Please refer to Class 12 Accountancy Sample Paper Term 1 Set B with solutions below. The following CBSE Sample Paper for Class 12 Accountancy has been prepared as per the latest pattern and examination guidelines issued by CBSE. By practicing the Accountancy Sample Paper for Class 12 students will be able to improve their understanding of the subject and get more marks.

CBSE Class 12 Accountancy Sample Paper for Term 1

Part – I

Section – A

1. D and E were partners in a firm sharing profits equally. With effect from 1st April, 2020, they decided to share profits in the ratio of 4 : 3. Due to change in profit sharing ratio, D’s gain or sacrifice will be

(a) gain 1/14

(b) sacrifice 1/14

(c) gain 3/4

(d) sacrifice 3/7

Answer

A

2. Under the capitalisation method of valuation of goodwill, the formula for calculating goodwill is

(a) super profits multiplied by the rate of return

(b) average profits multiplied by the rate of return

(c) super profits divided by the rate of return

(d) average profits divided by the rate of return

Answer

C

3. Verma Ltd. forfeited 4,000 equity shares of ₹ 100 each issued at a premium of 10% for non-payment of first and final call of ₹ 30 per share. The maximum amount of discount at which these shares can be reissued will be

(a) ₹ 40,000

(b) ₹ 1,60,000

(c) ₹ 2,80,000

(d) ₹ 1,20,000

Answer

C

4. Which of the following items are recorded in the profit and loss appropriation account of a partnership firm?

(i) Interest on capital

(ii) Salary to partner

(iii) Transfer to reserve

(a) Only (i)

(b) (i) and (ii)

(c) (ii) and (iii)

(d) (i), (ii) and (iii)

Answer

D

5. A company forfeited 1,000 shares of ₹ 10 each issued at 20% premium to be paid at the time of allotment of which ₹ 8 is called-up. Company has not received ₹ 4 on allotment including premium and ₹ 2 on first call. What will be the amount credited to share forfeiture account?

(a) ₹ 5,000

(b) ₹ 4,000

(c) ₹ 3,000

(d) ₹ 1,000

Answer

B

6. Ram is a partner in a firm. He withdraws regularly ₹ 6,000 at the end of every month for the six months ending 31st March, 2021. If interest on drawings is charged @ 10% p.a., the interest charged will be

(a) ₹ 750

(b) ₹ 900

(c) ₹ 1,050

(d) ₹ 1,800

Answer

A

7. The shares on which there is no pre-fixed rate of dividend is decided, but the rate of dividend is fluctuating every year according to the availability of profits, such shares are called

(a) Equity shares

(b) Non-cumulative preference shares

(c) Non-convertible preference shares

(d) Non-guaranteed preference shares

Answer

A

8. If the claim on account of workmen’s compensation is more than the workmen compensation reserve, which account(s) is/are debited initially?

(a) Workmen compensation reserve

(b) Revaluation

(c) Both (a) and (b)

(d) None of these

Answer

C

9. A company forfeited 500 shares of ₹ 10 each, ₹ 7 called-up for the non-payment of ₹ 2 on first call. All these shares were reissued at ₹ 5 per share. What will be the amount credited to share capital account on reissue?

(a) ₹ 3,500

(b) ₹ 5,000

(c) ₹ 2,500

(d) ₹ 1,000

Answer

A

10. P and Q were partners in a firm. They admitted R as a partner with 1/5th share in the profits of the firm. R brings ₹ 2,00,000 as his share of capital. Calculate the value of R’s share of goodwill on the basis of his capital, given that the combined capital of P and Q after all adjustments is ₹ 5,00,000.

(a) ₹ 60,000

(b) ₹ 3,00,000

(c) ₹ 7,00,000

(d) ₹ 10,00,000

Answer

A

11. X and Y were partners in a firm. Their fixed capitals were ₹ 4,50,000 and ₹ 1,50,000 respectively. They shared profits in the ratio of their capitals. Z was admitted as a new partner for 1/4th share in the profits of the firm.

Z brought ₹ 30,000 as his share of goodwill premium and ₹ 3,00,000 as his capital. The amount of goodwill premium credited to X’s account will be

(a) ₹ 30,000

(b) ₹ 15,000

(c) ₹ 22,500

(d) ₹ 7,500

Answer

C

12. From which account, expenses on issue of shares will be written-off first at all?

(a) Statement of profit and loss

(b) Miscellaneous expenditure account

(c) Share issue expenses account

(d) Securities premium reserve account

Answer

D

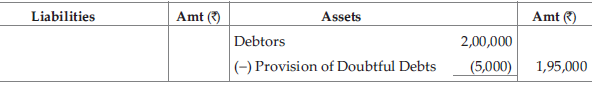

13. An Extract of Balance Sheet

At the time of change in profit sharing ratio, provision for doubtful debts is to be made equal to 5% of debtors. Journalise.

(a) Provision of Doubtful Debts Dr 10,000

To Revaluation A/c 10,000

(b) Provision of Doubtful Debts Dr 5,000

To Revaluation A/c 5,000

(c) Revaluation A/c Dr 5,000

To Provision of Doubtful Debts 5,000

(d) Revaluation A/c Dr 10,000

To Provision of Doubtful Debts 10,000

Answer

B

14. Sharma Ltd. issued 5,000 shares of ₹ 10 each at 20% premium which was oversubscribed to the extent of 2,500 shares. All money to be paid on application only and shares were allotted on pro rata basis. The company will refund ……… .

(a) ₹ 30,000

(b) ₹ 25,000

(c) ₹ 20,000

(d) ₹ 15,000

Answer

A

15. D, E, F are partners with ₹ 50,000, ₹ 1,00,000 and ₹ 1,50,000 capital respectively. Profits are to be divided equally. Interest on capital to be provided @ 10% p.a. Net loss is ₹ 3,000. What is D’s share of interest on capital?

(a) ₹ 1,500

(b) (₹ 1,000)

(c) ₹ 500

(d) Nil

Answer

D

16. At the time of change in profit sharing ratio, advertisement expenditure (deferred revenue) is ……… and partners’ capitals are ………… .

(a) credited, debited

(b) debited, credited

(c) Both (a) and (b)

(d) None of these

Answer

A

17. The balance sheet of Goya Ltd. showed ₹ 10,000 debit balance of profit and loss account. Calculate the goodwill on 2 years’ purchase of average profits of last two years, if the company earned ₹ 15,000 profit in the previous year.

(a) ₹ 15,000

(b) ₹ 10,000

(c) ₹ 5,000

(d) None of these

Answer

C

18. Discount allowed on reissue of forfeited shares is debited to which account?

(a) Share capital account

(b) Share forfeiture account

(c) Statement of profit and loss

(d) General reserve account

Answer

B

Section – B

19. L, M and N are partners sharing profits in the ratio of 5 : 3 : 2. They decided to share future profits in the ratio of 2 : 3 : 5. What will be the accounting treatment of workmen compensation reserve appearing in the balance sheet on that date when no other information is available for the same?

(a) Distributed among partners in their capital ratio

(b) Distributed among partners in their new profits sharing ratio

(c) Distributed among partners in their old profit sharing ratio

(d) Carried forward to new balance sheet

Answer

C

20. P and Q are partners sharing profits and losses as 2 : 1. R is admitted and profit sharing ratio becomes 4 : 3 : 2. Goodwill is valued at ₹ 47,250. R bring required goodwill in cash. Goodwill amount will be credited to

(a) P ₹ 7,000 and Q ₹ 3,500

(b) P ₹ 6,000 and Q ₹ 4,500

(c) P ₹ 10,500

(d) P ₹ 47,250

Answer

C

21. Amount of calls-in-arrear is shown in the balance sheet

(a) as deduction from issued capital

(b) as deduction from subscribed capital

(c) as addition to subscribed capital

(d) on the assets side

Answer

B

22. Assertion (A) Authorised capital is the maximum amount for which a company is authorised to issue shares.

Reason (R) Authorised capital is stated in the article of association of the company.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

23. For which of the following situations, the old profit sharing ratio of partners is used at the time of admission of a new partner?

(a) When a new partner brings only a part of his share of goodwill.

(b) When a new partner is not able to bring his share of goodwill.

(c) When, at the time of admission, goodwill already appears in the balance sheet.

(d) When a new partner brings his share of goodwill in cash.

Answer

C

24. Glacier Limited has an authorised capital of ₹ 50,00,000 divided into ₹ 50,000 equity shares of ₹ 100 each. If offered 45,000 equity shares of ₹ 10 each at a premium of ₹ 8, the public applied for 40,500 equity shares. Till 31st March, 2021, ₹ 17 (including premium) was called. An applicant holding 2,500 shares did not pay first call of ₹ 2 per share. As per the above given information ……… is the amount of share capital to be shown in the balance sheet of the company.

(a) ₹ 3,64,500

(b) ₹ 3,59,500

(c) ₹ 3,54,500

(d) ₹ 3,69,500

Answer

B

25. Which of the following is true in regards to rights of a partner?

(i) Right to inspect book of accounts

(ii) Right to not allow the admission of new partner

(iii) Right to conducts affairs of business

(a) Only (i)

(b) (i) and (ii)

(c) (i) and (iii)

(d) (i), (ii) and (iii)

Answer

D

26. Assertion (A) Personal properties of a partner mayalso be used to pay-off the firm’s debts.

Reason (R) All partners have limited liability in the firm.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

27. The subscribed share capital of Gupta Ltd. is ₹ 50,00,000 being each share of ₹ 100. There were no calls-in-arrear till the final call was made. The final call made was paid on 48,750 shares. The calls-in-arrear amounted to ₹ 43,750. The final call on shares is of

(a) ₹ 20

(b) ₹ 35

(c) ₹ 25

(d) ₹ 45

Answer

B

28. When fluctuating capital method is used, which of the following items are shown in debit side of partners’ capital account?

(a) Opening debit balance of capital account

(b) Drawings

(c) Interest on drawings

(d) All of these

Answer

D

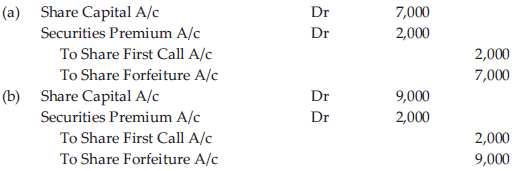

29. Malhotra Ltd. forfeited 1,000 shares of ₹ 10 each, ₹ 7 called-up, issued at a premium of ₹ 2 per share to be paid at the time of allotment for non-payment of first call of ₹ 2 per share.

Entry on forfeiture will be

Answer

D

30. D and L are partners with profit sharing ratio as 2 : 3. They admitted F who brought ₹ 40,000 as goodwill which was credited to D’s and L’s capital account as ₹ 30,000 and ₹ 10,000 respectively. Goodwill of the firm is ₹ 2,00,000. Calculate new profit sharing ratio.

(a) 2 : 3 : 5

(b) 5 : 11 : 4

(c) 5 : 12 : 3

(d) Can’t be determined

Answer

B

31. Assertion (A) At the time of admission of a partner, goodwill is paid to old partners in their sacrificing ratio.

Reason (R) Goodwill is the amount of compensation to be paid by the new partner to the old partners for acquiring the share of profits which they have surrendered in favour of new partner.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

32. 10,000 shares were issued to existing employees of a company as per their choice at a price below than the market price. It is an example of ……………….. .

(a) public issue

(b) private placement

(c) ESOP

(d) issue other than cash

Answer

C

33. G and H are Partners in a firm sharing profits and losses in the ratio of 1 : 3. K was admitted for 1/4th share of profit. Machinery would be depreciated by 20% (book value ₹ 50,000) and building would be appreciated by 10% (book value ₹ 40,000) unrecorded debtors of ₹ 1,000 would be brought in books. What was G’s and H’s share on revaluation?

(a) ₹ 1,250, ₹ 3,750

(b) ₹ 3,750, ₹ 1,250

(c) ₹ 3,750, ₹ 0

(d) ₹ 1,250, ₹ 0

Answer

A

34. Arora Limited forfeited 400 shares of ₹ 10 each who had applied for 1,000 shares, issued at a premium of 10% for non-payment of final call of ₹ 3 per share. Out of these 200 shares were issued as fully paid up for ₹ 15. The profit on reissue is

(a) ₹ 1,400

(b) ₹ 12,800

(c) ₹ 600

(d) ₹ 800

Answer

A

35. R, S and T are partners with ₹ 2,000, ₹ 4,000 and ₹ 6,000 capitals respectively. Profits are to be divided equally. Interest on capital to be provided @ 20% p.a. Net profit is ₹ 1,800. What is R’s share of profit?

(a) ₹ 800

(b) ₹ 600

(c) ₹ 300

(d) None of these

Answer

C

36. A and B are partners in a firm. They admitted C for 1/3 share. C brought ₹ 2,00,000 as his capital and ₹ 60,000 for premium. Journal entry for the transaction is

Bank A/c Dr X

To C’s Capital A/c Y

To Premium for Goodwill A/c Z

Here, X, Y, Z are

(a) ₹ 2,60,000, ₹ 2,00,000, ₹ 60,000 respectively

(b) ₹ 2,60,000, ₹ 6,00,000, ₹ 2,00,000 respectively

(c) ₹ 2,00,000, ₹ 60,000, ₹ 1,40,000 respectively

(d) ₹ 2,00,000, ₹ 1,40,000, ₹ 60,000 respectively

Answer

A

Section – C

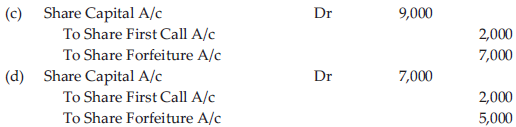

Classplus Ltd. was incorporated on 1st April, 2020 . It has its registered office in Mumbai. It issued 3,00,000 shares of ₹ 100 each payable as under

On application – ₹ 50 per share

On allotment – ₹ 30 per share

On first and final call – Balance

Company received application for 5,00,000 shares. 50,000 applications were rejected with a letter of regret and prorata allotment was made to the remaining share applicants. All money due was duly received except from Rim, to whom 15,000 shares were allotted. He failed to pay allotment and calls. These shares were forfeited, 9,000 shares were reissued at ₹ 75 per share fully paid up.

37. Journal entry for forfeiture of shares is ……… .

Answer

A

38. Which of the following amount will be transferred to capital reserve account?

(a) ₹ 7,50,000

(b) ₹ 6,00,000

(c) ₹ 4,50,000

(d) ₹ 2,25,000

Answer

D

Geet, Kartik and Vatsal were partners engaged in the business of manufacturing and selling low cost medicines. They shared profits in the ratio of 1 : 2 : 3. Their initial fixed capital contribution on 1st April, 2020 were A ₹ 60,000 B ₹ 90,000 and C ₹ 2,00,000. Geet provides her personal office to the firm for business use charging yearly rent of ₹ 30,000. Geet was also allowed a salary of ₹ 2,000 per month.

Interest on capital is provided @ 8%. p.a. Geet withdrews ₹ 1,000 in the beginning of each month, Kartik withdrews ₹ 1,000 at the end of each month and Vatsal withdrews ₹ 4,800 in the beginning of each quarter. Interest is charged on their drawings @ 10% p.a. Kartik was allowed a commission of 10% of net profit as shown in profit and loss account, after charging such commission. Vatsal was guaranteed a profit of ₹ 60,000 after making all adjustments. The net profit for the year ended 31st March, 2021 was ₹ 2,06,000 before making above adjustments.

39. Geet’s rent will be shown in

(a) Profit and loss account

(b) Profit and loss appropriation account

(c) A’s capital account

(d) None of the above

Answer

A

40. Net profit for the year is

(a) ₹ 2,06,000

(b) ₹ 2,36,000

(c) ₹ 1,46,000

(d) ₹ 1,76,000

Answer

D

41. What will be the total interest on drawings?

(a) ₹ 4,800

(b) ₹ 2,400

(c) ₹ 7,200

(d) ₹ 9,600

Answer

B

Part – II

Section – A

42. Balance sheet provides information about financial position of enterprise

(a) at a point of time

(b) over a period of time

(c) for a period of time

(d) None of the above

Answer

A

43. Current liabilities ₹ 40,000, current assets ₹ 1,00,000, inventory ₹ 20,000. Quick ratio is

(a) 1 : 1

(b) 2.5 : 1

(c) 2 : 1

(d) 1 : 2

Answer

C

44. Which one of the following statements is not true?

(i) Conversion of debentures into preference shares will decrease debt-equity ratio.

(ii) Long-term liabilities due for payment within a year should be treated as current liabilities.

(iii) Higher operating ratio indicates higher profits.

(iv) Cost of sales is a better numerator than sales while calculating stock turnover.

(a) (i) and (ii)

(b) Only (iii)

(c) (i) and (iii)

(d) (iii) and (iv)

Answer

B

45. Assertion (A) Ratio analysis is one of the tools employed to know the financial health of a concern.

Reason (R) Ratio analysis do not judge the profitability and liquidity of the business.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

C

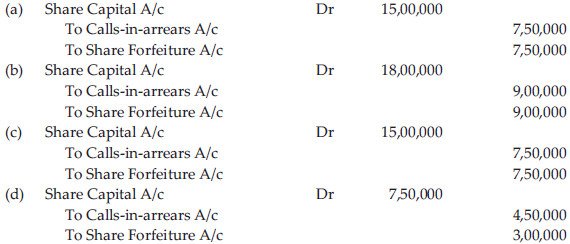

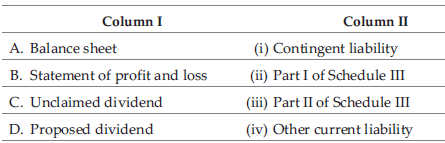

46. Match the column.

Codes

A B C D

(a) (ii) (iii) (iv) (i)

(b) (i) (ii) (iii) (iv)

(c) (iv) (i) (iii) (ii)

(d) (iii) (i) (ii) (iv)

Answer

A

47. The quick ratio of a company is 0.8 : 1. Purchase of loose tools of ₹ 2,000 will

(a) increase the quick ratio

(b) decrease the quick ratio

(c) not change the quick ratio

(d) increase gross profit ratio

Answer

B

48. Which of the following are the sub-headings of current liabilities?

(i) Short-term borrowings

(ii) Trade payables

(iii) Short-term provisions

(iv) Short-term investment

(v) Other current liabilities

(vi) Short-term loans and advances

(a) (i), (ii), (iii), (v)

(b) (i), (iv), (v), (vi)

(c) (iii), (iv), (v), (vi)

(d) (ii), (iv), (v), (vi)

Answer

A

Section – B

49. Which of the following items are included in ‘revenue from operations’ for a financial company?

(i) Dividend received

(ii) Sales

(iii) Sale of scrap

(iv) Interest earned

(v) Profit on sale of fixed asset

(vi) Profit on sale of investments

(vii) Refund of income tax

(a) (i), (iv), (v), (vi)

(b) (i), (v), (vi), (vii)

(c) (iii), (iv), (v), (vii)

(d) (ii), (iv), (v), (vi)

Answer

A

50. Assertion (A) Activity ratios are known as efficiency ratios.

Reason (R) Higher turnover ratio means better utilisation of assets and signifies improved efficiency and profitability.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

51. If fixed assets are ₹ 75,00,000, current assets ₹ 40,00,000, current liabilities ₹ 27,00,000, 12% debentures ₹ 80,00,000 and net profit before interest, tax and dividend ₹ 14,50,000, return on investment will be……… .

(a) 16.48 %

(b) 15.48 %

(c) 14.48 %

(d) 13.48 %

Answer

A

52. Which of the following is not the limitation of financial statement analysis?

(a) Ignores price level changes

(b) Window dressing

(c) Qualitative aspect ignored

(d) Inter-firm comparisons

Answer

D

53. Assertion (A) ‘Unpaid dividends’ are shown under ‘other current liabilities’.

Reason (R) All liabilities, of which payment is expected to be made within 12 months from the date of balance sheet, shall be treated as current liabilities.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is false, but Reason (R) is true

(d) Assertion (A) is true, but Reason (R) is false

Answer

A

54. Which of the following is not correct?

(i) Sale of fixed asset (book value ₹ 40,000) at a loss of ₹ 5,000 will increase debt-equity ratio.

(ii) Issue of new shares for cash will decrease debt-equity ratio.

(iii) Redemption of debentures for cash will decrease debt-equity ratio.

(iv) Declaration of final dividend will decrease debt-equity ratio.

(a) (i) and (iv)

(b) Only (iv)

(c) (i) and (ii)

(d) Only (i)

Answer

B

55. If revenue from operations is ₹ 16,00,000, average inventory ₹ 2,20,000, gross loss ratio 5%, inventory turnover ratio will be ……… .

(a) 8.64 times

(b) 5.64 times

(c) 7.64 times

(d) 4.64 times

Answer

C