Please see Accounting Ratios Exam Questions Class 12 Accountancy below. These important questions with solutions have been prepared based on the latest examination guidelines and syllabus issued by CBSE, NCERT, and KVS. We have provided Class 12 Accountancy Questions and answers for all chapters in your NCERT Book for Class 12 Accountancy. These solved problems for Accounting Ratios in Class 12 Accountancy will help you to score more marks in upcoming examinations.

Exam Questions Accounting Ratios Class 12 Accountancy

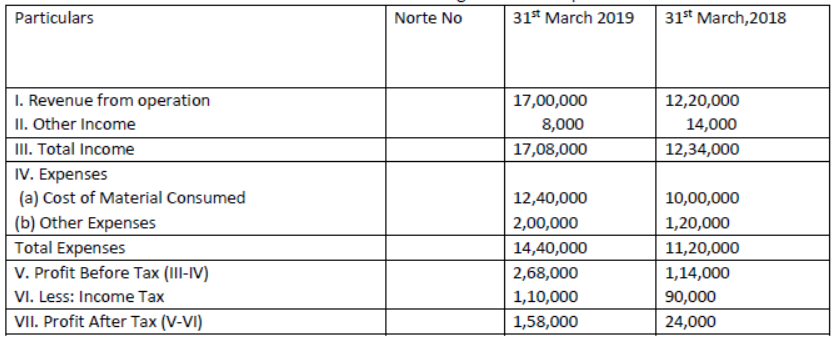

Question. Calculate Net Profit Ratio from the following Statement of profit and Loss

Solution:

Net Profit Ratio= 𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 𝐴𝑓𝑡𝑒𝑟 𝑇𝑎𝑥/𝑁𝑒𝑡 𝑅𝑒𝑣𝑒𝑛𝑢𝑒𝐹𝑟𝑜𝑚 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛×100

=1,58,000/17,00,000×100 = 9.29%

Question. Stock at beginning of the year ₹60,000

Stock at end of the year ₹1,00,000

Stock turnover Ratio ₹ 8 times

Selling Price 25% above cost

Compute Gross profit Ratio and Sales amount

Solution: Average Stock=𝑂𝑝𝑒𝑛𝑖𝑛𝑔 𝑠𝑡𝑜𝑐𝑘+𝐶𝑙𝑜𝑠𝑖𝑛𝑔 𝑆𝑡𝑜𝑐𝑘/2 = ₹60,000+₹1,00,000/2 = ₹1,60,000/2 =80,000

Stock turnover Ratio=𝐶𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑/𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑆𝑡𝑜𝑐𝑘

Cost of goods Sold =Average Stock ×Stock turnover ratio

=₹80,000×8= ₹6,40,000

Gross Profit =25% of ₹6,40,000=1,60,000

Sales = Cost of Goods Sold +Gross Profit

= 6,40,000+1,60,000=₹8,00,000

Gross Profit Ratio = 1,60,000/8,00,000 ×100= 20%

Question. Calculate Debtors Turnover Ratio if Closing Debtors are Rs. 40,000; Opening Debtors Rs. 60,000; Cash Sales is 25% of Credit Sales and Total Sales are Rs. 2,00,000.

Solution: Debtors Turnover Ratio = 𝑁𝑒𝑡 𝑐𝑟𝑒𝑑𝑖𝑡 𝑆𝑎𝑙𝑒𝑠/𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑟𝑎𝑑𝑒 𝑑𝑒𝑏𝑡𝑜𝑟𝑠

Cash Sales = 25% of Credit Sales

Let the Credit Sales be Rs. X

Then Cash Sales is 25% of X

Total Sales = Cash Sales + Credit Sales=Rs. 2,00,000

X+25x/100=2,00,00

100x+25x=2,00,000×100

125x= 2,00,00,000 X=2,00,00,000/125=1,60,000

X = Credit Sales=1,60,000 Cash sales=1,60,000×25/100 =40,000

Average Debtors = 60,000+40,000/2 = 1,00,000/2 = 50,000

Debtors Turnover Ratio=1,60,000/50,000 = 3.2 Times

Question. Calculate ‘Debt-Equity Ratio’ from the following information: Total Assets: Rs. 3,50,000; Total Debt: Rs. 2,50,000; Current Liabilities: Rs. 80,000

Solution: Debt Equity Ratio =𝐷𝑒𝑏𝑡/𝐸𝑞𝑢𝑖𝑡𝑦

Debt = Total Debt – Current Liabilities =

Rs. 2,500,000-Rs. 80,000 = Rs. 1,70,000

Equity = Total Assets – Total Debts =

Rs. 3,50,000 – Rs. 2,50,000 = Rs. 1,00,000

Debt – Equity Ratio = 1,70,000/1,00,000 = 1.7:1

Question. From the following information Calculate proprietary Ratio and Total Assets to Debt Ratio Balance sheet of ABC Ltd.

Solution: Proprietary Ratio= 𝐸𝑞𝑢𝑖𝑡𝑦/𝐸𝑞𝑢𝑖𝑡𝑦𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 = 4,50,000+1,80,000/7,50,000 = 0.84:1

Total Assets to Debt Ratio = 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠/𝐷𝑒𝑏𝑡𝑠 = 75,000 7,50,000 = 10:1

Question. Calculate Interest Coverage Ratio from the following information.

Net Profit (after taxes) = Rs. 1,00,000

Fixed interest charges on long term borrowing = Rs. 20,000

Rate of Income Tax 50%

Solution: Interest coverage Ratio=𝑃𝑟𝑜𝑓𝑖𝑡 𝑏𝑒𝑓𝑜𝑟𝑒 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑎𝑛𝑑 𝑇𝑎𝑥/𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡

Profit before interest and tax =Net profit after Tax+ Income Tax + Interest

=1,00,000+1,00,000+20,000=2,20,000

Interest coverage ratio=2,20,000/20,000 = 11 Times

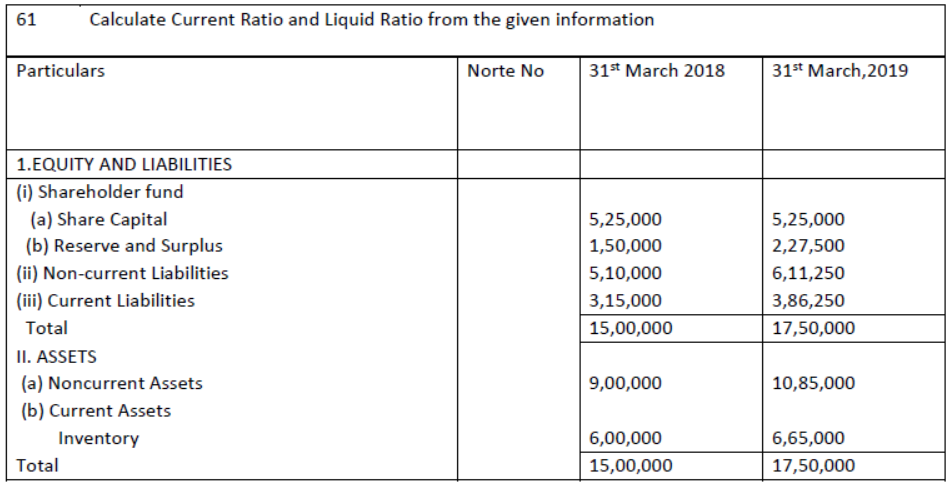

Question.

Solution: For, 2017-18

Current Ratio=𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠/𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 = 9,00,000/5,10,000 = 1.77/1 =1.77:1

Liquid ratio= 𝐿𝑖𝑞𝑢𝑖𝑑 𝐴𝑠𝑠𝑒𝑡𝑠/𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 = 9,00,000−6,00,000/5,10,000 = 3,00,000/5,10,000 = 0.59/1 =0.59:1

For, 2018-19

Current Ratio=𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠/𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 = 10,85,000/3,86,250 = 2.81/1 = 2.81:1

Liquid ratio=𝐿𝑖𝑞𝑢𝑖𝑑 𝐴𝑠𝑠𝑒𝑡𝑠/𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 = 10,85,000−6,65,000/3,86,250 = 4,20,000/3,86,250 = 1.09/1 =0.09:1

Question. Calculate ‘Operating Profit Ration’ and ‘Operating Ratio’ from the following information:

Net Revenue from Operations ₹80,000

Cost of Revenue from Operations ₹60,000

Operating Expenses ₹10,000

Indirect Expenses ₹60,000

Solution: Operating profit Ratio = 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡/𝑁𝑒𝑡 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 𝑓𝑟𝑜𝑚 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛 ×100

Operating profit = Net Revenue from Operation – Operating Cost

Operating Cost = Cost of Revenue from Operation + Operating Expenses

= Rs. 60,000+10,000 = Rs. 70,000

Operating profit =80,000 -70,000 = Rs. 10,000

Operating profit Ratio = 10,000/80,000 ×100 =12.5%

Operating Ratio = 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐸𝑥𝑝𝑒𝑛𝑠𝑒𝑠/𝑁𝑒𝑡 𝑟𝑒𝑣𝑒𝑛𝑢𝑒 𝑓𝑟𝑜𝑚 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛 ×100 or 100- Operating profit ratio

= 60,000+10,000/80,000 ×100 70,000/80,000 ×100=87.5 or 100-12.5=87.5

Question. From the following information calculate the Inventory Turnover Ratio

Revenue from operations ₹6,00,000; Gross profit 25% on cost; Opening inventory was 1/3rd of closing inventory; Closing Inventory was 30% of revenue from operation.

Solution: Revenue from operation=6,00,00

Cost of revenue from operations= Revenue from operation – Gross profit

Gross Profit=3,00,000×25/125= 60000

Cost of revenue from operations=600000 – 60000=240000

Closing Inventory=90000× 30/100 =₹90,000

Opening Inventory =1/3 ×90000=30000

Inventory turnover Ratio = 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 𝐹𝑟𝑜𝑚 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑜/𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦

=2,40,000/60,000 = 4 Times

Question. Following is the Balance sheet and Statement of profit and loss of a company Statement of Profit and Loss

Calculate Following ratios from above information

(a) Gross profit ratio

(b) Current Ratio

(c) Debt Equity ratio

(d) Stock Turnover Ratio

(e) Total Assets to Debts Ratio

Solution:

Gross profit ratio = 𝐺𝑟𝑜𝑠𝑠 𝑃𝑟𝑜𝑓𝑖𝑡/𝑁𝑒𝑡 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 𝐹𝑟𝑜𝑚 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛×100

=5,00,000/10,00,000 × 100= 50%

Current ratio = 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠/𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 = 4,00,000/1,50,000 = 2.67/1 = 2.67:1

Debt Equity Ratio=𝐷𝑒𝑏𝑡/𝐸𝑞𝑢𝑖𝑡𝑦 = 2,00,000/3,00,000 = 0.67/1 =0.67:1

Stock Turnover ratio= 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 𝑓𝑟𝑜𝑚 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑜𝑛/𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦

Cost of revenue from operation=Revenue from operation -Gross profit

= 10,00,000-5,00,000=5,00,000

Average Inventory =𝑂𝑝𝑒𝑛𝑖𝑛𝑔 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦+𝐶𝑙𝑜𝑠𝑖𝑛𝑔 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦/2

= 1,50,000+2,50,000/2 = 4,00,000/2 = 2,00,000

Stock Turnover ratio=5,00,000/2,00,000 =2.5 Times

Total Assets to Debts ratio= 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠/𝐷𝑒𝑏𝑡𝑠 = 6,50,000/2,00,000 = 3.25:1