Students should refer to Worksheets Class 12 Accountancy Reconstitution of a Partnership Firm – Admission of a Partner Chapter 3 provided below with important questions and answers. These important questions with solutions for Chapter 3 Reconstitution of a Partnership Firm – Admission of a Partner have been prepared by expert teachers for Class 12 Accountancy based on the expected pattern of questions in the class 12 exams. We have provided Worksheets for Class 12 Accountancy for all chapters on our website. You should carefully learn all the important examinations questions provided below as they will help you to get better marks in your class tests and exams.

Reconstitution of a Partnership Firm – Admission of a Partner Worksheets Class 12 Accountancy

Question. Asha and Nisha are partners’ sharing profit in the ratio of 2 : 1. Asha’s son Ashish was admitted for 1/4 share of which 1/8 was gifted by Asha to her son. The remaining was contributed by Nisha. Goodwill of the firm is valued at ₹ 40,000. How much of the goodwill be credited to the old partners’ capital account?

(a) ₹ 2,500 each

(b) ₹ 5,000 each

(c) ₹ 20,000 each

(d) None of these

Answer

C

Question. Which of the following statement(s) is/are correct?

(i) In case admission of partner, sacrificing ratio is used to distribute goodwill.

(ii) Inferred goodwill is the excess of desired total capital of the firm over the actual combined capital of all partners.

(iii) At the time of admission of a new partner in the firm, the new partner compensates the old partners for their loss of share in the super-profits of the firm for which he brings in an additional amount which is known as premium for goodwill.

(iv) Taxation fund should never be distributed among the old partners at the time of admission of partners.

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i), (iii) and (iv)

(d) All of these

Answer

D

Question. Workmen Compensation Reserve (WCR) appears in the balance sheet of Rashmi and Suman, who share profits in the ratio of 2:3, at ₹ 80,000. Deepa is admitted and the new profit sharing ratio is 1:1:1. If the claim on account of WCR is estimated at ₹ 1,00,000, then

(a) the difference of ₹ 20,000 will be debited to revaluation account

(b) the difference of ₹ 20,000 will be debited to Rashmi’s capital account

(c) the difference of ₹ 20,000 will be debited to Suman’s capital account

(d) None of the above

Answer

A

Question. Assertion (A) Profit or loss on revaluation account is not transferred to incoming partners’ capital account.

Reason (R) Profit or loss on revaluation at the time of admission of a partner belongs to pre-admission period hence belong to old partners.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

Question. When incoming partner acquires his share from existing partners in their profit sharing ratio, the steps for calculation of new profit sharing ratio are given as

(i) Calculate old partners’ new share as part of combined share.

(ii) Convert the new shares of all partners and find out the new profit sharing ratio.

(iii) Calculate combined share of old partners in the new firm by deducting new partner’s share from 1.

(a) (i), (iii), (ii)

(b) (iii), (i), (ii)

(c) (ii), (iii), (i)

(d) (iii), (ii), (i)

Answer

B

Question. When share of new or incoming partner is given without giving the details of sacrifice made by old or existing partners, then

(i) it is assumed that old partners make sacrifice in their old profit sharing ratio.

(ii) there is no change in profit sharing ratio of the old partners.

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Both (i) and (ii) are correct

(d) Both (i) and (ii) are incorrect

Answer

C

Question. ‘A’, ‘B’ and ‘C’ share profits and losses in the ratio of 3:2:1. ‘D’ is admitted with 1/6 share which he gets entirely from ‘A’. New ratio will be

(a) 2:2:1:1

(b) 3:1: 1:1

(c) 2:2:2:1

(d) None of these

Answer

A

Question. According to Section 31(1) of the Indian Partnership Act, 1932, “A person can be admitted as a new partner only with the ………… unless otherwise agreed upon.”

(a) consent of one partner

(b) consent of all the existing partners

(c) Both (a) and (b)

(d) consent of the firm

Answer

B

Question. ‘X’ and ‘Y’ are partners sharing profits in the ratio of 3 : 1. They admit ‘Z’ as a partner who pays ₹ 4,000 as goodwill, the new profit sharing ratio being 2 : 1 : 1 among ‘X’, ‘Y’ and ‘Z’. The amount of goodwill will be credited to

(a) ‘X’ and ‘Y’ as ₹ 3,000 and ₹ 1,000

(b) ₹ 2,000 each

(c) Only ‘Y’

(d) Only ‘X’

Answer

D

Question. A and B are partners in a firm sharing profits in 3 : 2 ratio. They admitted C as a new partner and the new profit sharing ratio will be 2:1:1. C brought in ₹ 40,000 as premium for goodwill for its share. What will be the journal entry for the premium of goodwill shared by old partners as per sacrificing ratio?

Answer

A

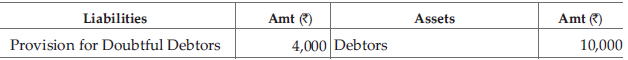

Question. Shishu and Pranav are partners in a firm and share profits and losses in the ratio of 3:2. Extract of their balance sheet on 31st March, 2020 is as follows

At the time of admission of Shiv as a partner, if provision for doubtful debts is to be reduced by 10% of receivables as on 31st March, 2020, then what amount of provision for doubtful debtors will be shown in reconstituted balance sheet?

(a) ₹ 1,000

(b) ₹ 3,000

(c) ₹ 400

(d) ₹ 6,000

Answer

B

Question. Contingency reserve appearing in the balance sheet at the time of admission of partner is ……… to old partners’ capital accounts in old ratio.

(a) debited

(b) credited

(c) Either (a) or (b)

(d) None of these

Answer

B

Question. A firm has an unrecorded investment of ₹ 5,000. Entry in the firm’s journal on admission of partners will be

(a) Unrecorded Investment A/c Dr 5,000

To Revaluation A/c 5,000

(b) Partners’ Capital A/c Dr 5,000

To Unrecorded Investment A/c 5,000

(c) Revaluation A/c Dr 5,000

To Unrecorded Investment A/c 5,000

(d) None of the above

Answer

A

Question. A newly admitted partner acquires the right to………. .

(a) share in the future profits

(b) share in the assets of the firm

(c) Both (a) and (b)

(d) None of these

Answer

C

Question. The new partner, at the time of admission, may acquire his share from old partners in

(a) old profit sharing ratio

(b) some agreed ratio

(c) particular fraction from some of the partners

(d) All of the above

Answer

D

CASE STUDY BASED QUESTIONS

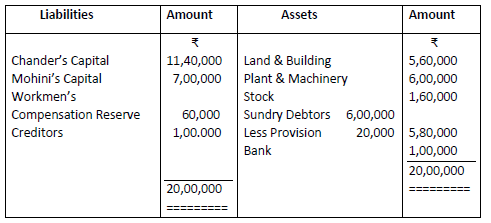

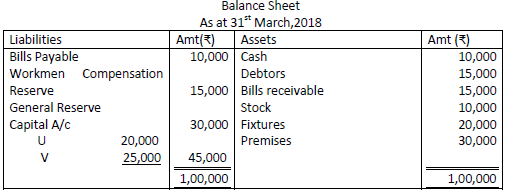

1. Chander and Moini are partners sharing profits in the ratio of 3 ; 2 Their Balance Sheet as at 31st March, 2018 is given below

They decide to admit Shikha as a new partner from 1st April,2018. Their new profit sharing ratio was 3:2:5. Shikha brought in Rs. 6,00,000 as her capital and her share of goodwill premium in cash.

(a) Shikha’s share of goodwill premium was valued at Rs.30,000.

(b) Plant and Machineruy was found under valued buy 20%.

(c) Creditors were unrecorded to the extent of Rs.20,000

(d) Claim on account of workmen compensation was Rs.40,000.

(e) Bad debts amounted to Rs.30,000

Question: From whioch item did parnters benefited at time of revaluation of assets.

(a) Plant & Machinery

(b) Land & Building

(c) Stock

(d) Sundry Debtors

Answer:

B

Question: What was loss/profit on revaluation and by how much amount ?

(a) Loss Rs. 1,20,000

(b) profit Rs.1,20,000

(c) Loss by Rs. 1,00,000

(d) profit Rs. 1,00.,000

Answer:

B

Question: Workmen Compensation Reserve giiven in the balance sheet will be distributed among —– partners in —— ratio.

(a) New, New

(b) old : New

(c) Sacrificing : old

(d) old : old

Answer:

B

Question: What was the amount of Goodwill of the firm.

(a) Rs. 50,000

(b) Rs. 40,000

(c) Rs. 60,000

(d) Rs.30,000

Answer:

C

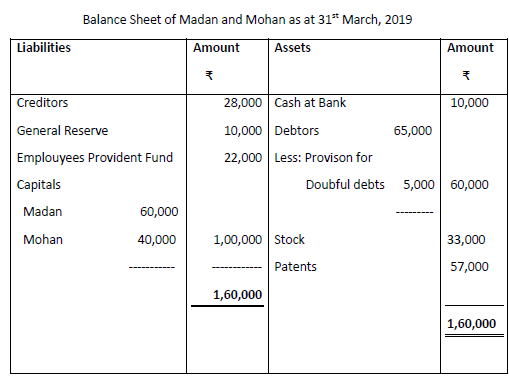

On 31st March, 2019 the Balance Sheet of Madan and Mohan who share profits and losses in the ratio of 3:2 was as follow

They decided to admit Gopal on 1st April, 2019 for 1/5th share which Gopal acquired wholly from Mohan on the following terms :

(i) Gopal shall bring Rs. 10,000 as his share of premium for Goodwill.

(ii) A debtor whose dues of Rs. 3,000 were written off as bad debt paid Rs. 2,000 in full settlement.

(iii) A Claim of Rs. 5,000 on account of workmen’s compensation was to be provided for.

(iv) Patents were undervalued by Rs. 2,000. Stock in the books was valued 10% more than its market value.

(v) Gopal was to bring in capital equal to 20% of the combined capitals of Madan and Mohan after all adjustments.

Question: What is the scarifying ratio of Madan and Mohan

(a) 3:2

(b) 2:3

(c) 0:1

(d) 1:2

Answer:

C

Question: What is the cash balance available after the admission of Gopal

(a) Rs,. 45,000

(b) Rs. 54,000

(c) Rs. 24,200

(d) Rs.45,200

Answer:

D

Question: What is the closing capital of Mohan.

(a) Rs.63,600

(b) Rs.52,400

(c) Rs. 23,200

(d) Rs. 51,000

Answer:

B

Question: What is Madan’s Share of profit/loss on revaluation ?

(a) profit Rs. 2,400

(b) Rs. 1,600 loss

(c) loss Rs. 2,400

(d) profit Rs.1,600

Answer:

C

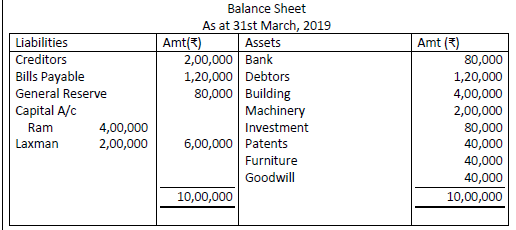

Ram and Laxman are partners in a firm with equal rati

Adjustments

(i) Bharat comes for 1/5th share and brings capital Rs. 2,00,000 and premium Rs. 40,000 out of Rs. 60,000.

(ii) New ration 2:2:1.

(iii) Rs. 20,000 included in creditors are not likely to be paid.

(iv) Patents are valueless.

(v) 10% provision for doubtful debts on debtors out of general reserve.

Question: If the old ratio is equal and new ratio (between old partners) is also equal, then what would be the sacrificing ratio ?

(a) 1:2

(b) 2:1

(c) 1:1

(d) Can’t be determined

Answer:

C

Question: What is the profit/loss of revaluation account ?

(a) Profit Rs. 60,000

(b) Loss Rs. 60,000

(c) Profit Rs. 20,000

(d) Loss Rs. 20,000

Answer:

D

Question: By how much amount was Laxman’s capital credited on account of General Reserve ?

(a) Rs. 80,000

(b) Rs. 68,000

(c) Rs. 40,000

(d) Rs. 34,000

Answer:

D

Question: What was the total of bank account at the end of transactions?

(a) Rs. 3,40,000

(b) Rs. 3,20,000

(c) Rs. 2,80,000

(d) Can’t be determined

Answer:

B

R and S are partners in a firm sharing profits in the ratio of 3:2 they admit T as new partner the new profit sharing ratio of R, S and T will be 5:5:3 T contributed the following assets towards his capital and for his share of Goodwill.Stock Rs. 1,67,000 debtors Rs.1,40,000 (Less Provision for doubtful debts of 5%) and land Rs. 1,00,000 Plant & Machinery Rs.1,80,000. On the date of admission of T, the Goodwill of the firm was valued at Rs.13,00,000.

Question: What could be the purpose of admitting T in the firm?

(a) Acquiring additional managerial skills

(b) Procuring additional capital

(c) Enhancing efficiency of operations

(d) None of the above

Answer:

B

Question: What is the sacrificing ratio of R and S ?

(a) 2:3

(b) 3:2

(c) 1:1

(d) None of the above

Answer:

D

Question: What was the amount of capital brought in by T ?

(a) Rs. 5,80,000

(b) Rs. 3,00,000

(c) Rs. 2,85,000

(d) Rs. 2,80,000

Answer:

D

Question: What share of goodwill did R get ?

(a) Rs. 6,50,000

(b) Rs. 1,50,000

(c) Rs. 2,80,000

(d) None of these

Answer:

C

U and V were partners sharing profits and losses in the proportion of 2:3 the following in the Balance Sheet of U and V on 31st March,2018

They admit Z for 1/5th share into partnership on 1st April, 2018, on the following terms.

(i) Z brings Rs. 30,000 as capital

(ii) Goodwill of the firm is valued on the basis of Z’s share in profit and capital contributed by him.

(iii) The provision on debtors is to be created @5%.

(iv) Fixtures and stock are to be decreased by 10%.

(v) The value of premises be appreciated by 10%

Question: What was the amount of total capital of firm according to Z’s share ?

(a) Rs. 30,000

(b) Rs. 90,750

(c) Rs.1,50,000

(d) Rs. 750

Answer:

C

Question: What was loss/profit on the revaluation and by how much amount ?

(a) Loss Rs. 1,500

(b) Loss Rs. 750

(c) Profit Rs. 1,500

(d) Profit Rs. 750

Answer:

B

Question: General reserve given in the balance sheet will be distributed among ……… partners in …….ratio.

(a) new, new

(b) old, old

(c) old, sacrificing

(d) old, new

Answer:

B

Question: What was the amount of goodwill of the firm ?

(a) Rs. 6,150

(b) Rs. 30,750

(c) Rs. 60,750

(d) Can’t be determined

Answer:

B

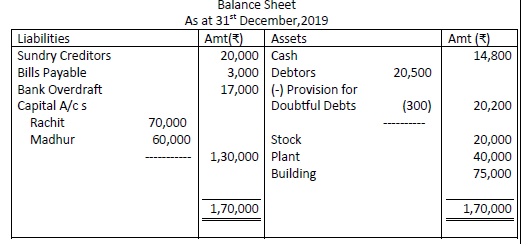

Rachit and Madhur were partners in a firm sharing profits and losses in the ratio of 4 : 3. The following is the balance sheet of the firm as on 31st December, 2019.

They agreed to admit Rishant as a partner with effect from 1st January,2020 for 1/4th share in profits on the following terms.

(i) Rishant will bring to Rs. 47,183 as his capital.

(ii) Building is to be appreciated by Rs. 14,000 and plant to be depreciated by Rs.7,000.

(iii) The provision on debtors is to be raised to Rs. 1,000

(iv) The goodwill of the firm has been valued to Rs. 21,000.

Question: What is the profit /loss revaluation and by what amount ?

(a) Profit Rs. 7,000

(b) Profit Rs. 6,300

(c) Loss Rs. 7,000

(d) Loss Rs. 6,300

Answer:

B

Question: What will be the net amount of debtors in new balance sheet ?

(a) Rs. 20,500

(b) Rs. 20,200

(c) Rs. 19,500

(d) Rs. 19,200

Answer:

C

Question: In general Goodwill adjustment is done in accounts of old partners in ……….. ratio

(a) old profit sharing

(b) sacrificing ratio

(c) both (a) and (b)

(d) new profit sharing ratio

Answer:

B

Question: What is the sacrificing ratio of Rachit and Madhur?

(a) 1:1

(b) 3:4

(c) 4:3

(d) Can’t be determined

Answer:

C

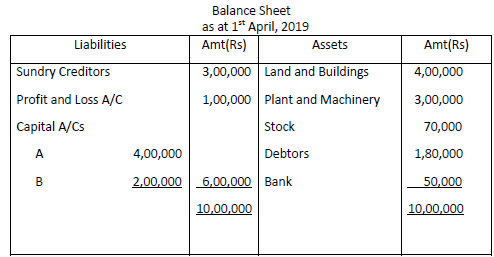

Given below is the balance sheet of A and B who are partners in a firm sharing profits in the ratio of 3:2

On the same date, C is admitted as a partner on the following terms.

(i) A gives 1/3rd of his share , while B gives 1/10 th from his share to C

(ii) Goodwill is valued at 2 years purchase of the average profits of the last 5 years, which were Rs 50,000(loss); Rs 1,20,000; Rs 10,000(loss); Rs 3,00,000 and Rs 3,40,000 respectively. C does not bring his share of goodwill in cash.

Question: What was the amount of firm’s goodwill ?

(a) Rs 84,000

(b) Rs 1,40,000

(c) Rs 1,64,000

(d) Rs 2,80,000

Answer:

D

Question: What was the sacrificing ratio of A and B?

(a)1:1

(b) 3:10

(c) 3:2

(d)2:1

Answer:

D

Question: Name the account which will be debited for adjustment of good will.

(a)A’s and B’s capital a/c

(b) C’s capital a/c

(c) cash account

(d) premium and goodwill

Answer:

B

Question: What was C’s share of goodwill ?

(a) Rs 84,000

(b) Rs 1,40,000

(c) Rs 1,64,000

(d) Rs 2,80,000

Answer:

A

Rahul and Modi are two partners into a firm sharing profits equally . On 1st January , 2020, they decided to admit Vikas as a new partner into the firm for 1/5th share. Vikas brings Rs 10,00,000 for his share to capital and premium of goodwill in cash . Half goodwill is withdrew by the old partneRs. Goodwill of the firm is valued on the basis of one year purchase of profits or losses of preceding last 3 yeaRs. Profits of last four years are Rs 6,00,000 in 2016; Rs 7,00,000 in 2017; Rs 8,00,000 in 2018 and Rs 15,00,000 in 2019.

Question: What was the value of goodwill of the firm ?

(a)Rs 7,00,000

(b) Rs 8,00,000

(c) Rs 9,00,000

(d) Rs 10,00,000

Answer:

D

Question: What was the amount of capital brought in by Vikas ?

(a) Rs 2,00,000

(b) Rs 8,00,000

(c) Rs 10,00,000

(d) Can’t be determined

Answer:

B

Question: What was the goodwill share given to Modi ?

(a) Rs 1,00,000

(b) Rs 2,00,000

(c) Rs 4,00,000

(d) Can’t be determined

Answer:

A

Question: Which account is debited when the goodwill is withdrawn by partners ?

(a) goodwill a/c

(b) premium for goodwill a/c

(c) partner’s capital a/c

(d) cash/bank a/c

Answer:

C

DIRECTION Sainath enterprises is a partnership business with Amar, Akbar and Anthony as partners engaged in the production and sales of home appliances. Their capital contributions were Rs 50,00,000, Rs 50,00,000 and Rs 80,00,000 respectively with the profit sharing ratio of 5:5:8.

As they are now looking forward to expanding their business it was decided that they would bring in sufficient cash to double the respective capitals. This was duly followed by Amar and Akbar but due to unavoidable reasons Anthony could not do so and ultimately it was agreed that to bridge the shortfall in the required capital a new partner should be admitted who would bring in the amount that Anthony could not bring and that partner would get share of profits equal to half of Anthony’s shares which would be sacrificed by Anthony only.

Consequent to this agreement, Mahesh was admitted and he bought in the required capital and Rs 30,00,000 as premium for goodwill.

Based on the above information you are required to answer the following questions:

Question: What is the amount of capital brought in by the new partner, Mahesh ?

(a) Rs 50,00,000

(b) Rs 80,00,000

(c) Rs 40,00,000

(d) Rs 30,00,000

Answer:

C

Question: What will be the new profit sharing ratio of Amar, Akbar, Anthony and Mahesh?

(a) 1:1:1:1

(b) 5:5:8:8

(c) 5:5:4:4

(d) None of the above

Answer:

C

Question: What is the value of goodwill of the firm ?

(a) Rs 1,35,00,000

(b) Rs 30,00,000

(c) Rs 1,50,00,000

(d) Rs 1,00,00,000

Answer:

A

Question: What will be the correct journal entry for the distribution of premium for goodwill brought in by Mahesh ?

(a) Mahesh capital a/c Dr 30,00,000

(b) Premium for goodwill a/c Dr 30,00,000

To Anthony’s capital a/c 30,00,000 To Anthony’s capital a/c 30,00,000

(Being ………………..) (Being ………………..)

(c) Premium for goodwill a/c Dr 30,00,000

(d) Premium for goodwill a/c Dr 30,00,000

To Amar’s capital a/c 10,00,000 To Amar’s capitals a/c 8,33,333

To Akbar’s capital a/c 10,00,000 To Akbar’s capitals a/c 8,33,333

To Mahesh’s capital a/c 10,00,000 To Mahesh’s capital a/c 13,33,333

(Being ……………………) (Being……………..)

Answer:

B

Amit and Mahesh were partners in a fast food corner sharing profits and losses in the ratio 3:2 .They sold fast food items across the continent and home delivery too.Their initial fixed capital contribution was Rs 1,20,000 and Rs 80,000 respectively.

At the end of first year their profit was Rs 1,20,000 before allowing the remuneration of Rs 3,000 per quarter to Amit and Rs 2,000 per half year to Mahesh. Such a promising performance for the first year was encouraging, therefore, they decided to expand the area of operations.

For this purpose they needed a delivery Van, a few bikes and an additional person to support. Six months into the accounting year, they decided to admit Sundaram as a new partner and offered him 20% as a share of profits along with monthly remuneration of rupees Rs. 2,500. Sundaram was asked to introduce Rs. 1,30,000 for capital and Rs.70,000 for premium for Goodwill. Additionally, Sundaram was required to provide Rs. 1,00,000 as loan for two year Sundaram readily accepted the offer and the terms of the offer were duly executed and he was admitted as a partner.

Question: Upon the admission of Sundaram the sacrifice for providing his share of profits would be done:

(a) by Amit only

(b) by Mahesh only

(c) by Amit and Mahesh equally

(d) by Amit and Mahesh in the ratio of 3:2

Answer:

D

Question: Remuneration will be transferred to _________ of Amit and Mahesh at the end of the accounting period

(a) capital account

(b) loan account

(c) current account

(d) none of the above

Answer:

C

Question: While talking up the accounting procedure for the reconstitution the accountant of the firm Mr Suraj Marwaha faced a difficulty. Solve it by answering the following.

For the amount of loan that Sundaram has agreed to provide he is entitled in the interest thereon at the rate of

(a) 6% p.a

(b) 7% p.a

(c) 8% p.a

(d) 9% p.a

Answer:

A

Question: Sundaram will be entitled to a remuneration of _______ at the end of the year

(a) Rs. 15,000

(b) Rs. 20,000

(c) Rs. 40,000

(d) Rs. 30,000

Answer:

A