Please refer to the Money and Credit Revision Notes given below. These revision notes have been designed as per the latest NCERT, CBSE and KVS books issued for the current academic year. Students will be able to understand the entire chapter in your class 10th Money and Credit book. We have provided chapter wise Notes for Class 10 Money and Credit as per the latest examination pattern.

Revision Notes Chapter 3 Money and Credit

Students of Class 10 Money and Credit will be able to revise the entire chapter and also learn all important concepts based on the topic wise notes given below. Our best teachers for Grade 10 have prepared these to help you get better marks in upcoming examinations. These revision notes cover all important topics given in this chapter.

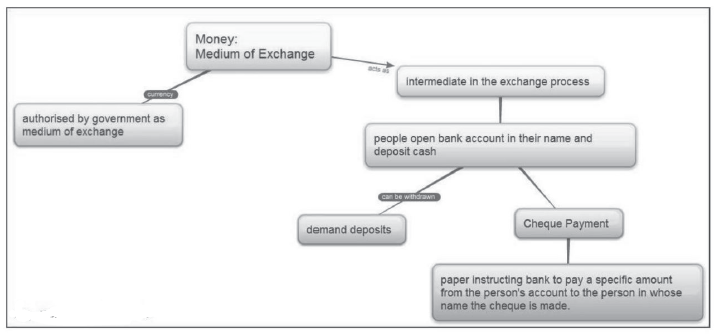

Money: Anything chosen by common consent as a medium of exchange.

Demand Deposits: Deposits in the bank account that can be withdrawn on demand.

Cheque: Paper instructing the bank to pay a specific amount from a person’s account to the person in whose name the cheque is drawn.

Reserve Bank of lndia: It is the central bank of India which controls the monitory policy of the country. It also control and supervises all the commercial banks in India.

Credit: The activity of borrowing and lending money between two parties.

Collateral: Collateral is an asset that the borrower owns (such as land, building, vehicle, livestock, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid. Property such as land titles, deposits with banks, livestock are some common examples of collateral used for borrowing.

Terms of Credit: Interest rate, collateral and documentation requirement, and the mode of repayment together comprise what is called the terms of credit. The terms of credit vary substantially from one credit arrangement to another. They may vary depending on the nature of the lender and the borrower.

Formal credit: Loans provided by institutions under the direct supervision of RBI. l’vfain sources are Banks, Cooperative Societies and Financial Institutions

Informal credit: Loans provided by individual under no supervision, like money lenders, Friends & Relatives, Traders etc.

Self Help Groups (SHG): These are groups generally formed in villages where money is collected from the members and given as loan to the member at a nominal rate of interest.

Short Answer type Questions

Question. What are the advantages of depositing money in the banks?

- It is the safer place to keep money as compared to the house or a working place.

- People can earn interest on the deposited money.

- People have the provisions to withdrawn the money as and when they require.

- People can also make payment through cheques.

Question. Self Help Groups support has brought about a revolutionary change in the rural sector. Which values according to you is it able to support.

- Women empowerment

- Team work

- Self sufficiency

- Eradication of poverty

Question. What are the functions of money?

- Money has solved the problem of barter system.

- Acts as medium of exchange

- Serves as a store of value.

- Serves as a measme of value.

Question. What are the limitations of the barter system?

- Lack of double coincident

- Lack of divisibility

- Lack of measure of value.

- Problem of store ofvalue.

Question. What is collateral?

- Collateral is an asset that the borrower owns (such as land, building, vehicles, livestock, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid.

- If the borrowers fails to repay the loan, the lender has the right to sell the asset or the collateral to obtain the payment.

- Property such as land, livestock etc are some of the common examples of collateral used for borrowing.

Long Answer type Questions

Question. Distinguish between formal and informal credit sources.

Ans. Formal Sector

- These resources work under the supervision of the Reserve Bank oflndia (RBI).

- The rate of interest is very low.

- Commercial banks, cooperative societies etc. are the main sources of formal credit.

Informal Sector

- These do not work under any government organization.

- The rate of interest is very high.

- Relatives, money lenders and landlords are the main sources of informal credit.

Question. In what ways does the Reserve Bank of India supervise the functioning of banks? Why is this necessary?

Ans.

- It ensures that the banks actually keep a certain % of their deposits as cash balance/cash reserve with the Central bank.

- It observes that banks give loans to small activators, small scale industries, small borrowers also and not become a profit making business.

- Report has to be submitted periodically by the banks to RBI containing details such as how much they have lent, to whom and at what rate of interest etc.

- Central Banks is the lender of the last resort. Whenever banks are short of funds, they can take loans from the Central Banks. Thus it is source of great strength to the banking system.

- It acts as a bank of central clearance settlements and transfers.

Question. Cheap and affordable credit is crucial for the countries development. Highlight the role of loans in reference to India.

Ans.

- High cost ofborrowing leads to a major share of profits to be paid as interest.

- At time, higher rates leads to more interests than the principal.

- Debt trap discourages new entrants

- More loans given by banks and co-operatives

- Promotion of small scale industries.

Question. Explain the functions of commercial banks.

Ans.

- Accepting deposits: Banks keep only a small proportion of their deposits as cash with themselves. This is kept as a provision to pay the depositors who might come to withdraw money from the bank.

- Providing loans: Banks use the major portion of the deposits to extend loans. Banks make use of the deposits to meet the loan requirements of the people.

- Transfer of funds: In this way, banks mediate between the depositor and borrowers.

- Credit creation: provides loan from people’s deposits. The borrower does not withdraw the whole loan amount instead deposits in the same bank. It enables the bank to provide further loan.

- Agency functions: In modem times bank also acts as an agent of the customer.

Question. What are demand deposits? What are their advantages? Why are demand deposits considered as money?

Ans. The deposits in the bank accounts which can be withdrawn on demand are known as demand deposits.

Advantages –

- People earn interest on the demand deposits.

- The depositor can make the payment through a cheque.

It Is considered as money because

- They can be used as a medium of exchange.

- They are easily acceptable.

- They help in settling payment without the use of cash.

Question.”Most of the poor households are still dependent on informal sources of credit”. Explain.

Ans.

- Banks are not present everywhere in rural India, where as the informal sources are easily available in all the villages.

- Getting a loan from the bank is much more difficult than taking a loan from the informal resources because bank loans require proper documents and collateral. Most of the poor people don’t possess anything to offer as collateral.

- Moneylenders provide loan to the poor people without any collateral.

- The formal sources provide loan only for productive purposes, whereas the informal sources provide credit for productive and non-productive purposes.

- The method of business of the formal source is very complex, whereas the informal resources have a very simple way of business.