Please see Reconstitution Of A Partnership Firm Retirement Death Of A Partner Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Reconstitution Of A Partnership Firm Retirement Death Of A Partner in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Reconstitution Of A Partnership Firm Retirement Death Of A Partner Class 12 Accountancy

Question. At what rate is interest payable to the amount remain unpaid to the executor of deceased partner?

Answer: 6% p.a

Question. “Retiring partner is not liable for firm’s acts after his retirement”. Is the statement True or False?

Answer: false

Question. What do you mean by gaining ratio?

Answer: The ratio in which remaining partners share the retiring or death partners share of profit is called gaining ratio.

Question. Name two adjustments to be made at the time of death of partner

Answer: a) calculation of death partners share of goodwill b) calculation of death partners share of profit to the date of death.

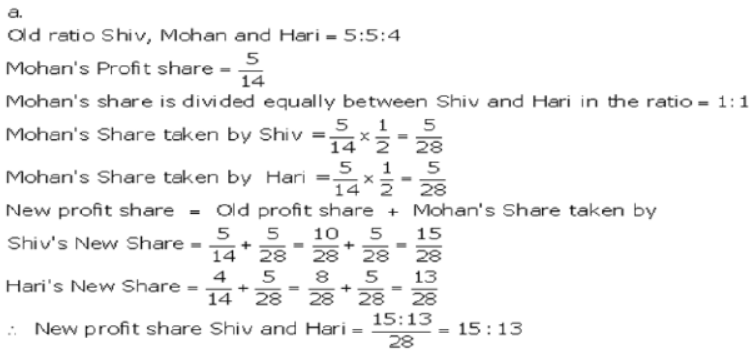

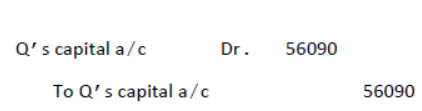

Question. From the following particulars, calculate new profit-sharing ratio of the partners: (a) Shiv, Mohan and Hari were partners in a firm sharing profits in the ratio of 5 : 5 : 4. Mohan retired and his share was divided equally between Shiv and Hari. (b) P, Q and R were partners sharing profits in the ratio of 5 : 4 : 1. P retires from the firm.

Answer:

Question. X,Y and Z are partners of a firm sharing profit and losses in the ratio of 3:1:1. Pass necessary journal entries at the time of Y,s death in the following cases.

i) There is a balance of workman’s compensation reserve Rs 70,000 and there is a claim of Rs 25,000 against it.

ii) Balance in workman compensation reserve Rs 60,000 and there is no any claim against it.

iii) Investment fluctuation reserve Rs 4,000. Investment appear at Rs 20,000 (market value Rs 19,000)

Answer:

Question. P, Q and R are partners sharing profits and losses in the ratio of 3:2:1 respectively. The balance sheet of the firm as on 1st April, 2016 was as under:

Q retires on the above date and it was agreed that:

(i) The goodwill of the firm is valued at Rs.24,000

(ii) Furniture, Plant and Machinery are depreciated by 10% and 6% respectively

(iii) Bills receivables of a customer Rs.5,000 discounted from bank was decided to create provision for doubtful debts on debtors @ 5%

(iv)Stock is appreciated by 10% and building is valued at Rs.53,000

(v)Revaluation expenses Rs.750 were paid by the firm

(vi)The amount due to Q is to be transferred to his loan account

Pass journal entries, Prepare Revaluation Account, Capital Accounts and Opening Balance Sheet of the new firm.

Answer: Journal Entries

Question. Write any three rights of a retiring partner?

Answer: Any three of these:

1. Share in Reserves and Profits or Losses

2. Share in Revaluation of Assets and Reassessment of Liabilities

3. Share in Goodwill

4. Right to get back his Capital

Question. The date of Z,s retirement following balances appeared in the books of the firm:

General reserve Rs 90,000, Profit and loss a/c (Dr) Rs 15,000, Workman compensation reserve Rs12, 000 which was no more required. Pass necessary journal entries at the time of Z,s retirement

Answer:

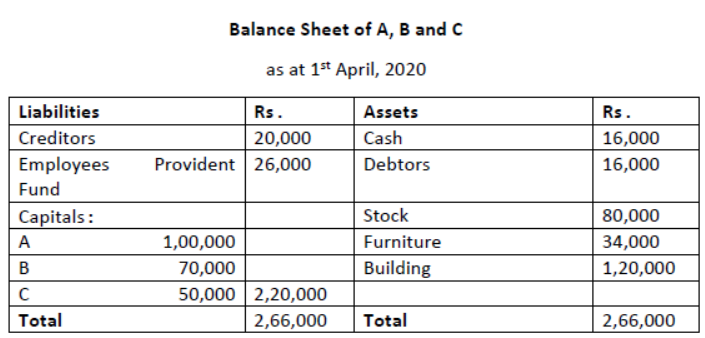

Question. A, B and C were partners sharing profits in the ratio of 5:3:2. Their Balance Sheet as on 1st April, 2020 was as follows:

C retires on the above date and it was agreed that:

(i) C’s share of goodwill was Rs.8,000

(ii) 5% provision for doubtful debts was to be made on debtors

(iii) Sundry creditors were valued Rs.4,000 more than the book value

Pass necessary journal entries for the above transactions on C’s retirement.

Answer: Journal Entries

Revaluation A/c Dr. 4,800

To Provision for Doubtful Debts A/c 800

To Sundry Creditors A/c 4,000

A’s Capital A/c Dr. 2,400

B’s Capital A/c Dr. 1,440

C’s Capital A/c Dr. 960

To Revaluation A/c 4,800

A’s Capital A/c Dr. 5,000

B’s Capital A/c Dr. 3,000

Question.

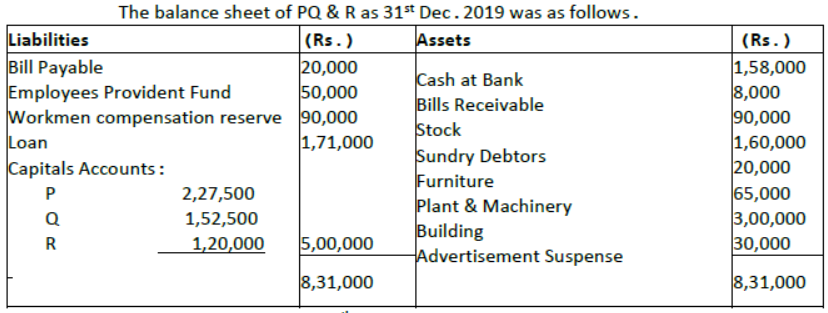

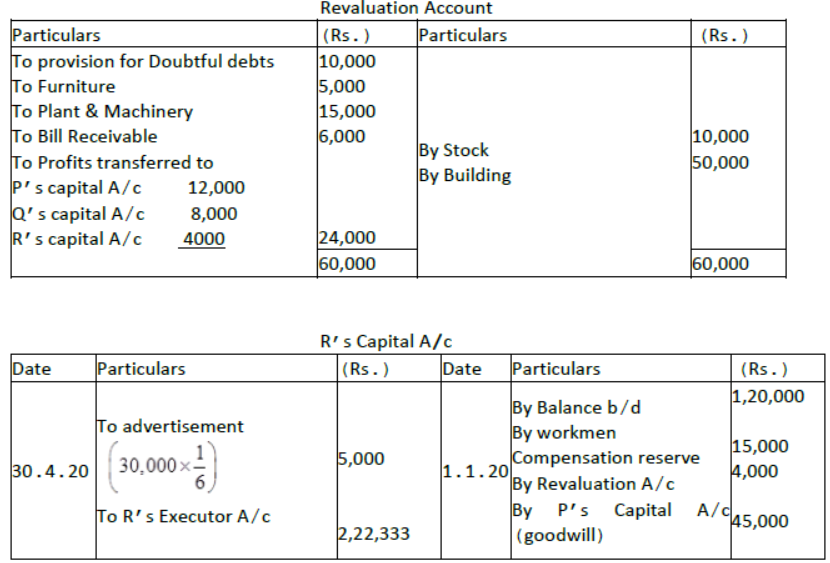

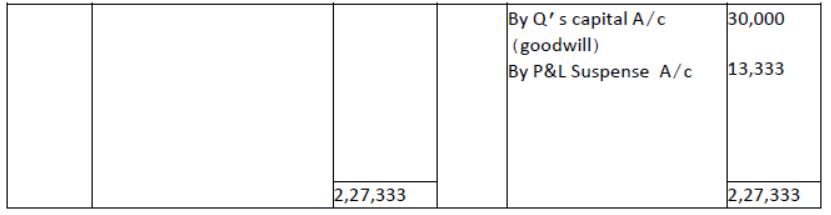

The profit ratio was 3:2:1 R died on 30th April 2020. The partnership deed provides that :

a. Goodwill is to be calculate on the basis of 3 years purchase of preceding 5 years average profits. The profits were Rs. 2,40,000, Rs. 1,60,000, Rs. 2,00,000 Rs. 1,00,000 and. Rs. 50,000.

b. Deceased partner should be given share of profits upto the date of death on the basis of previous your profits.

c. The assets have been revalued as under Stock Rs. 1,00,000 Debtors Rs. 3,50,000. A bill for Rs. 6000 was found worthless.

d. PREPARE R’s capital account.

Prepare Revolution account. Accounts are closed on 31st December.

Answer:

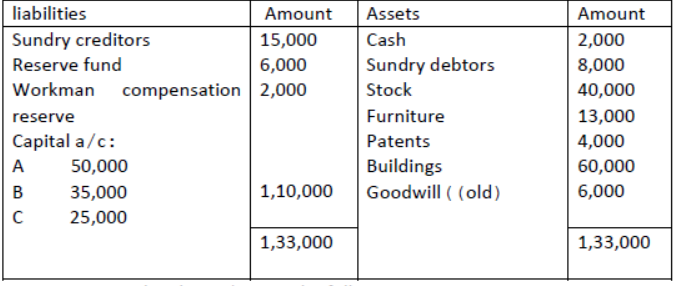

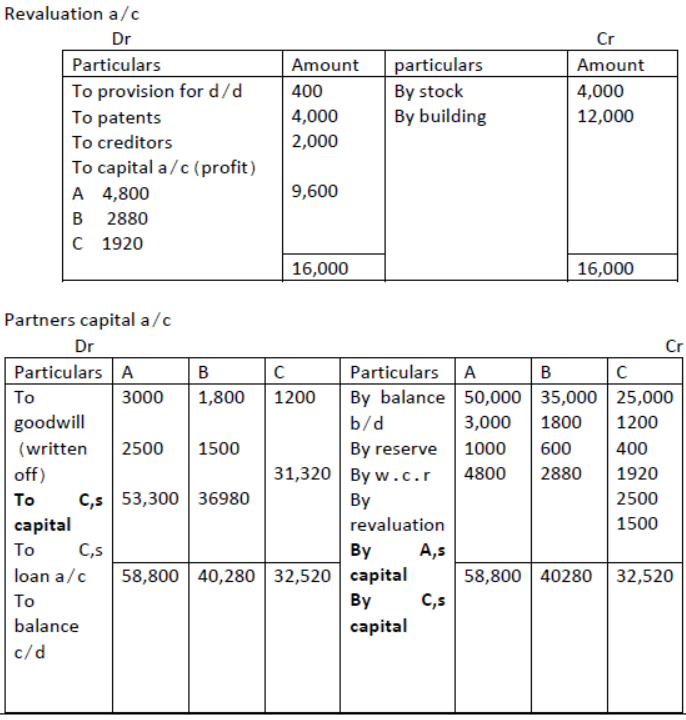

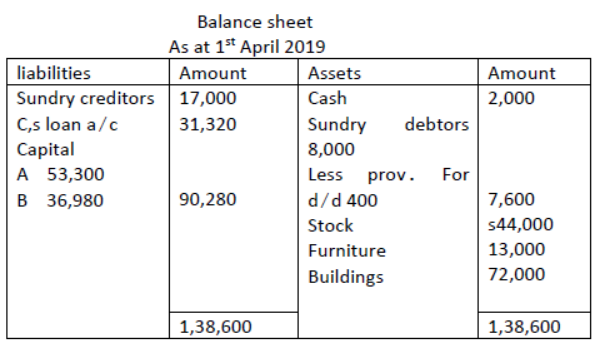

Question. A, B and C were partners sharing profit and losses in the ratio of 5:3:2. Their balance sheet as at 1stApril ,2019 was as follows:

i) C retires on the above date on the following terms:

ii) Goodwill of the firm is valued at Rs 20,000

iii) Provision for doubtful debts is to be maintained at 5% on debtors

iv)Stock be appreciated by 10%

v)Patents are valueless

vi)Building be appreciated by 20%

vii)Sundry creditors to be paid Rs 2,000 more than book value.

Prepare revaluation a/c, partners’ capital a/c and balance sheet of new firm.

Answer:

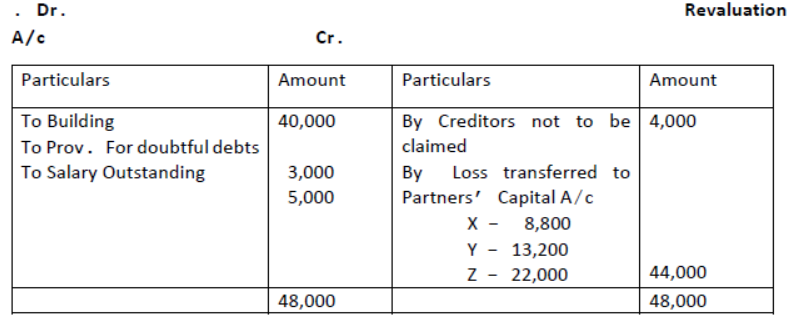

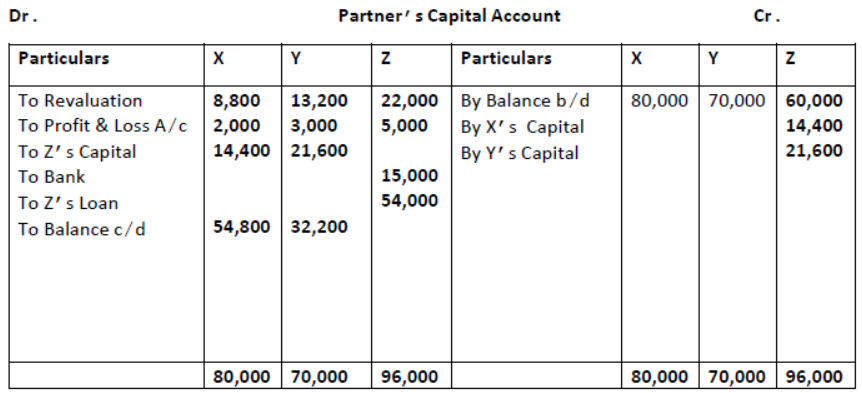

Question. 20 X,Y& Z were partners in a firm sharing profits in the ratio of 2:3:5. On 31.03.2020 their balance sheet was as follows:

On the above date Z retired from the partnership on the following terms:

I. Building was to be depreciated by Rs.40,000.

II. Provision for doubtful debts was to be maintained at 20% of the debtors.

III. Salary outstanding Rs.5,000 was to be recorded and creditors of Rs.4,000 will not be claimed.

IV. Goodwill of the firm was valued at Rs.72,000.

V. Z will be paid Rs.15,000 by cheque immediately and balance is to be transferred to his loan account.

Z decided to donate this amount to an orphanage. Name two values shown by Z with this act. Prepare Revaluation account, Partners’ capital Accounts and Balance sheet of the firm after Z’s retirement.

Answer: