Students should refer to Worksheets Class 12 Accountancy Financial Statements of a Company Chapter 3 provided below with important questions and answers. These important questions with solutions for Chapter 3 Financial Statements of a Company have been prepared by expert teachers for Class 12 Accountancy based on the expected pattern of questions in the class 12 exams. We have provided Worksheets for Class 12 Accountancy for all chapters on our website. You should carefully learn all the important examinations questions provided below as they will help you to get better marks in your class tests and exams.

Financial Statements of a Company Worksheets Class 12 Accountancy

Question. Which of the following items is shown in notes to accounts only?

(a) Inventories

(b) Current investments

(c) Contingent liability

(d) Building

Answer

C

Question. Assertion (A) Certain accounting conventions like conventions of consistency, conservatism, full disclosure, etc. are followed while preparing financial statements.

Reason (R) Use of accounting conventions makes the financial statements comparable, simple and realistic.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

Question. If cash balance is given as ₹ 10,000; Trade payable ₹ 80,000; Inventory ₹ 1,00,000; Trade receivable ₹ 1,30,000; Prepaid expenses ₹ 20,000 and Creditors ₹ 60,000. What will be the amount of current assets?

(a) ₹ 2,50,000

(b) ₹ 2,60,000

(c) ₹ 3,20,000

(d) ₹ 2,40,000

Answer

B

Question. Calculate revenue from operations from the following.

Sales = ₹ 1,04,00,000;

Sales return = ₹ 4,00,000;

Sales of scrap = ₹ 50,000;

Dividend received = ₹ 20,000;

Interest on fixed deposit = ₹ 60,000

(a) ₹ 1,00,00,000

(b) ₹ 1,01,30,000

(c) ₹ 1,00,80,000

(d) ₹ 1,00,50,000

Answer

D

Question. Which of the following statement(s) is/are incorrect?

(i) Statement of profit and loss shows financial performance of a company.

(ii) Format of statement of profit and loss is prepared as specified in Part II, Schedule III of Companies Act, 2013.

(iii) Share capital is included on assets side of the balance sheet.

(iv) General reserve can be used for distribution of dividend.

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i), (iii) and (iv)

(d) Only (iii)

Answer

D

Question. Which of the following is included under ‘other income’ head?

(a) Purchase of stock

(b) Sales of stock

(c) Interest received

(d) None of these

Answer

C

Question. A company should disclose all the information in

(a) statement

(b) annual report

(c) accounts book

(d) None of these

Answer

B

CASE STUDY BASED QUESTIONS

Financial statements are the basic sources of information to the shareholders and other external parties for understanding the profitability and financial position of any business concern. They provide information about the results of the business concern during a specified period of time in terms of assets and liabilities, which provide the basis for taking decisions. Thus, the primary objective of financial statements is to assist the users in their decision-making.

Financial statements provide the necessary information about the performance of the management to those parties interested in the organisation and help in taking appropriate economic decisions. It may be noted that the financial statements constitute an integral part of the annual report of the company in addition to the directors report, auditors report, corporate governance report, and management discussion and analysis. Though utmost care is taken in the preparation of the financial statements and provide detailed information to the users, they are not free from limitations.

Question: The primary objective of financial statements is to assist the users in their decision-making. The other objective of financial statements is

a) To abide by the Laws of the country

b) To follow the Accounting standards

c) To provide the information about the earning capacity of business.

d) To learn the nature, objectives and types of financial statements it has to prepare including their contents, format, uses etc

Answer:

C

Question: The interested parties of accounting information include

a) Share holders

b) Government

c) Prospective investors

d) All the above

Answer:

D

Question: Internal users of financial statements constitute

a) Owners

b) Employees

c) Investors

d) Government and tax authorities

Answer:

B

Question: The major limitations of financial statements are

a) Aids trade associations in helping their members

b) Guide to the value of the investment already made:

c) Do not reflect current situation

d) Report on stewardship function

Answer:

C

The American Institute of Certified Public Accountants states the nature of financial statements as, “the statements prepared for the purpose of presenting a periodical review of report on progress by the management and deal with the status of investment in the business and the results achieved during the period under review. They reflect a combination of recorded facts, accounting principles and personal judgements”.

Thus, financial statements are the summarized reports of recorded facts and are prepared the following accounting concepts, conventions, postulates, accounting policies, accounting standards and requirements of Law.

Based on the above, questions:

Question: Small items like pencils, pens, postage stamps, etc.are named as stationery and are treated as expenditure in the year in which they are purchased even though they are assets in nature. This is based on the principle of

a) Going concern concept

b) Realisation

c)Money measurement

d) Materiality

Answer:

D

Question: Every company registered under The Companies Act 2013 shall prepare its balance sheet, statement of profit and loss and notes to account thereto in accordance with the manner prescribed by Companies Act, 2013 to harmonise the disclosure requirement with the accounting standards and to converge with new reforms as per

a) Schedule VI, Part I& II of Companies Act 2013

b) Schedule III, Part I &IIof Companies Act 2013

c) The provisions of Memorandum of Association

b) As per Table F of Companies Act 2013.

Answer:

B

Question: While, preparing statement of profit and loss the revenue is included in the sales of the year in which the sale was undertaken even though the sale price may be received over a number of yea Rs.

This is based on which postulates of accounting?

a) Going concern concept

b) Realisation

c)Money measurement

d) Materiality

Answer:

A

Question: Balance sheet and Statement of Profit & Loss are supported by Notes to Accounts.

What do toy mean by Notes to Accounts?

a) Details of items given in the Balance sheet and Statement of Profit & Loss

b) Abstract of Memorandum of Association of a company

c) Provisions of Table F of Companies Act 2013

d) Provisions of Companies Act 2013

Answer:

A

Read the following hypothetical extract of the Balance sheet of Ramnath Ltd and answer the questions given below.

Balance sheet as per Schedule III Part I of Companies Act 2013

Question: Which of the following does not constitute Current liabilities as the operating cycle of the company is 12 months

a) Trade payables expected to repay within 12 months

b) Trade payables expected to repay after 24 months

c) Trade payables expected to repay within 3 months

d) Trade payables expected to repay within 6 months

Answer:

B

Question: Reserves & Surplus does not include

a) Capital Reserve

b) Capital Redemption Reserve

c) Reserve Capital

d) Revaluation Reserve

Answer:

C

Question: Example for Intangible asset is

a) Furniture

b) Mastheads & Publishing titles

c) Investments in other companies

d) Public deposits

Answer:

B

Question: Short term provisions include

a) Provision for Tax & Proposed dividend

b) Proposed dividend Provision for Depreciation

c) Provision for Tax & Provision for Depreciation

d) Sundry creditors & Proposed dividend

Answer:

A

Ramnath Ltd is dealing in import ofnorganic food items in bulk. The company sells the items in smaller quantities in attractive packages. Performance of the company has been up to the expectations in the past. Keeping up with the latest packaging technology, the company decided to upgrade its machinery. For this , the finance manager of the company was asked to present the financial statements . He furnished the following particulars before you.

Capital advances Rs.25,00,000

Capital work in progress Rs.1,50,00,000

Bank overdraft Rs.56,00,000

Unclaimed dividend Rs.35,000

Outstanding salary Rs.40,000

Trade payables Rs.48,000

Computer software Rs.50,00,000

Cheques in hand Rs.48,000

General Reserve Rs.38,00,000

Public deposits Rs.80,00,000

Patents Rs.38,00,000

Question: Under which major heading and sub heading will Unclaimed dividend be presented in the Balance sheet of the company as per Schedule III Part I of Companies Act 2013

a) Current liabilities- Short term provisions

b) Current liabilities- Short term borrowings

c) Current liabilities- Other Current liabilities

d) Current liabilities- Trade payables

Answer:

C

Question: Under which major heading and sub heading will Capital advances be presented in the Balance sheet of the company as per Schedule III Part I of Companies Act 2013

a) Noncurrent asset –Long term loans & advances

b) Noncurrent asset- fixed asset (Tangible)

c) Noncurrent asset-long term borrowings

d) Noncurrent asset- Fixed asset (Intangible)

Answer:

A

Question: Under which major heading and sub heading will Public deposits be presented in the Balance sheet of the company as per Schedule III Part I of Companies Act 2013

a) Noncurrent liabilities- Long term borrowings

b) Noncurrent assets- Noncurrent investments

c) Noncurrent liabilities- Long term provisions

d) Noncurrent Liabilities- Other noncurrent liabilities

Answer:

A

Question: Under which major heading and sub heading will Cheques in hand be presented in the Balance sheet of the company as per Schedule III Part I of Companies Act 2013

a) Current Assets- Other current assets

b) Current assets- Cash & Cash equivalents

c) Current Assets- Inventories

d) Current Assets- Current investments

Answer:

B

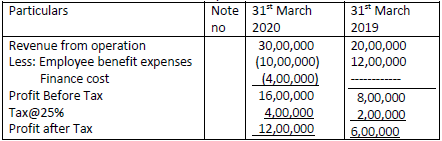

Pharma Ltd is engaged in the manufacturing of low cost generic medicines. Its management and employees are hardworking and motivated. The net profit of the company increased during the year ended 31st March 2020. Encouraged by its performance, the company decided to pay bonus to all employees at a higher rate.

Following is the Statement of Profit & Loss for the year ended 31st March 2020

Statement of Profit & Loss for the year ended 31st March 2020

Question: Employee Benefit expenses does not include which of the following/

a) Wages

b) Conveyance expenses

c) Salaries

d) Bonus

Answer:

B

Question: Under which head the Profit on sale of asset will be shown in the Statement of Profit & Loss as per Companies Act 2013?

a) Revenue from Operation

b) Other income

c) Finance cost

d) Other expenses

Answer:

B

Question: Under which schedule of Companies Act 2013, the Statement of Profit & Loss is prepared?

a) Schedule III Part I Of Companies Act 2013

b) Schedule VI of Companies Act 2013

c) Schedule III Part II of Companies Act 2013

d) Section 52 of Companies Act 2013.

Answer:

C

Question: Finance cost includes which of the following?

a) Discount on issue of debentures & premium payable on redemption of debentures

b) Interest received on fixed deposits

c) Bank charges

d) Repayment of loan

Answer:

A