Students should refer to Worksheets Class 12 Accountancy Analysis of Financial Statement Chapter 4 provided below with important questions and answers. These important questions with solutions for Chapter 2 Analysis of Financial Statement have been prepared by expert teachers for Class 12 Accountancy based on the expected pattern of questions in the class 12 exams. We have provided Worksheets for Class 12 Accountancy for all chapters on our website. You should carefully learn all the important examinations questions provided below as they will help you to get better marks in your class tests and exams.

Analysis of Financial Statement Worksheets Class 12 Accountancy

Question. When financial statements for a single year are analysed, it is called ……… .

(a) vertical analysis

(b) horizontal analysis

(c) lateral analysis

(d) circular analysis

Answer

A

Question. A finance manager is interested in financial statement analysis because

(i) it helps finance manager to assess the financial potential of the business.

(ii) it assists him in predicting future financial requirements and enables the finance manager to take appropriate action.

(a) Only (i)

(b) Only (ii)

(c) Both (i) and (ii)

(d) Neither (i) nor (ii)

Answer

C

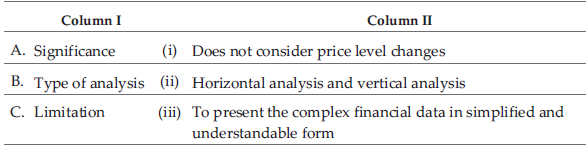

Question. Match the following.

Codes

A B C

(a) (iii) (ii) (i)

(b) (iii) (i) (ii)

(c) (ii) (i) (iii)

(d) (i) (ii) (iii)

Answer

A

Question. Sumatra limited wants to assess the future profit earning capacity of its business. It will conduct

(a) external analysis

(b) short-term analysis

(c) long-term analysis

(d) None of these

Answer

C

Question. The technique of studying the operational results and financial position over a series of years is known as

(a) Trend analysis

(b) Common size analysis

(c) Ratio analysis

(d) Cash flow analysis

Answer

A

Question. State the importance of financial analysis for labour unions.

(a) To assess whether an enterprise can increase their pay

(b) To check whether an enterprise can increase productivity or raise the prices of products/services to absorb a wage increase

(c) To determine tax liabilities

(d) Both (a) and (b)

Answer

D

Question. Assertion (A) Analysis of financial statements is done to assess the managerial efficiency.

Reason (R) Financial statement analysis helps to identify the areas where the managers have been efficient and the areas where they have been inefficient.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

A

Question. Which elements are ignored while preparation or analysis of financial statements?

(a) Quantitative elements

(b) Qualitative elements

(c) Both (a) and (b)

(d) None of these

Answer

B

Question. Assertion (A) Inter-firm analysis is a comparison of financial statements of an enterprise for two or more accounting periods.

Reason (R) Time series analysis is conducted to determine the trend of different financial variables over a period of time.

Alternatives

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A)

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A)

(c) Assertion (A) is true, but Reason (R) is false

(d) Assertion (A) is false, but Reason (R) is true

Answer

D

Question. Which of the following is not a limitation of ‘financial statements analysis’?

(a) It is affected by personal bias

(b) Inter-firm comparative study possible

(c) Lack of qualitative analysis

(d) Ignores price level changes

Answer

B

Question. A study of relationship among the various financial factors in a business is called …… .

(a) qualitative analysis

(b) price level change analysis

(c) financial statement analysis

(d) None of the above

Answer

C

Question. Which of the following statement(s) is/are correct?

(i) Financial statement analysis may be misleading without the knowledge of the accounting procedures followed by the firm

(ii) Financial statement analysis is a judgemental process

(iii) The nature of financial analysis will differ depending on the purpose of the analyst

(iv) The financial statements are prepared on the basis of accounting concept; as such it does not reflect the current position

(a) (i) and (ii)

(b) (ii) and (iii)

(c) (i), (iii) and (iv)

(d) All of these

Answer

D

Question. Which of the following brings out the difference between vertical analysis and horizontal analysis?

(a) Horizontal analysis is time series analysis whereas vertical analysis is done to review and analyse the financial statements of one particular year only.

(b) Vertical analysis is time series analysis whereas horizontal analysis is done to review and analyse the financial statements of one particular year only.

(c) Horizontal analysis is static analysis whereas vertical analysis is dynamic analysis.

(d) None of the above

Answer

A

Question. The analysis of financial statements is important for ……… .

(a) management

(b) trade unions

(c) creditors

(d) All of these

Answer

D

Question. Analysis simply means ……… .

(a) simplification of financial data

(b) explaining the meaning and significance of the data

(c) Both (a) and (b)

(d) None of the above

Answer

A

CASE STUDY BASED QUESTIONS :

Nidiya Limited was incorporated on 1st April, 2017 with registered office in Mumbai. The capital clause of Memorandum of Association reflected a registered capital of 8,00,000 equity shares of ₹ 10 each and 1,00,000 preference shares of ₹ 50 each.

Since some large investments were required for building and machinery, the company in consultation with vendors, Ms.VPS Enterprises, issued 1,00,000 equity shares and 20,000 preference shares at par to them in full consideration of assets acquired. Besides this, the company issued 2,00,000 equity shares for cash at par payable as ₹ 3 on application, ₹ 2 on allotment, ₹ 3 on first call and ₹ 2 on second call.

Till date second call has not yet been made and all the shareholders have paid except Mr. Ajay who did not pay allotment and calls on his 300 shares and Mr. Vipul who did not pay first call on his 200 shares. Shares of Mr. Ajay were then forfeited and out of them 100 shares were reissued at ₹ 12 per share. Based on above information, you are required to answer the following questions.

Question. What is the amount of security premium reflected in the balance sheet at the end of the year?

(a) ₹ 200

(b) ₹ 600

(c) ₹ 400

(d) ₹ 1,000

Answer

C

Question. What amount of share forfeiture would be reflected in the balance sheet?

(a) ₹ 600

(b) ₹ 900

(c) ₹ 200

(d) ₹ 300

Answer

A

Question. Shares issued to vendors of building and machinery, Ms.VPS Enterprises, would be classified as

(a) Preferential allotment

(b) Employee stock option plan

(c) Issue for consideration other than cash

(d) Right issue of shares

Answer

C

Question. How many equity shares of the company have been subscribed?

(a) ₹ 3,00,000

(b) ₹ 2,99,500

(c) ₹ 2,99,800

(d) None of these

Answer

C