy, calculate the amount of Subscription received during the year 2020-21.

(i) Subscription credited to Income & Expenditure A/c for the year ending 31st March ,2021 amounted to ₹3,00,000 and each member is required to pay an annual subscription of ₹ 3,000.

(ii) Subscription in arrears as on 1st April 2020 amounted to ₹ 16,000.

(iii) During the year 2020-21, 10 members made partial payment of ₹26,000 towards subscription, 8 members failed to pay the subscription amount and 5 members paid the subscription amount for the year2021-22.

(iv) During the year 2019-20, 12 members paid the subscription amount for the year 2020-21.

OR

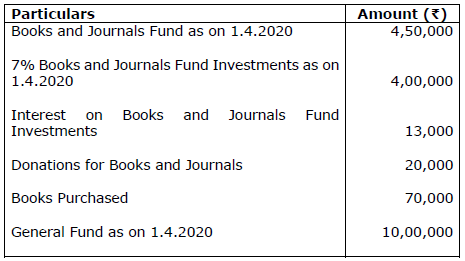

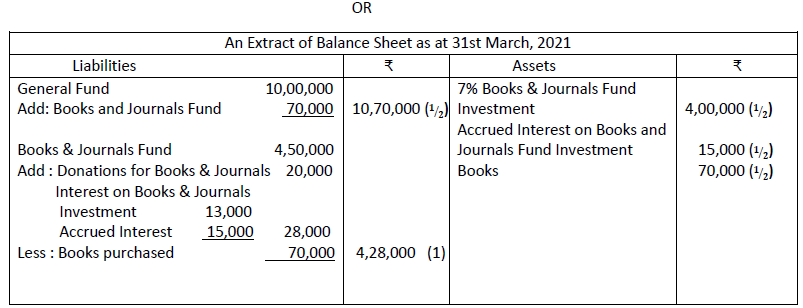

Following information is given by Alchemy Medical College, Library department for the year 2020-21.

Show the accounting treatment of the above-mentioned items in the Balance Sheet of the Alchemy Medical College as at 31st March,2021.

Answer.Calculation of amount of Subscription received during the year 2020-21

Working Note:

Interest on Books and Journals Investments = 4,00,000 x 7/100 = 28,000

Accrued Interest = 28,000 – 13,000= 15,000

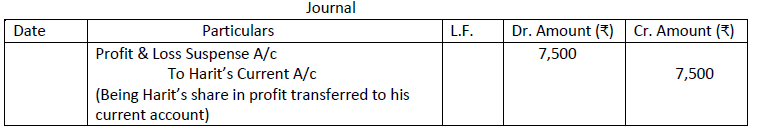

Question. Harihar, Hemang and Harit were partners with fixed capitals of ₹3,00,000, ₹ 2,00,000 & ₹ 1,00,000 respectively. They shared profits in the ratio of their fixed capitals. Harit died on 31st May, 2020, whereas the firm closes its books of accounts on 31st March every year. According to their partnership deed, Harit’s representatives would be entitled to get share in the interim profits of the firm on the basis of sales. Sales and profit for the year 2019-20 amounted to ₹8,00,000 and ₹2,40,000 respectively and sales from 1st April, 2020 to 31st May 2020 amounted to ₹ 1,50,000. The rate of profit to sales remained constant during these two years. You are required to:

(i) Calculate Harit’s share in profit.

(ii) Pass journal entry to record Harit’s share in profit.

Answer. (i) Ratio of Profit to sales= 2,40,000/8,00,000 X 100 = 30%

Profit upto the date of death= 1,50,000 X 30% = ₹45,000

Profit sharing Ratio = 3:2:1

Harit’s Share of Profit = 45,000 X 1/6 = ₹7,500

Alternative: Harit’s Share of Profit = 2,40,000/8,00,000 X 1,50,000 X 1/6=₹7,500

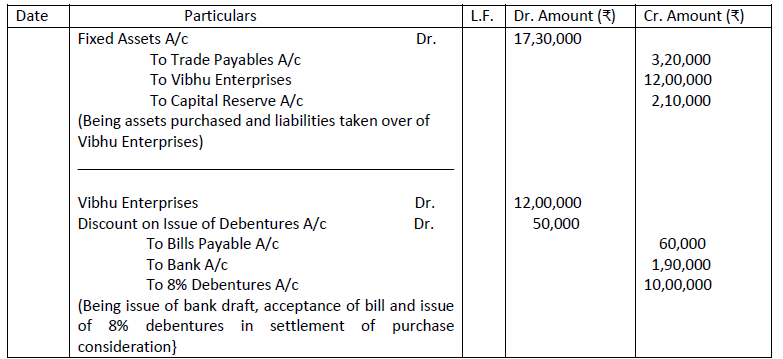

Question. Vedesh Ltd. purchased a running business of Vibhu Enterprises for a sum of ₹ 12,00,000. Vedesh Ltd. paid ₹ 60,000 by drawing a promissory note in favour of Vibhu Enterprises., ₹1,90,000 through bank draft and balance by issue of 8% debentures of ₹ 100 each at a discount of 5%. The assets and liabilities of Vibhu Enterprises consisted of Fixed Assets valued at ₹ 17,30,000 and Trade Payables at ₹ 3,20,000.

You are required to pass necessary journal entries in the books of Vedesh Ltd.

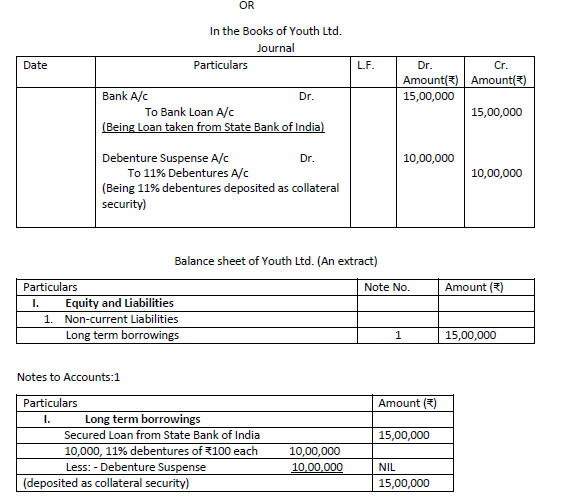

OR

Youth Ltd. took a loan of ₹ 15,00,000 from State Bank of India against the security of tangible assets. In addition to principal security, it issued 10,000 11% debentures of ₹ 100 each as collateral security.

Pass necessary journal entries for the above transactions, if the company decided to record the issue of 11% debentures as collateral security and show the presentation in the Balance Sheet of Youth Ltd.

Answer. In the Books of Vedesh Ltd.

Journal

Working Note:

Number of Debentures issued = 9,50,000 / 95 = 10,000

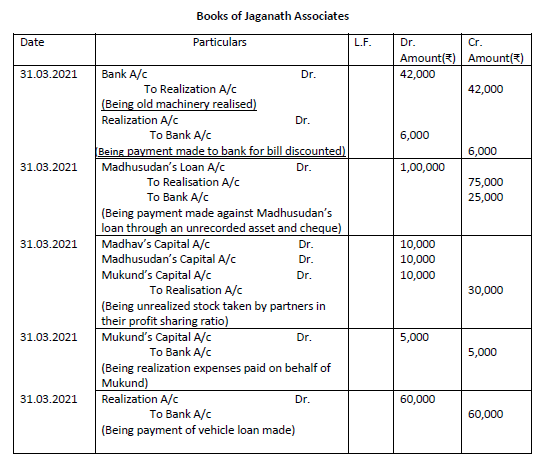

Question. Madhav, Madhusudan and Mukund were partners in Jaganath Associates. They decided to dissolve the firm on 31st March 2021.

Pass necessary journal entries for the following transactions after various assets (other than cash) and third-party liabilities have been transferred to realization account:

(i) Old machine fully written off was sold for ₹ 42,000 while a payment of ₹ 6,000 is made to bank for a bill discounted being dishonoured.

(ii) Madhusudan accepted an unrecorded asset of ₹80,000 at ₹75,000 and the balance through cheque, against the payment of his loan to the firm of ₹1,00,000.

(iii) Stock of book value of ₹30,000 was taken by Madhav, Madhusudan and Mukund in their profit sharing ratio.

(iv) The firm had paid realization expenses amounting to ₹5,000 on behalf of Mukund.

(v) There was a vehicle loan of ₹ 2,00,000 which was paid by surrender of asset to the bank at an agreed value of ₹ 1,40,000 and the shortfall was met from firm’s bank account.

OR

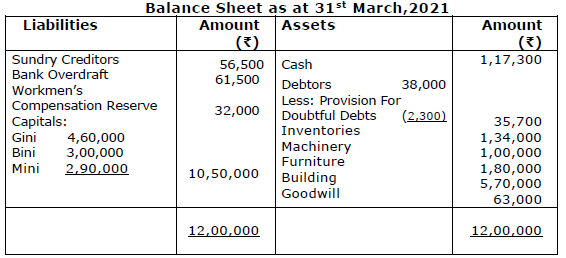

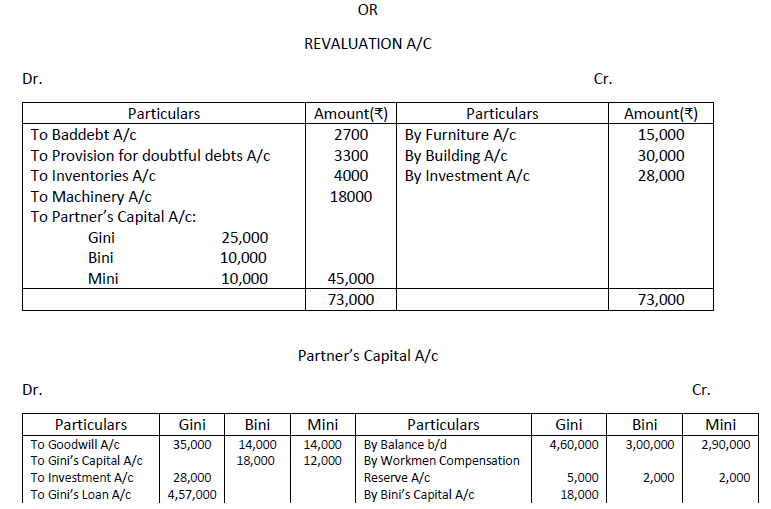

Gini, Bini and Mini were in partnership sharing profits and losses in the ratio of 5:2:2. Their Balance Sheet as at 31st March, 2021 was as follows:

On 31st March, 2021, Gini retired from the firm. All the partners agreed to revalue the assets and liabilities on the following basis:

(i) Bad debts amounted to ₹ 5,000. A provision for doubtful debts was to be maintained at 10% on debtors.

(ii) Partners have decided to write off existing goodwill.

(iii) Goodwill of the firm was valued at ₹ 54,000 and be adjusted into the Capital Accounts of Bini and Mini, who will share profits in future in the ratio of 5:4.

(iv) The assets and liabilities valued as: Inventories ₹1,30,000; Machinery ₹ 82,000; Furniture ₹1,95,000 and Building ₹ 6,00,000.

(v) Liability of ₹23,000 is to be created on account of Claim for Workmen Compensation.

(vi) There was an unrecorded investment in shares of ₹ 25,000. It was decided to pay off Gini by giving her unrecorded investment in full settlement of her part payment of ₹ 28,000 and remaining amount after two months.

Prepare Revaluation Account and Partners’ Capital Accounts as on 31st March, 2021.

Answer.

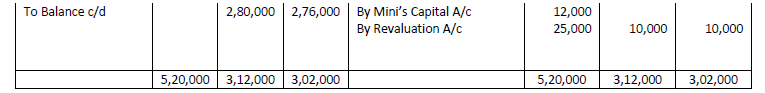

Question. Yogadatra Ltd. (pharmaceutical company) appointed marketing expert, Mr. Kartikay as the CEO of the company, with a target to penetrate their roots in the rural regions. Mr. kartikay discussed the ways and means to achieve target of the company with financial, production and marketing departmental heads and asked the finance manager to prepare the budget. After reviewing the suggestions given by all the departmental heads, the finance manager proposed requirement of an additional fund of ₹52,50,000.

Yogadatra Ltd. is a zero-debt company. To avail the benefits of financial leverage, the finance manager proposed to include debt in the capital structure. After deliberations, on April1,2020, the board of directors had decided to issue 6% Debentures of ₹100 each to the public at a premium of 5%, redeemable after 5 years at ₹110 per share.

You are required to answer the following questions:

(i) Calculate the number of debentures to be issued to raise additional funds.

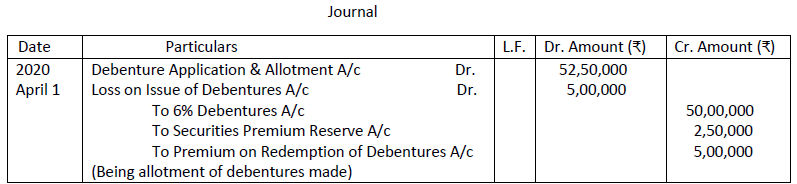

(ii) Pass Journal entry for the allotment of debentures.

(iii) Pass Journal entry to write off loss on issue of debentures.

(iv) Calculate the amount of annual fixed obligation associated with debentures.

(v) Prepare Loss on Issue of Debentures Account.

Answer.(i) Number of Debentures to be issued = 52,50,000/105 = 50,000

(ii) In the Books of Yogadatra Ltd.

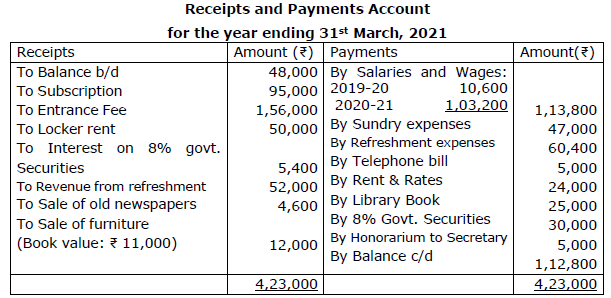

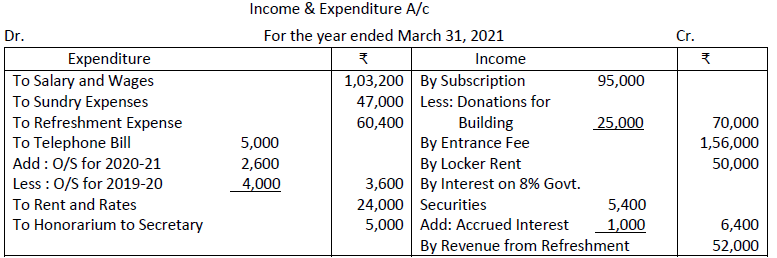

Question. From the following Receipts and Payments Account and additional information provided by Ramanath Club, Prepare Income and Expenditure Account for the year ending on 31st March 2021.

Additional Information:

(i) Subscription received during the year includes ₹ 25,000 as donation for Building.

(ii) Telephone bill unpaid as on March 31, 2020 was ₹ 4,000 and on March 31, 2021 ₹ 2,600.

(iii) Value of 8% Government Securities on March 31, 2020 was ₹ 80,000.

(iv) Additional Government Securities worth ₹ 30,000 were purchased on March 31, 2021.

Answer.

Part-B

Option-I

(Analysis of Financial Statements)

Question. State whether the following transactions will result in inflow, outflow or no flow of cash while preparing cash flow statement:

(i) Decrease in outstanding employees benefits by ₹3000

(ii) Increase in Current Investment by ₹ 6,000.

Answer. (i) Outflow

(ii) No Flow

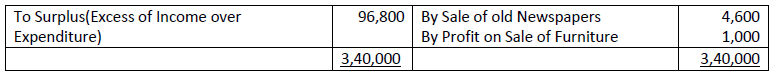

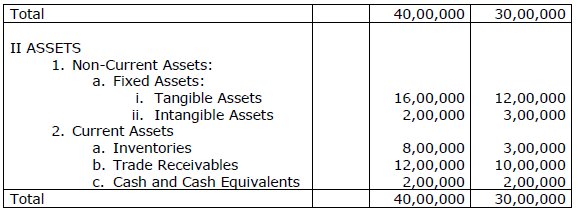

Question. From the following details provided by Kumud Ltd., prepare Comparative Statement of Profit & Loss for the year ended 31st March 2021:

OR

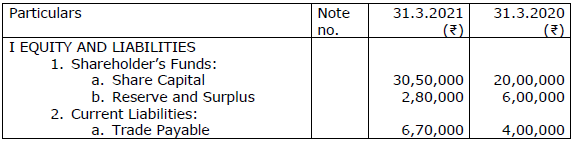

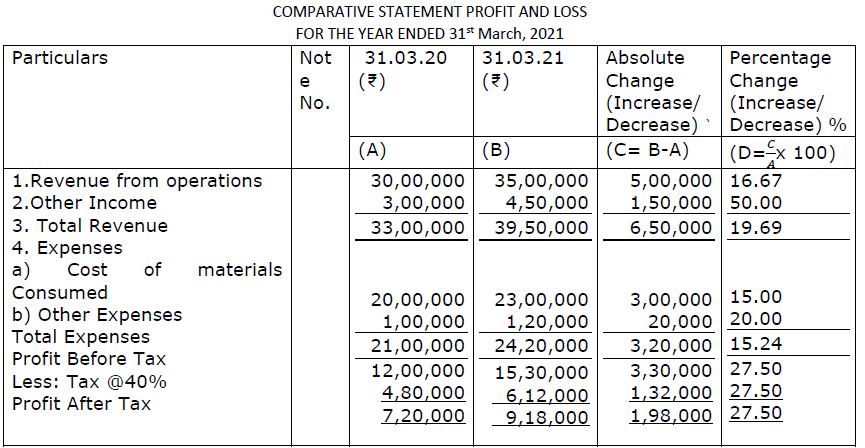

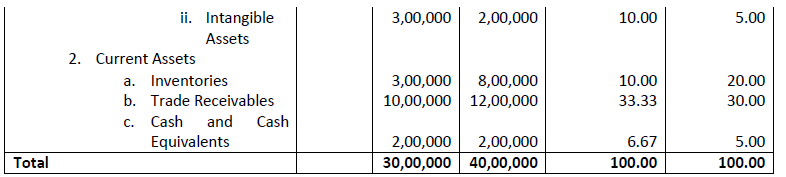

From the following Balance Sheets of Vinayak Ltd. as at 31st March,2021, Prepare a Common-size Balance Sheet.

Vinayak Ltd.

Balance Sheet as on 31st March, 2021

Answer.

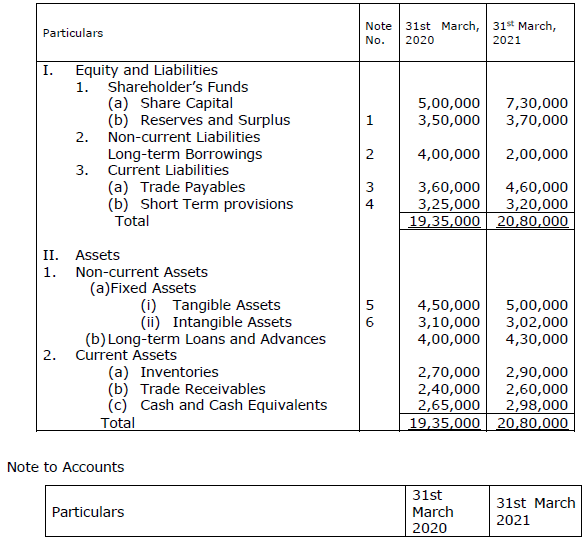

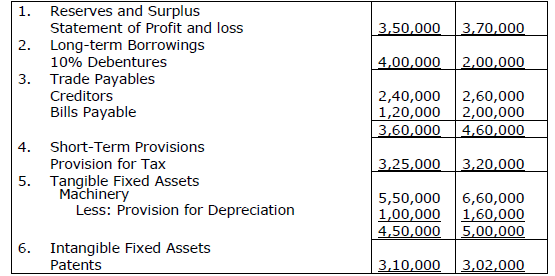

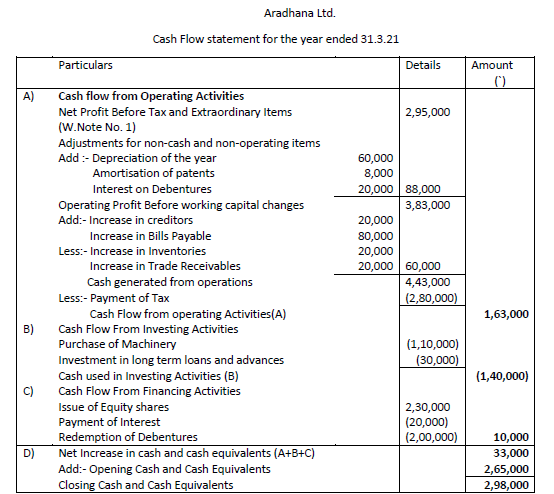

Question. On the basis of information given by Aradhana Ltd., prepare Cash Flow Statement for the year ending 31st March, 2021:

Aradhana Ltd.

Balance Sheet as on 31st March, 2021

Additional Information:

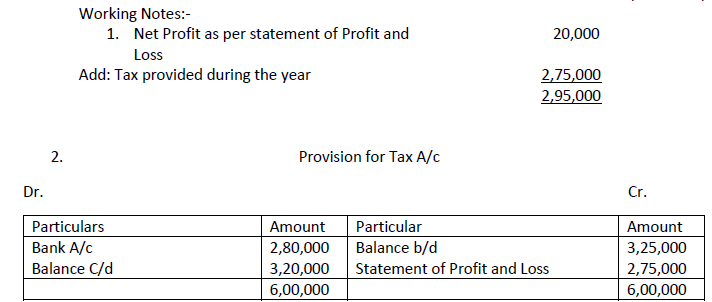

1. Debentures were redeemed on 1st April,2020.

2. Tax paid during the year ₹2,80,000.

Answer.

Part -B

Option-II

(Computerized Accounting)

Question. What do you understand by terms ‘primary key’ and ‘secondary key’ in a database?

Answer.A primary key is a field that identifies each record in a database table admitting that the primary key must contain its UNIQUE values. A secondary key shows the secondary value that is unique for each record. It can be used to identify the record and it is usually indexed. It is also termed as Alternate key.

Question. State any three features of computerized accounting system.

Or

State any three advantages of computerized accounting system.

Answer.Simple and Integrated: It helps all businesses by automating and integrating all the business activities. Such activities may be sales, finance, purchase, inventory, and manufacturing etc. It also facilitates the arrangement of accurate and up-to-date business information in a readily usable form. Accuracy & Speed: Computerised accounting has customized templates for users which allows fast and accurate data entry. Thus, after recording the transactions it generates the information and reports automatically. Scalability: It has the flexibility to record the transactions with the changing volume of business.

OR Advantages of Computerised Accounting

1. Better Quality Work: The accounts prepared with the use of computerized accounting system are usually uniform, neat, accurate, and more legible than a manual job.

2. Lower Operating Costs: Computer is a reliable and time-saving device. The volume of job handled with the help of computerized system results in economy and lower operating costs. The overall operating cost of this system is low in comparison to the traditional system.

3. Improves Efficiency: This system is more efficient in comparison to the traditional system. The computer makes sure speed and accuracy in preparing the records and accounts and thus, increases the efficiency of employees.

Question. Name and explain the function which returns the future value of an investment which has constant payment and interest.

Answer.PMT: The PMT function calculates the periodic payment for an annuity assuming equal payments and a constant rate of interest. The syntax of PMT function is as follows: =PMT (rate, nper, pv, [fv], [type]) where

Rate is the interest rate per period,

Nper is the number of periods,

Pv is the present value or the amount the future payments are worth presently, future value or cash balance that after the last payment is made (a future value of zero when we omit this optional argument) Type is the value 0 for payments made at the end of the period or the value 1 for payments made at the beginning of the period.

The PMT function is often used to calculate the payment for mortgage loans that have a fixed rate of interest.